- October 5, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

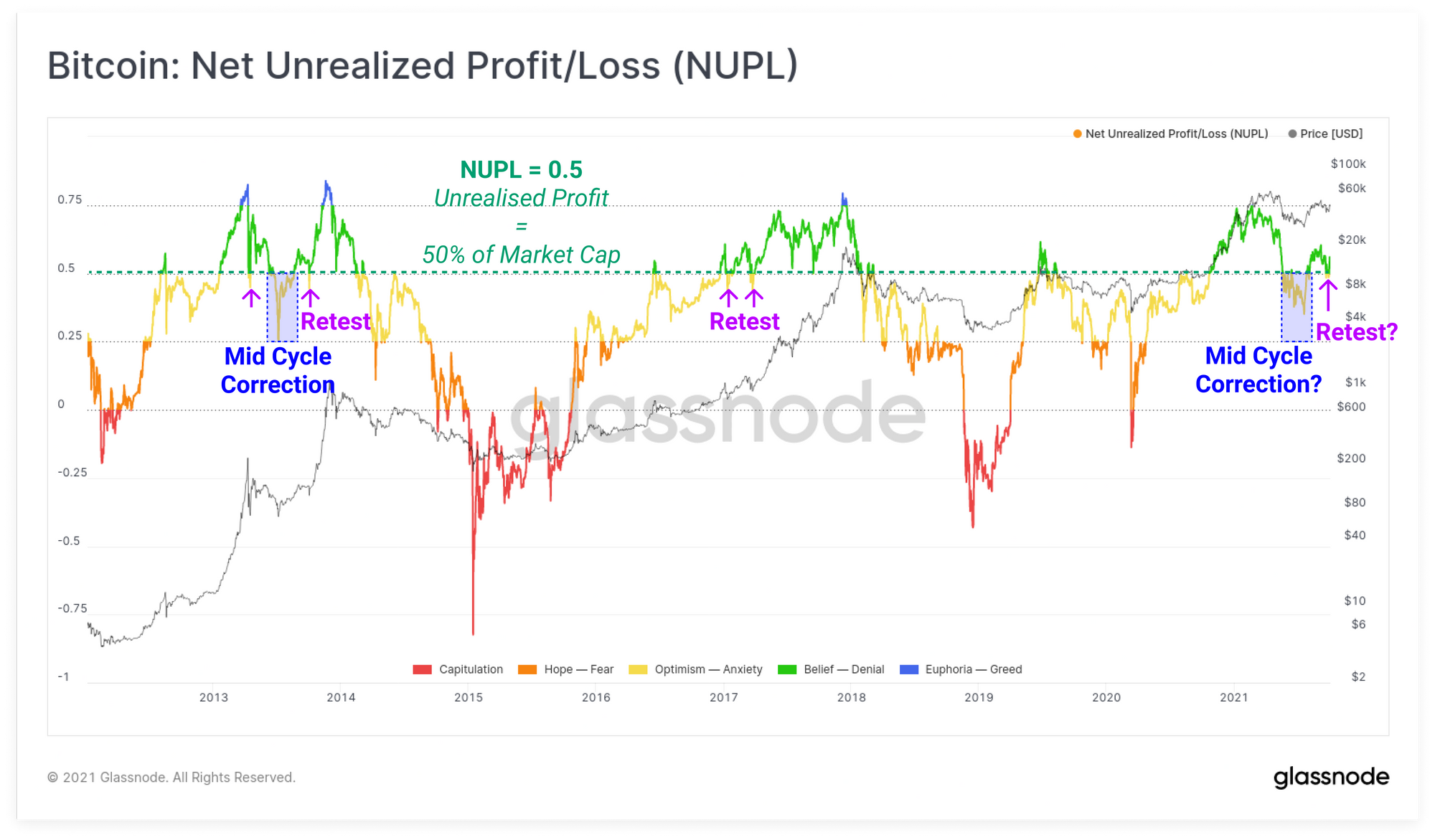

On-chain data may show a retest of a Bitcoin indicator that has happened after mid-cycle corrections in the past. If it’s indeed one, more highs could be ahead.

Bitcoin Net Unrealized Profit/Loss Retests A Lower Level

As per the latest weekly report from Glassnode, the net unrealized profit/loss indicator has just retested the 0.50 level.

The net unrealized profit/loss (NUPL) is a Bitcoin metric that’s based on the difference between the total unrealized gains and the total unrealized losses on the network. With its help, it can become possible to say whether the market as a whole is currently in profit or loss.

The “unrealized” profit and loss are determined by looking at when each coin on the blockchain was last transacted and where that coin stands today in terms of value gained or lost.

When the indicator has values above zero, it means the network as a whole is currently in profit. The higher the values get, the closer the market gets to a top.

Related Reading | Bitcoin Loses Steam As Institutional Investors Shift Focus To Ethereum

On the other hand, the metric’s values below zero would indicate a state of loss for the market. Here also as values deviate further from zero, the market reaches a turning point (the bottom in this case).

Now, here is a chart showing the latest trend for the net unrealized profits/loss for Bitcoin:

Looks like the indicator has just retested the 0.50 level | Source: Glassnode

As the above graph shows, the net unrealized profit/loss just bounced off from the 0.50 line. At this value, the total unrealized profit in the market is equal to 50% of the cap. Approximately $450 billion at current values.

Similar retests took place during the 2013 and 2017 cycles and the level acted as “support” after major corrections. In both the cycles, the market went on to rally higher afterwards.

What Does It Mean For The Current BTC Price?

If this retest of the net unrealized profit/loss is similar to the ones in 2013 or 2017, then the coin’s price could head up soon similar to how it happened then.

Related Reading | $47,000,000 In Bitcoin Shorts Liquidate In An Hour As BTC Climbs To $47.5k

However, if the retest fails and the indicator’s value drops below 0.50, investors could sell off their coins in fear of losing their returns. This could lead to another drop in BTC’s price.

In other news, Bitcoin’s price has finally broken $50k again, as the crypto’s value is up 19% in the last seven days. Though the coin is still in the red over the last thirty days as returns stand at -0.5%.

The below chart shows the trend in the price of the coin over the last five days.

Bitcoin's price retests the $50k level | Source: BTCUSD on TradingView

Featured image from Unsplash.com, charts from TradingView.com, Glassnode.com