- November 9, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post Stablecoin Market Surges to $176 Billion: Tether Leads the Pack appeared first on Coinpedia Fintech News

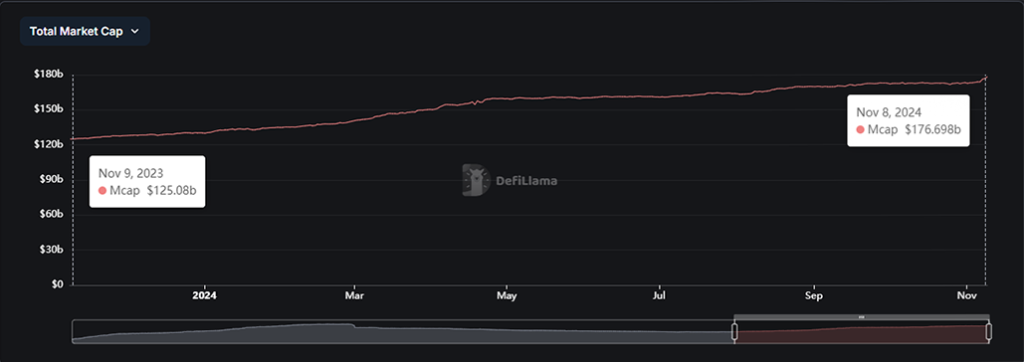

The stablecoin market has surged past $176 billion, reaching levels last seen in 2022. With Tether (USDT) and USD Coin (USDC) leading the way, this rise shows how stablecoins are quickly gaining traction in the crypto space. Here’s what’s behind the growth and what it means for the future.

Tether’s Hold on the Market

The stablecoins marketcap has seen a rise of 41.27% in the last year. From $125.08 billion on November 9, 2023 it has grown to $176.698 on November 9, 2024. It’s no shock that Tether (USDT) dominates, with a market share of 69.17% and a hefty $123 billion market cap. Though its 24-hour trading volume dipped a bit, Tether’s place as the main liquidity provider for crypto traders holds strong. Over the past week, its market cap even grew by 2.24%, proving Tether’s continuous demand.

Tether remains a go-to for many traders, especially during uncertain market swings. It’s like the “safe zone” in crypto—stable, reliable, and essential for quick trading.

USDC’s Steady Rise

Not far behind, USD Coin (USDC) saw its market cap grow by 7.06%, reaching $37 billion. This steady climb points to a growing acceptance of USDC, as more people choose it for transactions and storage of value. While Tether holds the largest share, USDC is catching on fast, especially with those who value its strong reputation for stability.

This increase in USDC shows that stablecoins aren’t just tools for traders but have value in everyday digital transactions, making them useful for both small and big players in the crypto world.

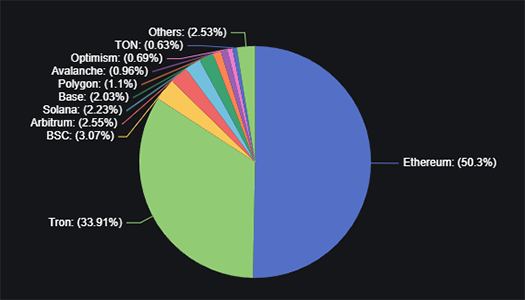

Ethereum and Tron as Stablecoin Hubs

Ethereum hosts more than half of all stablecoins, worth $89 billion. Thanks to its solid infrastructure, it’s a natural fit for stablecoin usage. Tron follows closely with a 33.9% share, amounting to around $60 billion in stablecoins, most of which is USDT. While Ethereum leads, Tron’s popularity is undeniable, especially among those who rely on USDT’s presence on the platform.

Binance Smart Chain (BSC) also plays a role, holding 3.07% of the stablecoin supply with USDT as the main player on this network. Each of these platforms has its unique strengths, and the demand for stablecoins on multiple chains is a sign of their broad appeal.

What to Expect

The stablecoin market shows no sign of slowing down. With Tether and USDC holding strong and platforms like Ethereum and Tron supporting growing use, stablecoins are set to be key players in the future of digital finance. As demand grows, we’re likely to see stablecoins continue shaping how people interact with the crypto world, making it more accessible and stable for everyone.