- January 19, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

Amidst the accelerated pace of GBTC outflows contributing to downward pressure on Bitcoin’s price, two divergent behavioral patterns are becoming evident among older cohorts. Data demonstrates a growing preference among more oversized Bitcoin holders or ‘whales’ to accumulate more Bitcoins, while smaller cohorts appear to be more inclined towards selling.

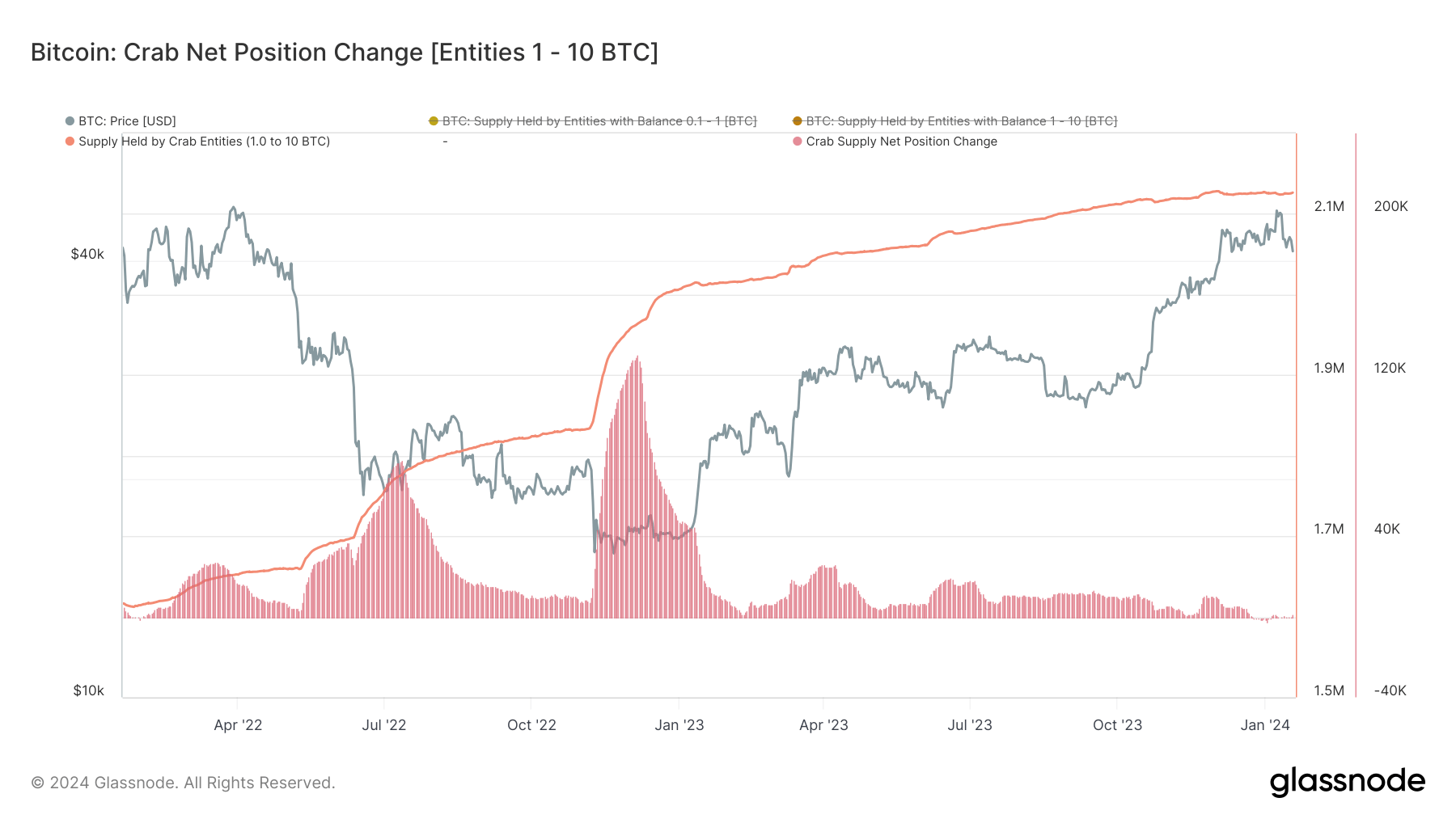

Specifically, holders identified as ‘crabs,’ known to possess 1-10 BTC, have maintained a flat to negative growth in their Bitcoin portfolios. Currently, this cohort holds approximately 2.1 million BTC, showing no substantial increase since December’s end.

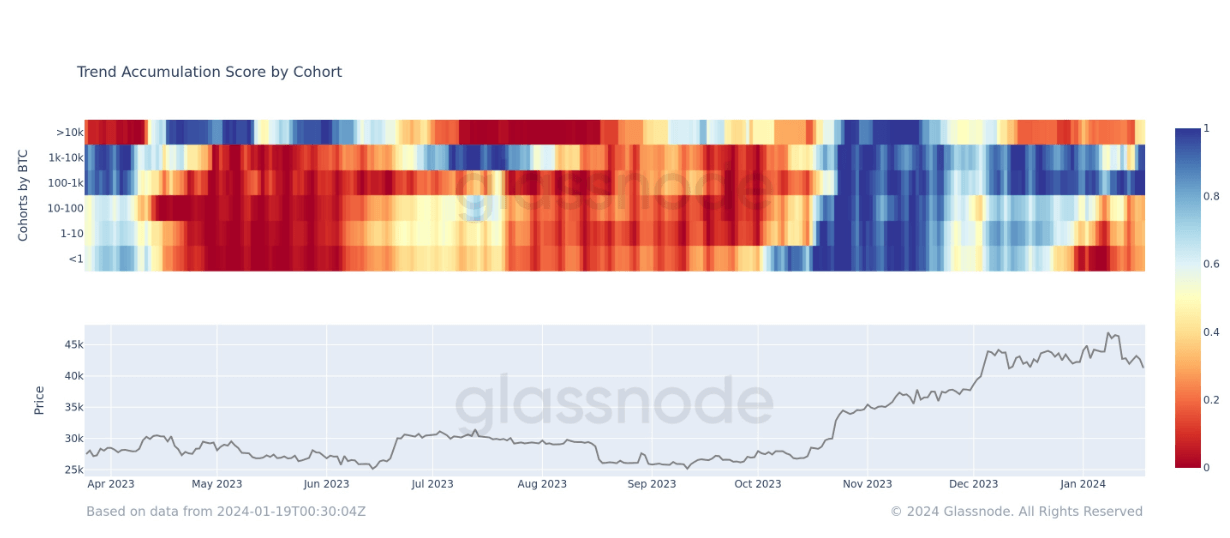

This divergence becomes more apparent when considering the Accumulation Trend Score broken down by wallet cohorts. A score closer to 1 suggests accumulation, whereas a score closer to 0 indicates distribution. Interestingly, holders with at least 100 BTC have begun accumulating, and those with 10,000 BTC have ceased distribution and are seemingly moving towards gradual accumulation. This trend is expected to strengthen in the coming days.

In stark contrast, holders with 100 BTC or less show a distribution trend, affirming the disparity in the accumulation habits of larger and smaller cohorts.

The post Whales dive deeper into Bitcoin as smaller holders retreat amid ETF pressures appeared first on CryptoSlate.