- December 8, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

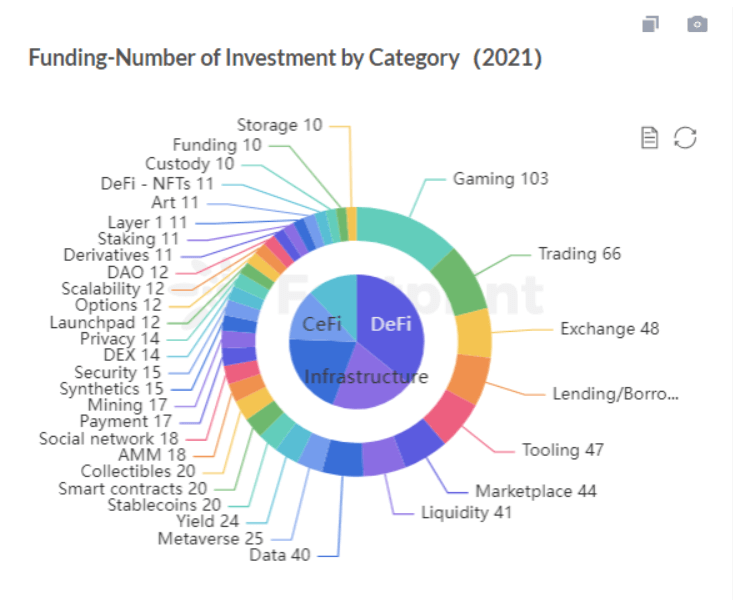

While all categories of blockchain have been blazing hot in 2021, gaming took the top spot with nearly 13% of all investments.

With the seasons seemingly moving from DeFi to NFT and now to GameFi, the second half of the year was overtaken by huge gaming announcements and figures. For example, on August 6th, Axie Infinity generated $17 million in revenue, surpassing even Honor of Kings.

What makes GameFi so appealing, and what will happen once this initial burst of momentum wears off?

The term GameFi, short for Game Finance, was coined by Mary Ma in the 2019 Wuzhen World Blockchain Conference hosted by 8BTC, MixMarvel’s CSO, and refers to the integration of finance with gaming.

The primary means by which games generate their own financial ecosystems is via NFTs and liquidity mining. In this way, games become “Play to Earn”, or P2E in short.

Features that GameFi differs from traditional gaming:

- Ownership of assets: In GameFi, through on-chain smart contracts, the game’s assets belong to the player rather than the developer.

- Tradable assets in crypto markets: With the ownership of the assets, players can trade these assets, either NFT or tokens, in the open Crypto markets with other players.

- Transparent data: All GameFi game codes are open source and transparent, and developers cannot simply change these codes. A player can also participate in-game upgrades and changes via a DAO, giving them a greater degree of participation.

Current Status of GameFi

Despite its promise, there are still several major problems most projects face in the GameFi industry. As an investor, you should assess the projects based on their likelihood of overcoming these challenges.

Small player base

There are roughly 3 billion traditional gamers, whereas the user base of GameFi is still only a fraction of DeFi’s total of 1.33 million. In the era of mobile gaming, on-chain games are predominantly based on the web, meaning it is unlikely to enter the mainstream until there are significant developments in mobile on-chain gaming.

Another reason that traditional gamers are not flocking to GameFi en masse is that it requires players, at this stage, to understand concepts such as cryptocurrency wallets, key phrases, and gas fees.

Congestion and high gas fees

Great games require frequent transactions, which puts a high demand on the network’s TPS (Transactions Per Second) and gas fees. The popularity of CryptoKitties in 2017 caused serious congestion on the Ethereum network, for example. One response to this has been to build out ad hoc infrastructure to support popular games, like Ethereum migrating Axie Infinity to a sidechain.

Poor playability

Even the most popular GameFi projects still look like traditional 3A games. In many cases, there is much room for improvement with playability—making the games purely money-making methods for many players rather than a fun activity that can generate some income.

This raises the question of whether integrating the money motive in games necessarily makes them less fun. If a particular game doesn’t generate enough income in the GameFi space, the player will leave to another. Therefore, this creates a cycle where developers are rewarded for focusing on the finance rather than the gaming aspect of a project.

