- November 24, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The El Salvador and Blockstream partnership to issue cheap, U.S. dollar-denominated debt to directly buy bitcoin is a new version of speculative attack.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Over the weekend, the president of El Salvador, Nayib Bukele, and Blockstream announced the issuing of a $1 billion U.S. “Bitcoin Bond” on the Liquid Network. This comes directly after the International Monetary Fund announced last week that “for the moment, it is not discussing a possible financial agreement with the Salvadoran government” referring to the potential $1 billion loan agreement.

The $1 billion bitcoin bond will be split 50/50 for buying bitcoin and building out energy and bitcoin mining infrastructure. The bond’s duration is 10 years, paying 6.5% initially with additional dividends paid out to bondholders from bitcoin holding liquidations after a five-year lockup period. The initial bonds will be issued in 2022, with Blockstream highlighting that it can easily accept investments as small as $100.

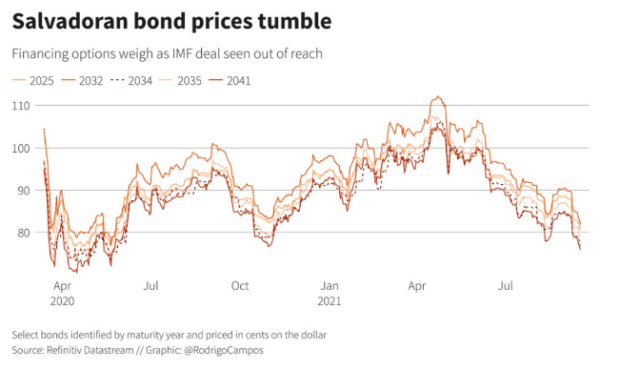

With U.S.-denominated government junk-bond debt now yielding over 13% in the market, El Salvador has ventured into a creative alternative to raise money at lower costs while directly betting on bitcoin’s upside over the next five years. Without an agreement with the IMF, the government’s main alternative would be to issue more junk-bond debt that has already been selling off in distressed territory all year. When backed into a financial corner, Bukele and El Salvador have doubled down on Bitcoin.

We’ve now seen the issuance of cheap U.S. dollar-denominated debt to directly buy bitcoin at the nation-state level. This is the same playbook that we’ve witnessed with MicroStrategy, Marathon Digital Holdings and now El Salvador. Many of the previous debt-issuance strategies, that have offered investors bitcoin exposure have been oversubscribed almost immediately. We’ll see what the demand looks like as the bonds are rolled out. It may be an appealing option to emerging market fixed-income allocations that want bitcoin exposure. If the full $1 billion is satisfied, that would take an estimated 8,929 bitcoin, at today’s prices, off the market for five years.