- June 10, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Lightning has seen major growth as Bitcoin’s medium of exchange scaling solution, but is still in its infancy stage as companies build on top of the protocol.

The below is a free, full excerpt from a recent edition of Bitcoin Magazine Pro, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Lightning Network Update

“The Lightning Network will allow anyone — individuals, SMEs, institutions, etc. — to send domestic or international payments of any size, with unlimited frequency, without bank intermediaries, nearly instantly, and essentially for free.” — “On Impossible Things Before Breakfast,” NYDIG

For readers that are not familiar with Lightning, the Lightning Network is an open, Layer 2 payment protocol built on top of Bitcoin that utilizes channels between peers to transfer value without relaying every transaction to the entire network and settling on the Bitcoin blockchain.

The opening of channels between peers allows for the scaling of payments greater than the max throughput of the Bitcoin blockchain. This process is often analogized to the opening of a bar tab, where, in theory, an unlimited amount of transactions can be relayed between parties, before settling at the end of the night by closing your tab, which is then processed as one transaction on the users’ statement.

In a similar fashion, only the opening and closing of channels is recorded on the blockchain when using Lightning, while nodes in the system verify with cryptographic certainty that the state of ownership is known and clear by relaying back to the immutable Bitcoin UTXO set.

We last covered the growth of the Lightning Network in our March 17 issue, which readers can find here. Since our last coverage, Bitcoin’s Layer 2 scaling solution has continued its rapid ascent, with increasing commercial and individual user adoption. Also, exciting new potential applications have arisen, including the release of Taro, a protocol that operates on the Lightning Network, that would bring new features and scalability to the network, including the ability to use stablecoins.

While the release of Taro by Lightning Labs (which was enabled by the Taproot soft fork) is still a proposal that requires multiple BIPs (Bitcoin Improvement Proposal) via soft forks to activate, it is exciting to see many previously unforeseen applications being built out across the open-source ecosystem that is Bitcoin.

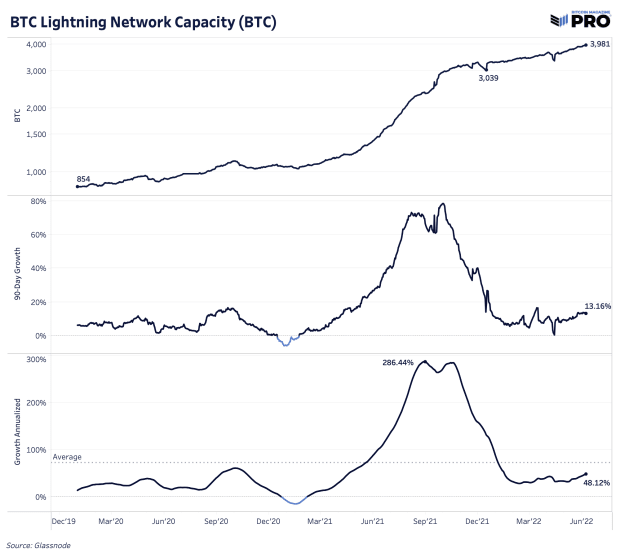

Public Channel Capacity Nearing 4,000 BTC

Public channel capacity on the Lightning Network is closing in on 4,000 BTC, at a current real-time figure of 3,996 BTC, experiencing growth of 5.41% over the previous 30 days.

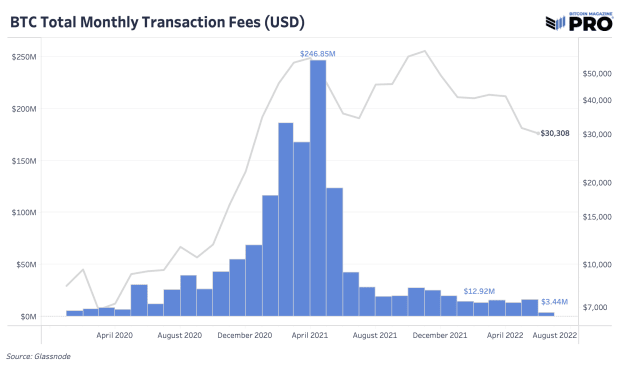

It is worth highlighting that the recent growth of the Lighting Network has come during a time where on-chain bitcoin fees have been extremely low, which partially reduces the economic incentive to use the Layer 2 solution to save on costs. This makes growth in public channel capacity over the course of 2022 (as seen by the 90-day annualized growth rates) all the more impressive.

The median on-chain transaction fee, over the last 30 days, is around $0.73 versus a Lightning fee of approximately 1 satoshi or $0.000301142. Even as median on-chain fees have reached near $34 at peaks, dependent on block space demand, Lightning fees have remained near zero due to the many zero-fee routing nodes and liquidity providers that operate across the network.