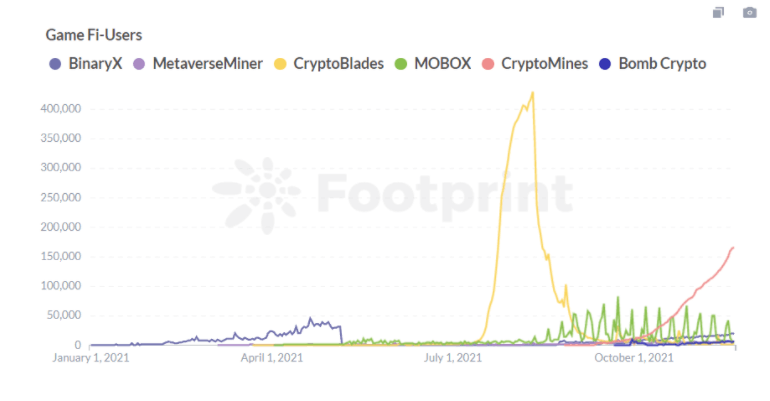

One example of this is CryptoBlades, which saw a mass exodus of players in July after the game reduced its SKILL (the native token) rewards sending token prices plummeting. Hence, it takes longer than expected for players to recoup their initial investment, causing a more and more serious problem of players losing.

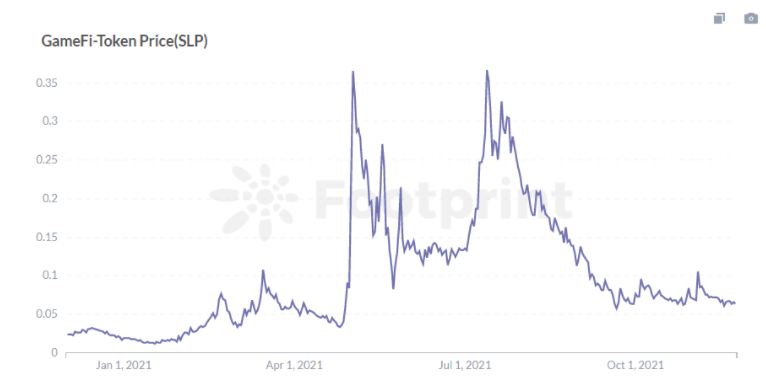

The same thing happened with Axie Infinity. In the game, the token Smooth Love Potion (SLP) is an important source of revenue for players to earn from the game. When the price of SLP fell, it led to a decrease in Axie Infinity’s revenue. Axie Infinity once helped people in countries like the Philippines to make a living at the beginning, but now players’ daily income from the game is less than the local minimum wage.

GameFi’s prosperity on BSC

According to Dappradar, BSC has occupied 4 spots in the top 10 games. With almost 6 times the TPS(Transactions Per Second) of Ethereum, continues to make a push in the GameFi with195 game projects already deployed on BSC.

Although Ethereum occupies the majority of the overall TVL the low transaction speed and the problem of high gas fees have become obstacles for ordinary users to enter the blockchain world. By comparison, BSC seems a better blockchain for GameFi to grow for the following reasons.

Reason 1: BSC’s conducive ecosystem for GameFi’s the development

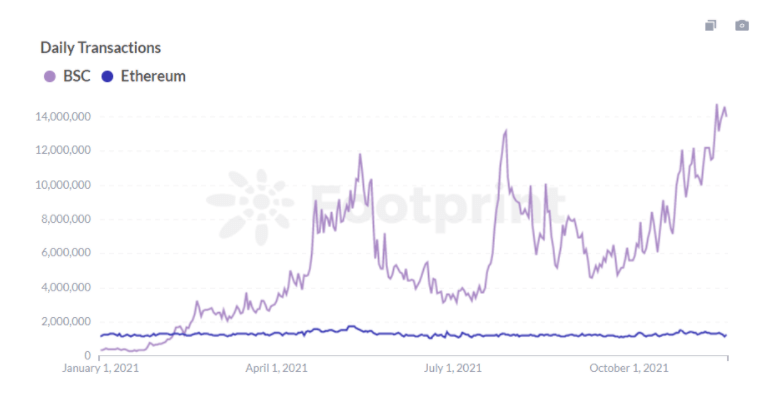

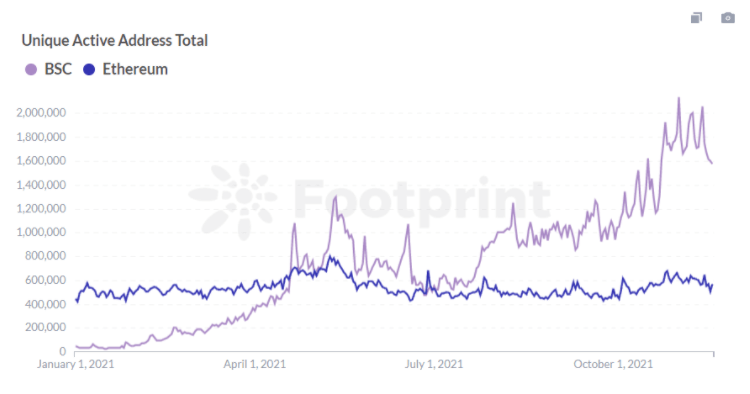

In terms of TVL and the total number of unique addresses, Ethereum has firmed in the first place, but in terms of daily transaction volume and the number of unique active addresses, BSC completely surpassed Ethereum in February and April of this year respectively.

