- June 19, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin and Ethereum prices start to fall as the weekend approaches, a move that has become a familiar pattern in the past few months.

It can be seen that weekends recently have been ‘red’ for the cryptocurrency markets as the volume drops along with the price.

A lack of buyers leads to sellers taking control and pushing the price further down especially on weekends. Such price action has caught many crypto hopefuls on the wrong foot and claims the market is entering into a bear market…again.

But some even see further downside. “Some traders claim that all gaps in the CME Group Bitcoin $BTC contract get filled. Here is one that has not yet been filled at 24,210,” tweeted Peter Brandt, a popular futures and crypto markets trader.

Some traders claim that all gaps in the @CMEGroup Bitcoin $BTC contract get filled. Here is one that has not yet been filled at 24,210. pic.twitter.com/U6EEFqPlnE

— Peter Brandt (@PeterLBrandt) June 16, 2021

The ‘gap’ refers to the difference between spot Bitcoin prices on crypto exchanges compared to the futures prices on the CME. The latter is closed weekends, meaning gaps arise—leading some traders to hypothesize that such price displacements are, always, filled.

Such a move would mark a nearly 60% drop for Bitcoin from its May highs of $63,000.

So what’s next for Bitcoin?

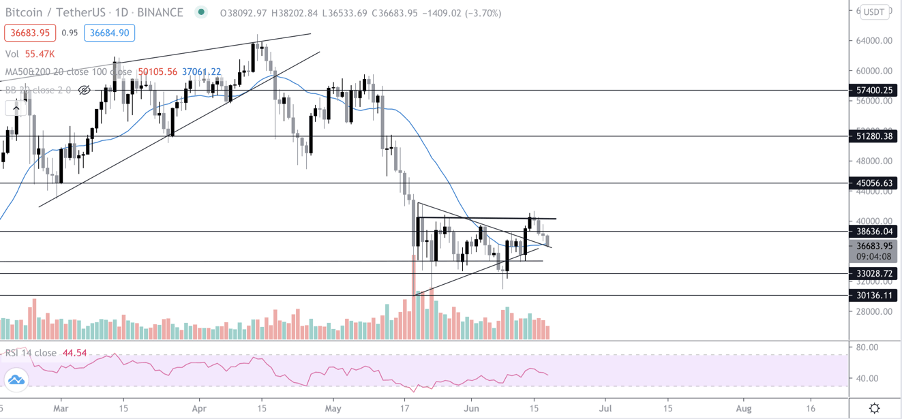

Bitcoin got rejected at the $40,000 mark once again and turned bearish going into the weekend. Volume usually becomes very low during the weekends which leads to a drop in the price action.

BTC looks bearish on the daily timeframe, a daily close below the 20MA (a popular technical indicator used by the traders to determine the market trend) will lead to further downside in the price.

The $34,000 range looks likely as we go into the weekend. With the current downside in the past few weeks it is clear that the sellers are in control and the ‘Bulls’ look to be losing momentum with each passing week.

What’s next for Ethereum?

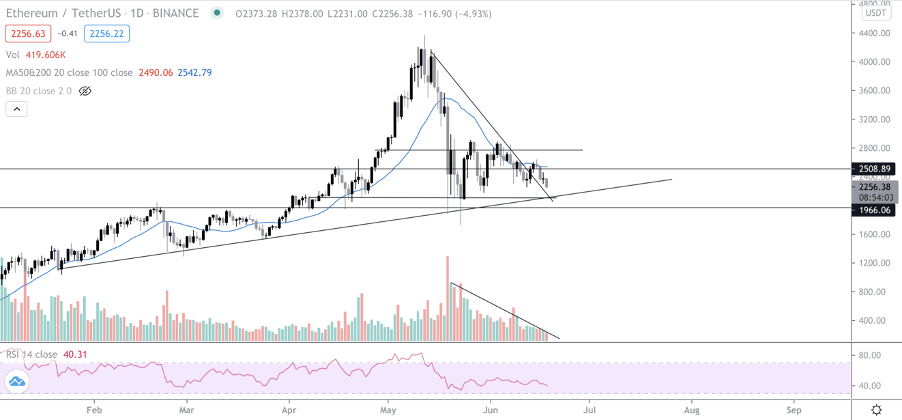

ETH looks bearish on several time frames, and on several trading indicators. Volume continues to decline on the daily time frame and is also very flat indicating that the bears are still in control of the price action.

$2,150 will be an ideal range to place buy bids as that continues to be strong historical support and it is likely that going into the weekend that price should drop down till that region.

The post Veteran trader points out bearish ‘CME gap’ as Bitcoin, Ethereum take a hit appeared first on CryptoSlate.