- September 10, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

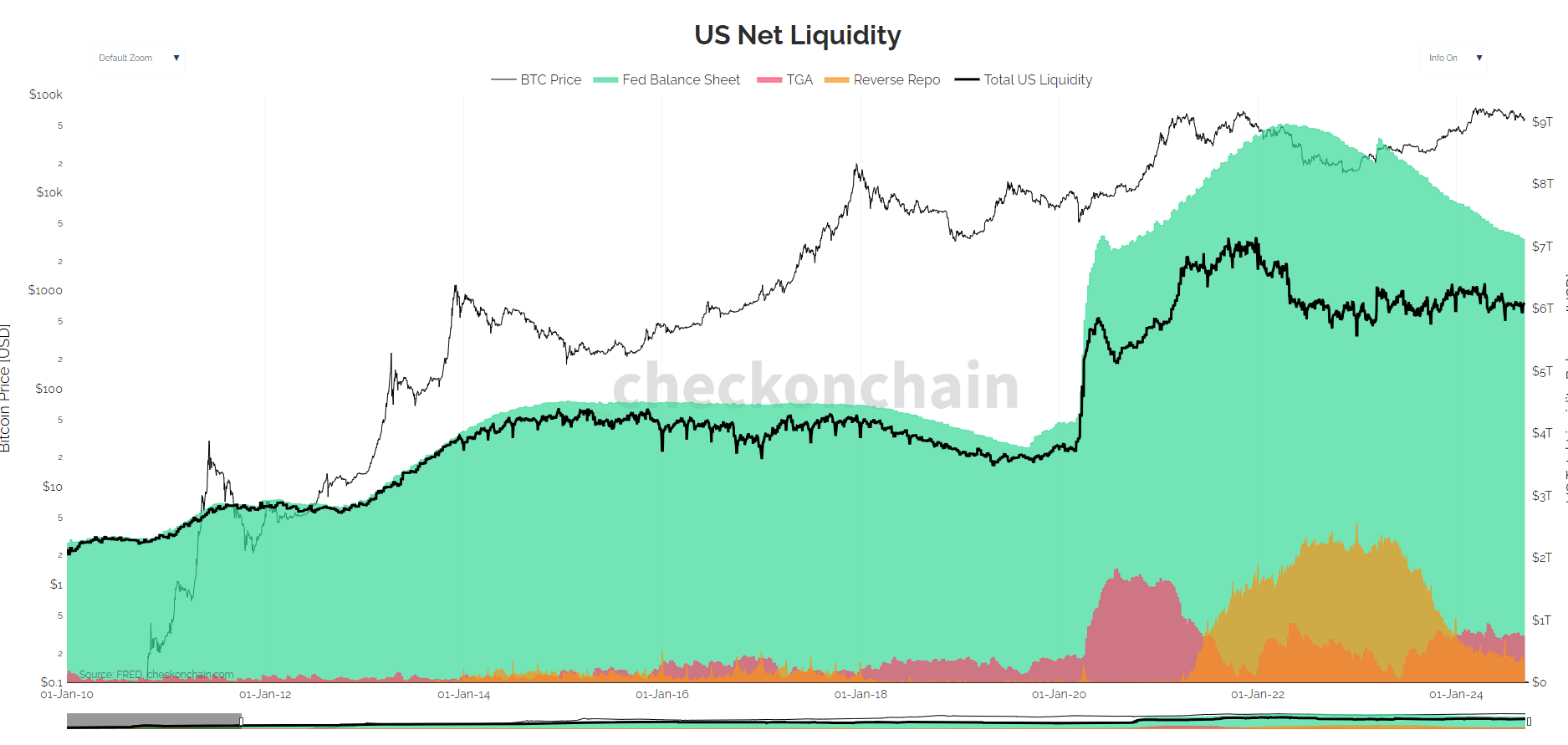

US net liquidity, which reflects the overall liquidity conditions in financial markets, can be measured by key components: the Federal Reserve balance sheet, the Treasury General Account (TGA), and the Reverse Repo (RRP) facility.

The Fed’s balance sheet represents the assets the Federal Reserve holds, primarily Treasury and mortgage-backed securities, which, when expanded, inject liquidity into the market. Conversely, the TGA is the US Treasury’s cash balance at the Fed; when it is high, it absorbs liquidity from the market, and when it is low, it adds liquidity.

The Reverse Repo facility is a short-term borrowing arrangement in which financial institutions lend cash to the Fed, temporarily draining liquidity from the system. Together, these three factors drive changes in net liquidity in the financial system.

