- January 20, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

It’s hard to pinpoint a moment or a movement in the history of the crypto industry that can quite compare to the popularity NFTs have seen last year. The impact the relatively new asset class had was both deep and wide, seeping through to mainstream media and traditional news outlets.

The success NFTs have seen in 2021 becomes even greater when compared to other sectors of the crypto industry.

Their popularity was so great even beyond the realms of the crypto industry—so much so that Collins Dictionary chose “NFTs” as the word of the year.

“2021 was indisputably the year of the NFT,” Pete Humiston, the manager of Kraken Intelligence, told CryptoSlate. “The sector surged from near-obscurity to mainstream headlines in a matter of months. Not only did newcomers recognize the appeal, but so too did a diverse range of companies, from video game developers to established fashion houses, who released their own branded NFTs in the second half of the year, giving the sector the second-wind that helps explain its standout outperformance.”

Diving deep into the world of NFTs

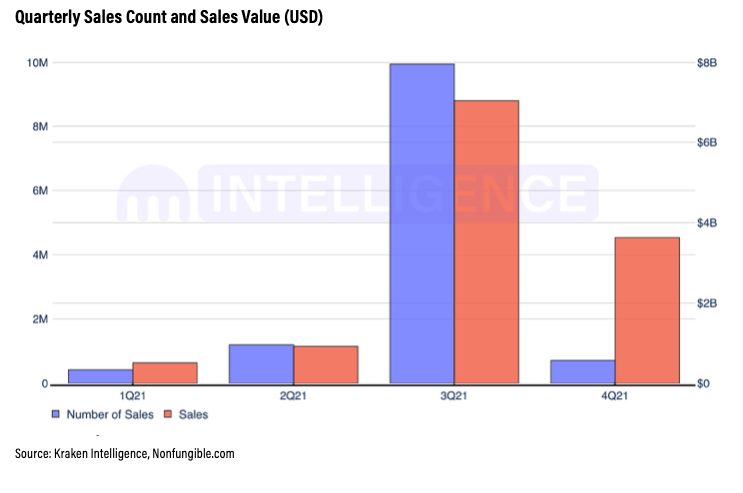

While NFTs have been the most popular asset class in 2021, the success they’ve seen wasn’t consistent throughout the year. The initial wave of popularity took off in Q1 2021 following steady growth in the final months of 2020.

At the beginning of the year, arts and collectibles dominated the NFT world—everyone from celebrities to lesser-known digital artists issued their own non-fungible tokens throughout the first quarter. Even traditional auction houses like Christie’s and Sotheby’s leveraged the power of NFTs to expand and reach their offerings.

According to Kraken Intelligence’s 2021 Crypto-in-Review report, the success collectibles have seen seeped over into Q2. By Q3, most of the NFT adoption was happening with in-game NFTs, following a broader macro trend that put more focus on metaverses and blockchain-based games. In the second half of 2021, NFTs became increasingly integrated into the music industry, with artists looking for new ways to monetize their music.

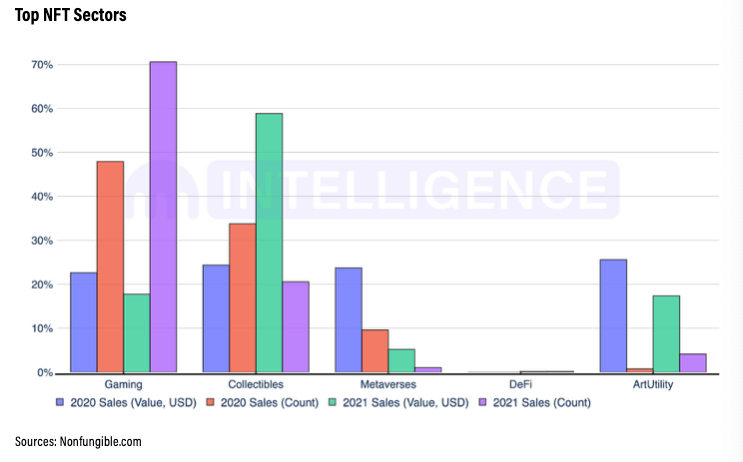

By the end of 2021, the booming NFT market had a very diverse audience and was comprised of several distinctive sectors, including art, collectibles, DeFi, gaming, metaverse, and utility-driven NFTs. As CryptoSlate reported in December, the largest growth was seen in the gaming sector, which saw a 70% growth in sales count. The biggest increase in the sales value was seen in the collectibles sector, which recorded a 59% increase YoY, despite having a modest 21% increase in its sales count when compared to 2020.

