- September 2, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Vast Bank has become the first U.S. bank with FDIC insurance and a Federal Reserve charter to offer Bitcoin services.

Vast Bank has become the first U.S. bank with FDIC insurance and a Federal Reserve charter to offer Bitcoin services.

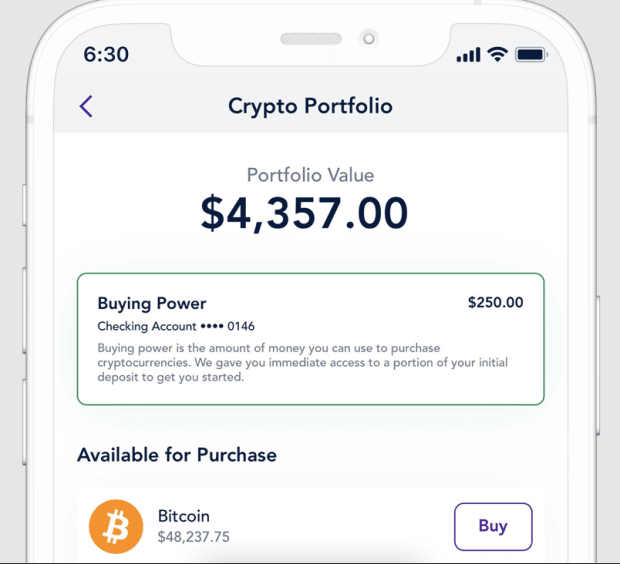

Customers at Vast Bank can now buy and sell Bitcoin directly from an FDIC-insured checking account, while its Bitcoin custody solutions include a mobile trading platform with instant settlement to its accounts.

Vast’s groundbreaking ability to buy, sell, and custody Bitcoin within the bank comes after it was approved by the Office of the Comptroller of the Currency (OCC) and the matter was discussed with the Federal Reserve, Forbes reported.

Vast Bank CEO Brad Scrivner implied in an interview with Forbes that a U.S. Bank is the best place to buy Bitcoin. “We’re familiar with regulation, we’re going to do the right things, we’re going to do things to make sure the financial system is kept safe and sound,” he said.

Federally regulated banks could serve to bring Bitcoin to people who may not have the time or the interest in learning how to custody Bitcoin themselves. Scrivner commented, “There’s lots of different customers out there that may want to control everything and have their own wallet, their own passcodes, and then there are those who are crypto curious and may prefer to work with a bank or an intermediary, just because they don’t quite understand.”

During the interview Scrivner attributed the shift to offering Bitcoin as a way to meet the current demands of customers, but also as a way to stay relevant in anticipation of future demand.

Scrivner continued: “We also believe that technology has enabled the customer in a way that it really hadn’t been enabled in the financial services industry previously, and that cryptocurrency was going to be very disruptive in financial services.”

Vast first looked into custodying crypto in July of 2020, after the OCC announced that with a National Bank Charter the institution could custody Bitcoin and other crypto assets, Scrivner told Forbes. After that both the Board and the shareholders decided to “prioritize crypto in our work.” According to Scrivner, a Gallup/inhouse poll at Vast showed that more than 60 percent of customers were interested in Bitcoin and other cryptos, but “they’re also saying we want to have a bank involved with our custody of cryptocurrency.”

Vast even pitched the shareholders about Bitcoin use cases such as cross-border payments with near instantaneous final settlement and foreign exchange, according to Scrivner. The development comes in part after Vast partnered with Coinbase, who refer their customers to Vast about custodial solutions.

Vast is also currently working to allow customers to deposit their Bitcoin in private wallets and exchanges with the bank.