- June 22, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The first of this four-part series discusses the various aspects of money that are not commonly understood.

The Wall Street Analyst’s Introduction to Bitcoin:

- The Dimensions of Money

- What Bitcoin Does

- How Bitcoin Works

- The Monetary Properties of Bitcoin

Introduction

I first discovered Bitcoin in 2015 as an undergrad, and then wrote a short essay concluding that bitcoin was a speculative asset with no fundamental value. Though I wish that were not my initial opinion, when applying the economic theory I had learned in school it was the only logical conclusion I could come to. Over the years however, reading about Bitcoin started to consume my spare time. By 2018 I came to the realization that Bitcoin was the next step in the world’s monetary evolution. By 2019 I quit my job in private equity to jump into the industry.

For me to understand the value of Bitcoin I had to change my perspective of value from the traditional cash flow-based methodology to a qualitative assessment of monetary value. This shift made me realize I had originally concluded that bitcoin was a speculative asset with no fundamental value, because I was assessing it with the wrong framework.

The following series summarizes some of the key concepts about money and Bitcoin that properly illustrate its value proposition. With this understanding, you can assess Bitcoin and its competitors within a framework of monetary value – the framework that I think is necessary for financial analysts to understand Bitcoin. This series is just scratching the surface of this information – if you want to read further on these topics, check out my book on amazon.

The Dimensions Of Money

What is money?

Why is it used?

Which money is best and why?

Who decides this for us?

Is there a way to understand money at a fundamental level so that we can choose for ourselves?

What does it mean when people say money needs to be “backed” by something?

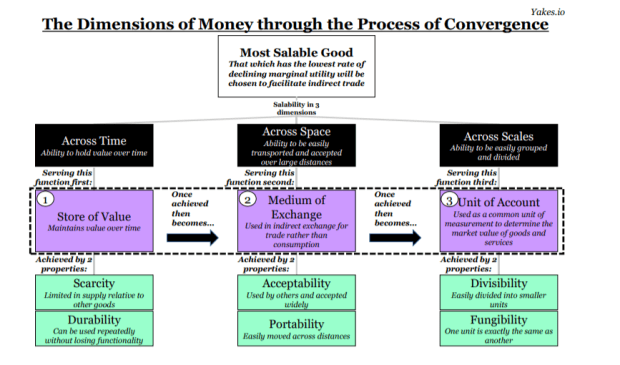

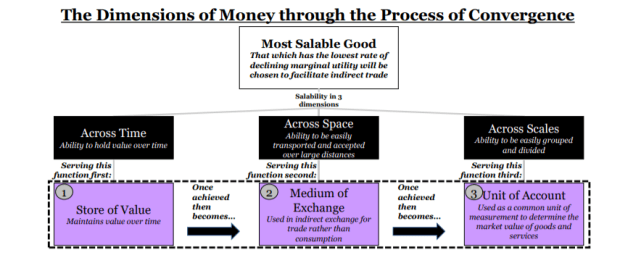

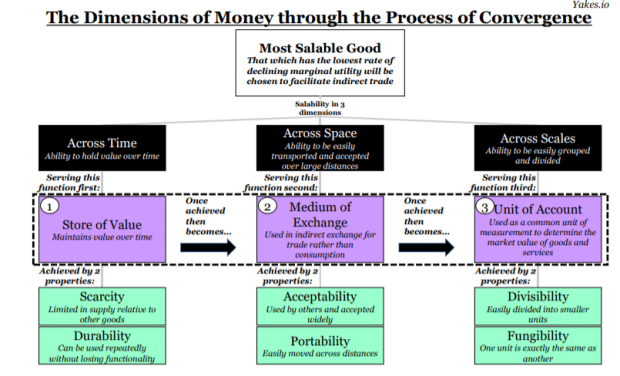

These are important questions that can be expensive to neglect. Money is confusing because it crosses multiple dimensions. We will walk through the below graphic step by step to understand how the dimensions are distinct and related.

The Purpose Of Money

People specialize to achieve economies of scale and scope. Specialization necessitates trade. Trade necessitates money. Before money, systems of barter were used that inefficiently required a coincidence of interests. In small groups this was possible but as organization scaled these coincidences became increasingly burdensome. As groups grew larger, those which utilized forms of money to facilitate transactions and store wealth were able to become more specialized in their productive capacities – allowing more sophisticated forms of organization to emerge and living standards to rise.

The purpose of money is to facilitate trade which allows groups to specialize and organize with greater complexity.

Defining Money

Barter systems are forms of direct trade while monetary systems are forms of indirect trade. Goods used in indirect trade are naturally converged upon (i.e., chosen freely through iterations of trade) because they have properties that most people want most often. Goods that maintain these properties are desired because they are most likely to present a coincidence of interest with other parties. In this sense, money enables a system of indirect exchange.

Carl Menger, in the The Origins of Money, defined the relative ability for a good to be sold in a given market at the time and price desired as a good’s salability.1 Market participants converge upon the most salable commodity over time, through many transactions. Eventually, the good that is most widely accepted and best maintains value over time will become money. By using money, market participants can protect themselves from depending on any coincidence of interests in the future.