Kraken Intelligence’s data presents an interesting conclusion—while collectibles saw the biggest increase in sales value YoY, gaming tokens recorded a much higher sales count. This means that more people adopted gaming NFTs than collectibles, but those that invested in collectibles did so with significantly more money than in 2020.

However, focusing on 2021 alone paints a much different picture.

In terms of sales value, gaming NFTs saw the greatest growth from Q1 2021 to Q3 2021—a whopping 7,302%. By Q4 2021, while the hype around NFTs in most sectors cooled off, metaverse and utility NFTs continued to grow in sales value.

“This illustrates the level of interest in art and collectibles at the beginning of the year, and a gradual shift towards the metaverse and utility NFTs by the end of the year,” Kraken Intelligence wrote in the report.

This expansion into the gaming and metaverse sector caused many global brands to launch their own NFTs, NFT-based games, and metaverses. Nike launched Cryptokick, a platform that issues NFTs with each shoe purchase, enabling buyers to verify the authenticity of their purchase and store their footwear in a virtual locker. Its competitor Adidas announced shortly after that it will be issuing its own “rare NFTs” this year. Even Louis Vuitton dabbed in blockchain gaming, launching “Louis the Game,” an adventure-based NFT collecting game designed in collaboration with Beeple.

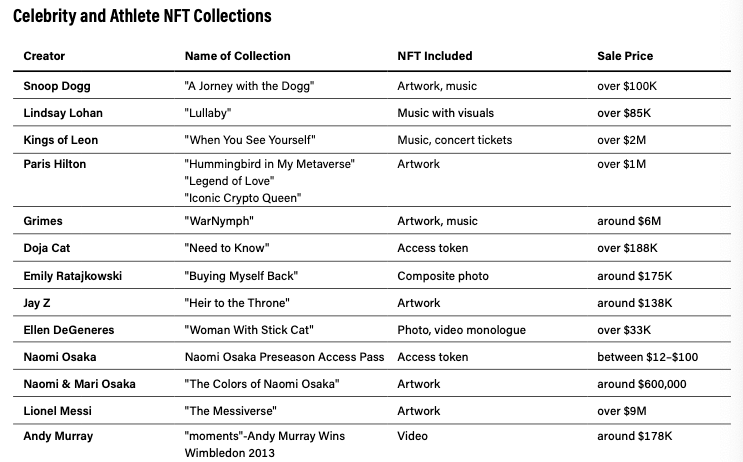

It’s not just big brands that saw the potential of NFTs—musicians, celebrities, and athletes alike all jumped at the opportunity to disseminate their content.

The potential of the NFT sector and the problems it needs to solve

The popularity of NFTs meant that they were the focus of many reports in the mainstream media. And while the crypto industry was falling head over heels for the innovative approach to ownership, legacy media was rather reserved when reporting on the new asset class, focusing mostly on the outrageous prices some NFTs sold for.

What the legacy media failed to understand were the implications NFTs had on various industries. Kraken Intelligence noted that NFTs quickly went far beyond just art and made their way into industries often controlled by middlemen with a higher share of profits and control over the dissemination of content.

Since non-fungible tokens can be programmed to return a commission to their original creator in every sale, artists and musicians quickly adopted them to remove the need for relying on a third party to distribute their content.

“Empowering creators on an individual level and eliminating barriers to entry stirs a greater conversation around the transformative power of NFTs. While current applications alone seem revolutionary, the developments of this year suggest to us that we have only scratched the surface,” Kraken Intelligence concluded in the report.

And while Kraken’s analytics arm believes that we’ll see continued demand for the asset class, it notes that there are still many problems the sector needs to overcome.

It specifically refers to hacks and counterfeits. Most platforms and collections today use data storage solutions that rely on third parties to house NFT data, which are vulnerable to exploits. Creating storage solutions that don’t rely on third parties would create more robust security for users and create a safer ecosystem.

The issue of counterfeit or duplicated tokens will also need to be tackled in order to ensure the longevity of the industry. The report identified a growing need for a strong verification system that can identify similar NFTs and provide assurance of authenticity.

If the space manages to develop these solutions and introduce more robust security measures, we could see even greater adoption, Kraken concluded.

The post The NFT sector defined the market last year with returns of nearly 8,000% appeared first on CryptoSlate.