- May 12, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Terra’s CEO, Do Kwon, reappeared early Wednesday to present an emergency plan to save UST and LUNA.

To protect against network governance attacks, the business proposes burning all UST in the community pool, burning the remaining 371 million UST cross-chain on Ethereum, and stakeing 240 million LUNA.

Terra Plans To Save LUNA And UST

The Terra Money Twitter account went into additional depth about Terraform Labs CEO Do Kwon’s UST rescue plan in a tweet thread.

Kwon stated in his tweet series:

“Before anything else, the only path forward will be to absorb the stablecoin supply that wants to exit before $UST can start to repeg. There is no way around it. With the current on-chain spread, peg pressure, and UST burn rate, the supply overhang of UST (i.e., bad debt) should continue to decrease until parity is reached and spreads begin healing. Naturally, this is at a high cost to UST and LUNA holders, but we will continue to explore various options to bring in more exogenous capital to the ecosystem & reduce supply overhang on UST.”

Proposal 1164, Do Kwon’s original Terra approach from May 11, is discussed in this thread. The idea would improve the algorithmic stablecoin UST’s balance by increasing the currency’s base pool. The proposal has earned 220,000 votes, or more than half of the total. The proposal received 49% abstain from the vote, with the remaining minority voting against it. It will be over in six days.

In order to save the network, Terraform Labs has advised a number of additional “emergency actions.” To secure the network from regime attacks, all remaining UST owned in Terra’s community pool, an extra 371 million UST now stored on Ethereum, and 240 million LUNA tokens will be burned.

Related Reading | How Terra Is Using Its Bitcoin Reserves To Keep UST Stable

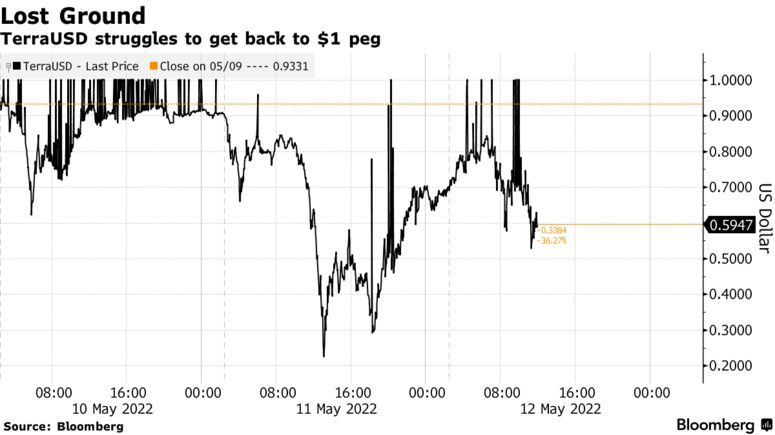

Terra’s algorithmic stablecoin, UST, has lost its peg, resulting in a bearish run this week. While UST plans to follow the dollar, it touched a low of $0.30 on Wednesday and remains below the $0.50 peg.