Regarding the active addresses, Ethereum fluctuates between 400,000 and 600,000 per day, while the number of BSC fluctuates from 1.5 million to 2 million per day, nearly 3-5 times more than Ethereum. The difference between these two of daily transaction volumes even reaches 13 times.

Compared with Ethereum, BSC has higher transaction efficiency, lower gas fees, and is also compatible with the Ethereum Virtual Machine(EVM), which allows developers of Ethereum to migrate to BSC at a low cost and attract more small scattered users to the world of blockchain. Throughout the whole ecosystem of BSC from resources to infrastructure is more friendly for the development of game projects.

Reason 2: Most GameFi Projects grated from BSC incentive programs

In order to stimulate the development of the entire NFT ecosystem, BSC also launched the Most Valuable Builder (MVB) II, where selected projects can receive a $10,000 grant, full security audit from Certik and exclusive incubation workshop with industry experts.

In July of this year, BSC announced the list of winners, which included popular game projects such as CryptoBlades, MyDeFiPet, MOBOX, X World Games, etc. In the next MVB III program directly positioned as GameFi, we believe BSC can once again detonate the GameFi field.

BSC regularly hosts hackathons around the world, and also launches Learn & Earn events, with four of the nine projects in the two Learn & Earn events so far involving games or NFTs, including CryptoBlades, which skyrocketed in July. By rewarding users with unique NFTs and bonuses to encourage participation in excellent projects, BSC is practically a natural fertile ground for GameFi’s growth.

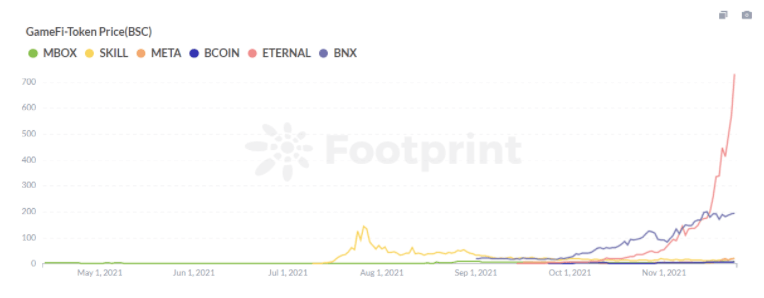

The current top 5 games on BSC for the last 30 days are CryptoMines (ETERNAL), Mobox (MBOX), Bomb Crypto (BCOIN), BinaryX (BNX) and MetaverseMiner (META).

As the number of users and transactions continues to rise, the price of the game’s tokens is also climbing, with the most insane increase being seen in CryptoMines’ token, ETERNAL, which has far surpassed the price of Axie Infinity’s token AXS. As of October 24, ETERNAL’s price was $572, 16 times higher than a month ago. For players who play for P2E purposes, there will be significant gains to be made.

Conclusion

GameFi allows players to:

- Take ownership of game assets through NFTs and tokens

- Use NFTs as a tool for liquidity mining

- Make assets liquid through DeFi

While these benefits could make GameFi more fun and increase blockchain adoption, there are still many problems to be solved with GameFi. A favorable ecosystem is very important for GameFi, and there is still a lot of room for optimization in terms of the ecosystem in Ethereum.

In the current period when various blockchains are emerging, different blockchains are constantly innovating in terms of differentiation, such as Terra with an innovation of stablecoin and Celo focusing on decentralized mobile payment.

GameFi can also support its own environment and bring traffic to some unpopular blockchains. Ronin, a sidechain built by Ethrereum for Axie Infinity has won popularity due to the success of Axie, also WAX and Flow have become two of the most popular blockchains due to their main focus on GameFi and NFT.

The last blockchain explosion was in DeFi, GameFi has all the making of leading the next wave of blockchain development if projects can balance infrastructure, playability and returns.

The post Will GameFi be a new battlefield for blockchains? appeared first on CryptoSlate.