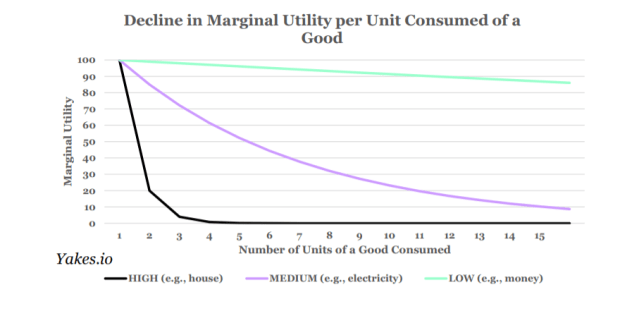

Menger defined the good with these qualities as that which has the lowest rate of declining marginal utility. Meaning, each unit consumed maintains similar utility to the prior unit consumed. For example, high marginal utility decline would be a house whereas low marginal utility decline would be money.

We’ve now defined the first aspect of our monetary dimensions table:

Salability can be stratified across the three dimensions of time, space, and scales2:

In a free market, the most salable good will be chosen as money. Salability can be broken into three dimensions: time, space, and scales.

Defining Monetary Value

Thus far we’ve discussed how a good maintains monetary value. This is not to be confused with a good’s market value. Think of this as a good’s utility for trade vs. its utility for consumption. Market value is derived from a good’s consumption value while monetary value is derived from a good’s monetary properties. We value stocks based on the company’s cash flows which are obtained by goods and services that have utility for consumption. Money does not have cash flows, it has monetary properties that allow it to facilitate trade. Many people try to apply a consumption value framework to money when they should be viewing it through the lens of monetary value.

A monetary good obtains its value by enabling the trade of goods which have market value and need to be exchanged across space, time, and scales. The better the form of money used, the lower the costs of transacting, and the greater the ability to transfer, store, and measure wealth.

The monetary value of a good is obtained by its ability to enable trade and is completely separate from the good’s market value for consumption.

Market value is estimated by discounting future cash flows. Monetary value is estimated by qualitatively comparing monetary properties. The remainder of this essay will describe how to compare monetary properties.

How People Choose Money

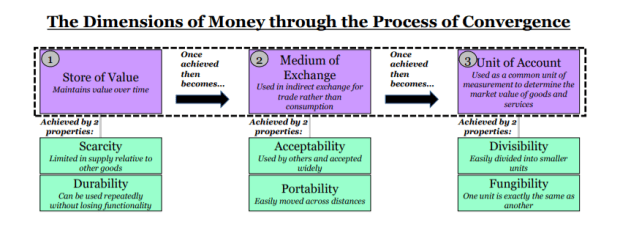

The evolution of a good’s transition to becoming a monetary medium can be roughly summarized as follows. It must have properties that store value, in that one can reasonably assume its market demand will not deteriorate over time. As more market participants realize that a certain good stores value, they can then exchange it between themselves for this property, even though it may not be widely accepted yet. As more of this exchange occurs, the knowledge of it being widely accepted becomes a self-fulfilling prophecy, and its use as a medium of exchange becomes more frequent. Once it is accepted at a large enough scale as a medium of exchange, participants using it as a medium will begin to commonly quote the prices of their goods and services in amounts of the good – until finally it becomes a common unit of account. Through this process market participants converge upon a monetary good that supports these functions:

The Six Properties Of Money

The monetary medium chosen by societies has differed due to availability and evolved as new materials and technology emerged which better fulfill the properties sought in a monetary medium. What is consistent across history is that goods chosen as money have maintained certain properties that enable monetary functionality.