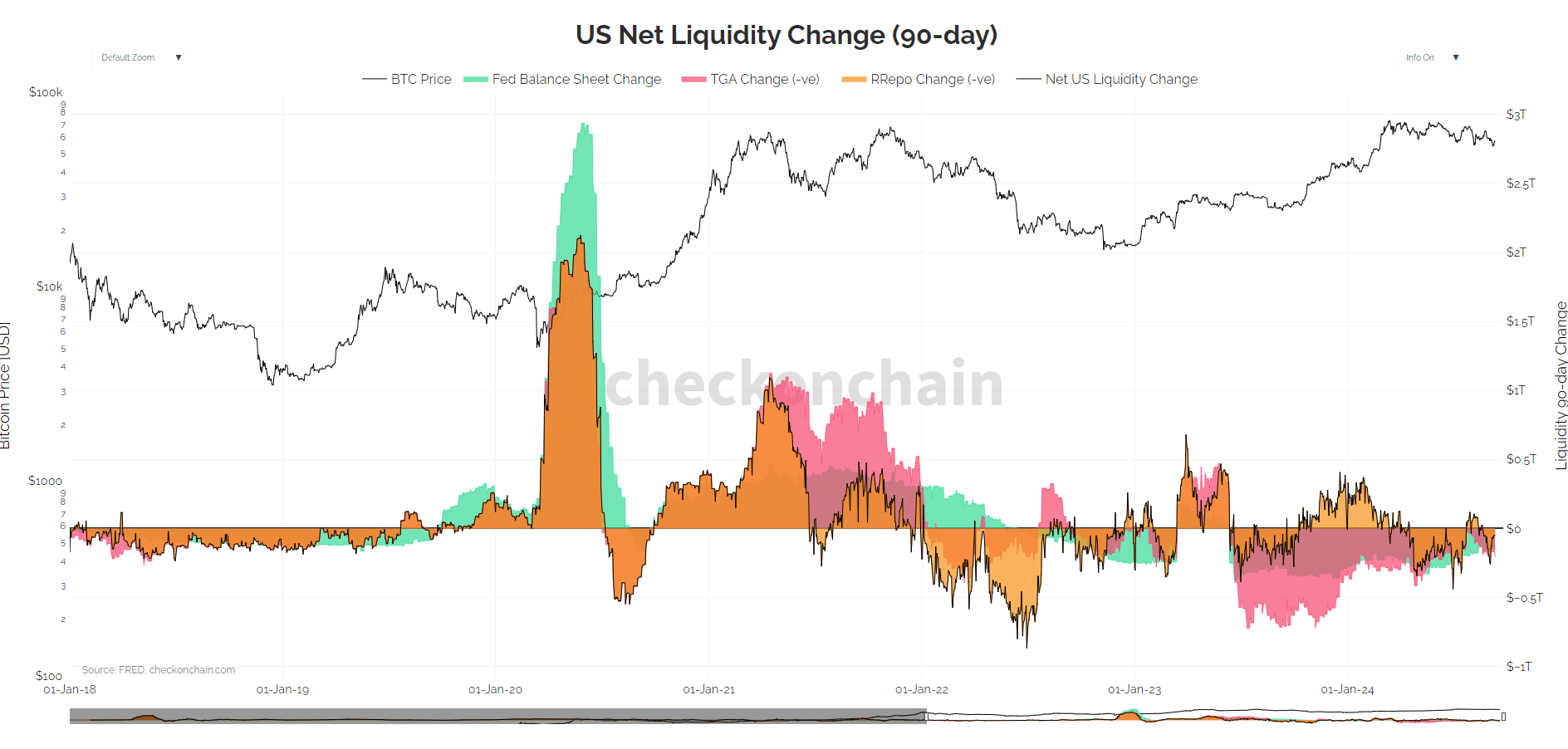

The charts illustrate the 90-day net liquidity changes and the long-term trend. The green shading represents the Fed balance sheet expansion, while the red and orange areas represent TGA and reverse repo activities. Net liquidity plays a significant role in market performance. Bitcoin’s price (shown in black) appears to correlate with increased or reduced liquidity periods, especially during sharp changes like those seen during the COVID-19 pandemic response and subsequent monetary tightening phases.

Since Bitcoin reached its all-time high of over $70,000 in March, amid around $6 trillion in US net liquidity, the price has primarily followed a sideways/downward trend. Currently, the Reverse Repo (RRP) facility stands at $300 billion, the lowest level since mid-2021, while the Treasury General Account (TGA) has remained relatively flat over the past year, staying under $800 billion.

For Bitcoin to begin trending higher, several liquidity conditions need to shift. Ideally, the Federal Reserve would need to reinitiate quantitative easing (QE), which would expand the Fed’s balance sheet and inject more liquidity into the market. Additionally, a continued decline in the TGA would free up more cash for circulation. Finally, the Reverse Repo (RRP) facility would need to stabilize rather than continue declining, which would prevent further liquidity drains. These factors combined could increase total US liquidity, creating a more favorable environment for Bitcoin and other risk assets to move higher.

The post US net liquidity signals critical juncture for Bitcoin’s path forward appeared first on CryptoSlate.