However, even with the current state of transaction fees on the Bitcoin base layer, the speed of settlement on Lightning is much faster, with near instantaneous settlement possible between peers acting as an incentive for entrepreneurs and developers alike to build on top of the technology.

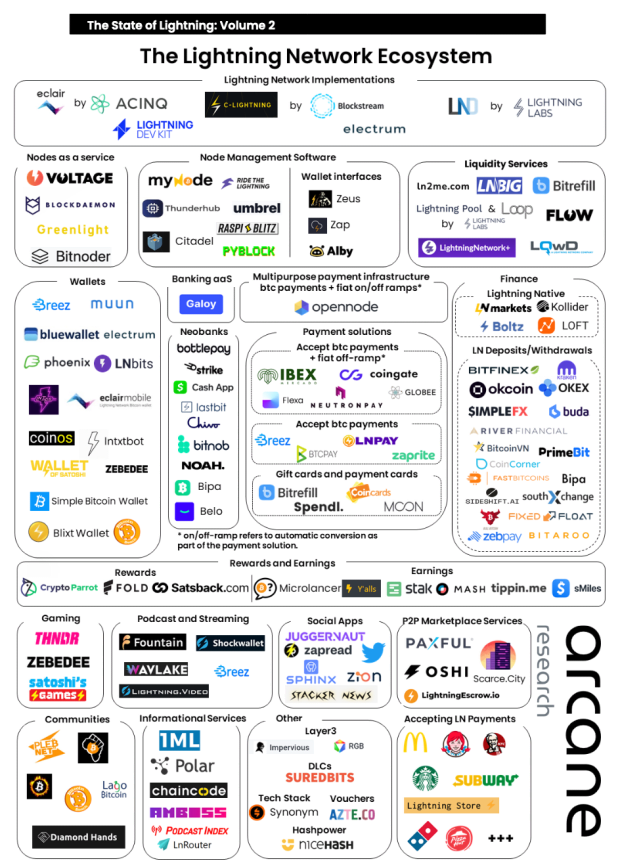

State Of Lightning Research

Arcane Research has been instrumental in publishing in-depth Lightning Network reports with the “State of Lightning Network Volume 2” published as their most recent in April. Partnering with multiple participants in the ecosystem, the report highlights private data inputs and estimates for overall payment volume that can’t be tracked in public data. Public capacity growth, channel sizes and the number of nodes can give us some insights on Lightning’s ongoing adoption, but it doesn’t provide that much insight on usage (i.e., growth in payment volumes, withdrawals and deposit activity or distribution of payments).

One of the more interesting conclusions that Arcane highlights in the report is the inevitable comparison to Visa as a competing payments network,

“Lightning Network usage is growing rapidly. However, comparing the numbers with other payment networks such as Visa show there is still much ground to be conquered. In 2021, Visa handled more than $1 trillion in payment volume and close to 20 billion transactions per month.10 In comparison, we estimate that the Lightning Network handled about $20 million in payment volume and slightly over 800,000 transactions in February 2022. But the prospect of increased Lightning Network adoption looks very promising.”

Like any new developing technology, Lightning has seen extraordinary growth as Bitcoin’s dominant medium of exchange scaling solution (and will continue to do so), but it’s still in its infancy stage as new companies flock to the ecosystem to build out solutions and use cases on top of the protocol. These solutions span across wallets, liquidity, payment solutions, social media, gaming, banking, rewards and more.

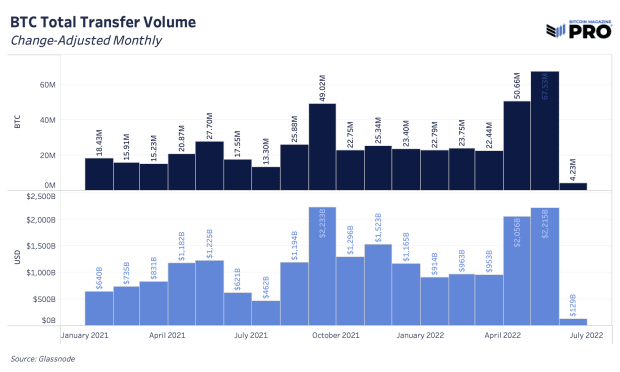

The $20 million estimate for payment volume in one month, $240 million annualized, pales in comparison to Bitcoin’s on-chain monthly volume of $963 billion in February 2022, $11.56 trillion annualized. This is more of a rough comparison for context on where Lightning payment volume stands today, as sending value across Lightning versus on-chain are used for entirely different purposes with a much wider adoption gap across the two.