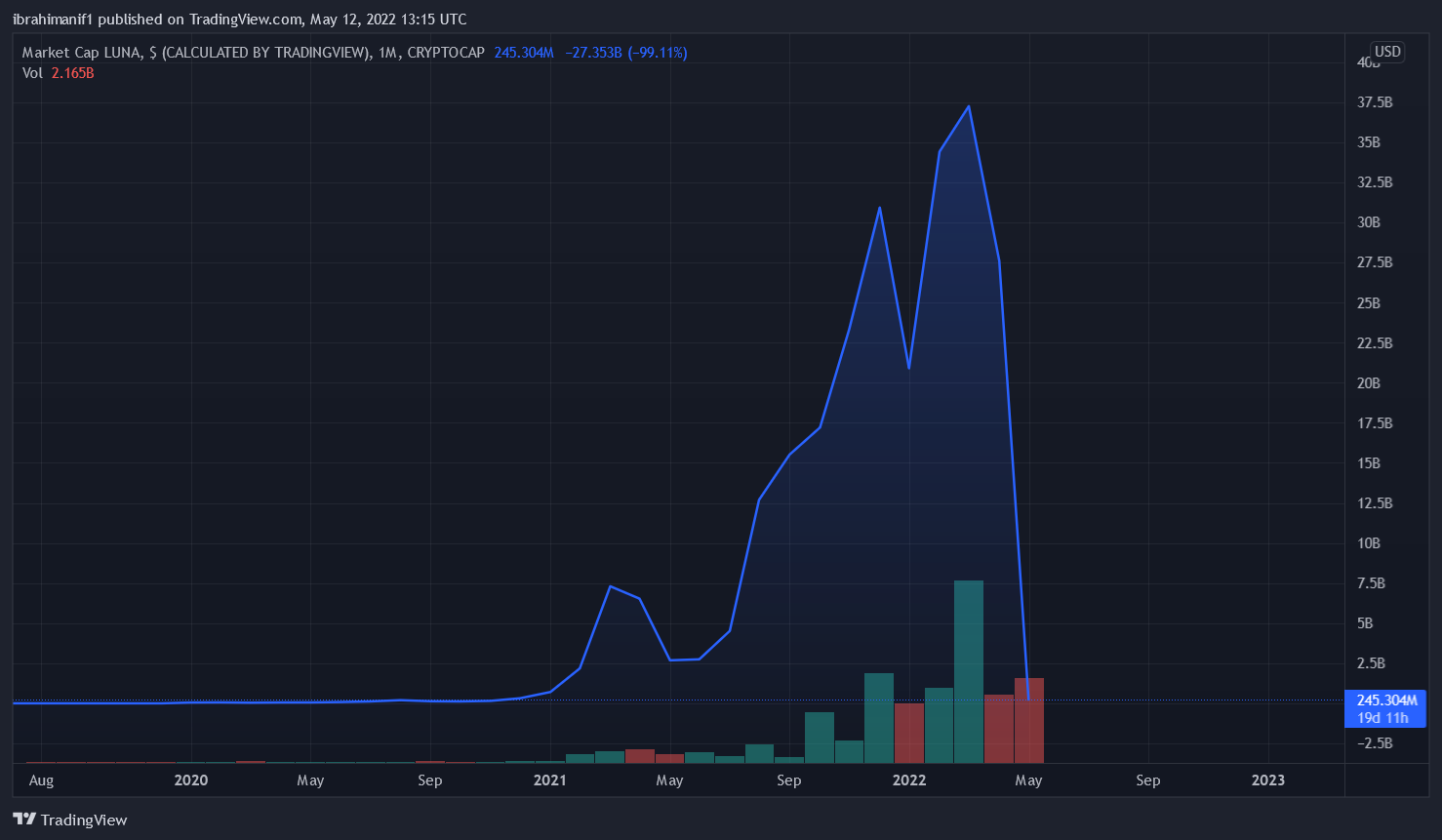

LUNA, Terra’s volatile coin, isn’t faring any better: it’s currently trading below $0.05, down 99.9% this week. Its price peaked at $119 just five weeks ago. The drop has been dubbed “one of the sharpest and most brutal in crypto history,” and it has serious implications for the rest of the market.

LUNA Market Cap has crashed from $37 Billion to $245 Million. Source: TradingView

Several other significant assets have dropped today, with Ethereum losing 20% and Solana and Cardano losing more than 30% of their value. As speculators hurried to abandon the market, the USDT lost its peg against the US Dollar, temporarily falling to $0.95. Despite the fact that the market is bleeding freely, no project is facing a greater challenge than Terra.

The firm hopes to boost Terra’s economy and avoid governance threats by staking 240 million LUNA.

All three moves will help to address the system’s on-chain swap spreads, allowing the UST to be pegged once more.

The circulating quantity of LUNA grew by 4.355 billion on May 12, according to Terra Analytics. Furthermore, in the last two hours, over 1 billion had been issued.

Terra Under SEC Investigation?

The Securities and Exchange Commission (SEC) is said to have opened an inquiry against Terra’s UST stablecoin, despite Treasury Secretary Janet Yellen publicly criticizing its risks.

“A stablecoin known as TerraUSD experienced a run and had declined in value,” Yellen said when she testified before the Senate earlier this week. “I think that simply illustrates that this is a rapidly growing product and that there are risks to financial stability.”

LUNA Plunges. Source: TradingView

The SEC may have been called in when the UST was de-pegged from the US dollar and the LUNA price fell in just two days. Furthermore, the SEC may be prompted to investigate due to the involvement of money managers and the likelihood of a coordinated attack on the blockchain.

Related Reading | LUNA Sinks As Binance Suspends Withdrawals Of Tokens Amid Market Turmoil

Featured image from Getty Images, chart from TradingView.com, and Bloomberg