- February 8, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Definition

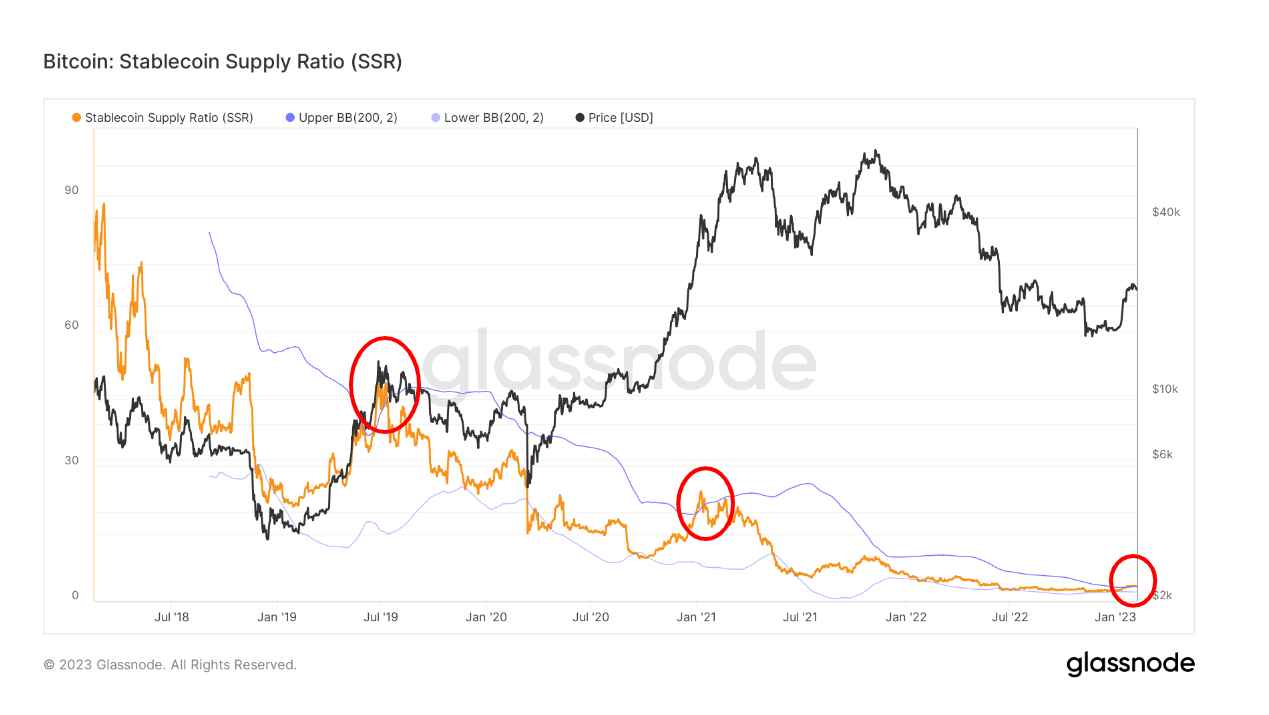

- The Stablecoin Supply Ratio (SSR) is the ratio between Bitcoin supply and the supply of stablecoins denoted in BTC, or: Bitcoin Market cap / Stablecoin Market cap. We use the following stablecoins for the supply: USDT, TUSD, USDC, USDP, GUSD, DAI, SAI, and BUSD.

- When the SSR is low, the current stablecoin supply has more “buying power” to purchase BTC. It serves as a proxy for the supply/demand mechanics between BTC and USD.

Quick Take

- The stablecoin supply ratio has broken the upper bound for the third time in five years.

- This suggests stablecoins are being redeemed for Bitcoin, which is encouraging during a risk-off environment and not being redeemed for dollars.

- The last two times the SSR broke the upper BB was in Jan 2021 and June 2019, when Bitcoin hit a local top on both occasions.

- The SSR is still relatively close to all-time lows — suggesting a lot of stablecoin buying power is still yet to be deployed.

The post Third highest rate of stablecoin outflows into Bitcoin in 5 years appeared first on CryptoSlate.