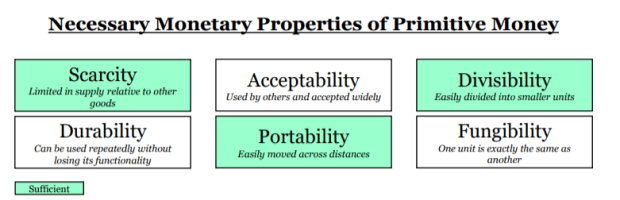

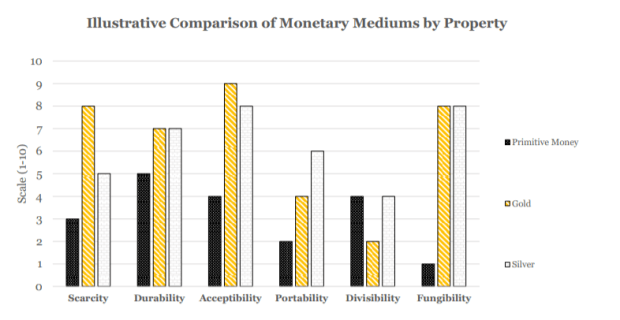

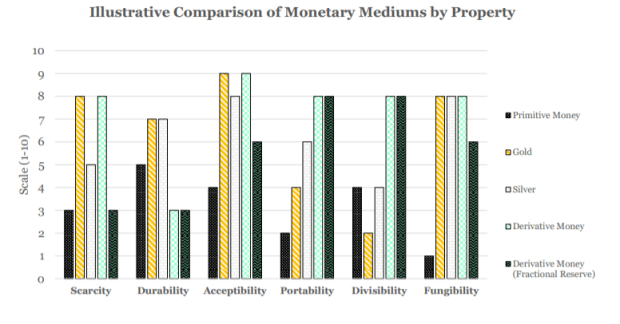

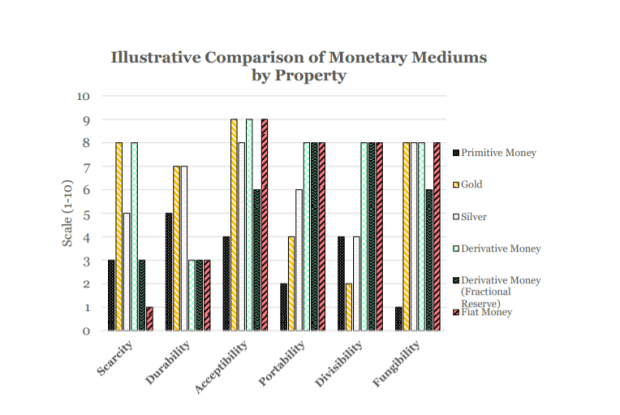

There are six monetary properties that determine a good’s merit for fulfilling the desired functionality as money:

Any good that has these six properties could be money. Goods that excel across all properties are most likely to be naturally chosen as money. Money does not need to be “backed” by anything; it needs to have these properties. Gold was chosen because it has these properties, while paper money does not. Thus, paper money needed to be “backed” by gold so that it could maintain monetary properties while also being more efficient for use in trade; more on this later.

Money Across All Dimensions

For a good to become money in a free market it must be the most salable good. Salability can be thought of in three dimensions: time, space, and scales. A good must excel in certain properties to be considered salable in a respective dimension. For example, if a good is the most salable across time, then it will be the best store of value. If a good is the most salable across space, then it will be the best medium of exchange. If a good is the most salable across scales, it will be the best unit of account. Some goods can be highly salable in one dimension while not at all in another. The good that is the most salable across all three will eventually become money through the process of convergence.

The Evolution Of Money

Now that we have an established understanding of money and its dimensions, I’ll briefly describe the stages of money throughout history. At the end of this series, I will compare bitcoin to each of these categories of money by monetary property.

1. Primitive Money – This category includes beads, necklaces, furs, flints, etc. Primitive money emerged spontaneously in a variety of forms across every society. It generally required at least three monetary properties to be sufficient.

2. Precious Metals – As societies became more technologically advanced, precious metals were converged upon as money due to their monetary properties. Gold, in particular, emerged as the highest standard of value due to its scarcity. Historically, the inflation rate of gold supply was approximately 2% annually – significantly less than silver which was closer to 15%. Because the supply of gold increased so little, its scarcity was better than any alternative. However, silver was used in tandem with gold because it was more divisible, as it was less valuable per unit of weight.

3. Derivative Money – This form of money emerged due to the efficiencies gained from moving paper across distances as opposed to heavy quantities of metal. Further, governments eventually enforced its use. Derivative money is any sort of legally enforceable document (paper receipt) that grants the owner redemption of a defined amount of money. The paper receipt itself is useless as money, as it does not possess the necessary monetary properties. Its value is derived from the certainty that the money backing it is safely stored, and is accessible for withdrawal on demand by holders.

- The custodians of derivative money eventually realized they didn’t need to maintain a full reserve but instead could maintain a fractional reserve to meet demand by receipt holders. Here I distinguish between full reserve and fractional reserve forms of derivative money:

4. Fiat Money – What was eventually reasoned by bankers and governments alike is that if you could remove the requirement to have reserves (money/gold) and simply issue paper that is irredeemable, there would be no limitation to the amount you could loan. Thus emerged fiat money, the system we are subject to today. Fiat money effectively removed the scarcity property that originally was one of most desirable properties of money.

We now have a framework from which we can assess money by property. We can look at the above categories and illustrative examples to understand how money evolved over time. The question of how banking and governments effectuated these changes over time is important, but I will not go into detail here.

The goal of this series is to compare bitcoin by each monetary property. This comparison is the necessary basis to understand why bitcoin has greater monetary value than any form of money in existence today or that has come before it. To do so, we must first understand Bitcoin at a technical level – the goal of the next two essays in this series.

References

- The Origins of Money, Carl Menger, 3-4

- The Bitcoin Standard, Dr. Saifedean Ammous, 4

Eric Yakes came from the private equity industry and is a CFA charterholder turned bitcoin pleb and author of The 7th Property: Bitcoin and the Monetary Revolution – a comprehensive/technical resource on money, banking, and bitcoin. He is passionate about enabling the Bitcoin ecosystem through financial services – if you have similar interests send him a DM @ericyakes.

This is a guest post by Eric Yakes. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.