- August 24, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The Fidenza #313 NFT, created by artist Tyler Hobbs, just sold for 1,000 ETH. At today’s price, that equates to $3,350,000.

Even more staggering, the seller, who goes by the OpenSea username “PizzAle,” paid 0.58 ETH (around $1,100) for it two months ago, marking an impressive return on investment.

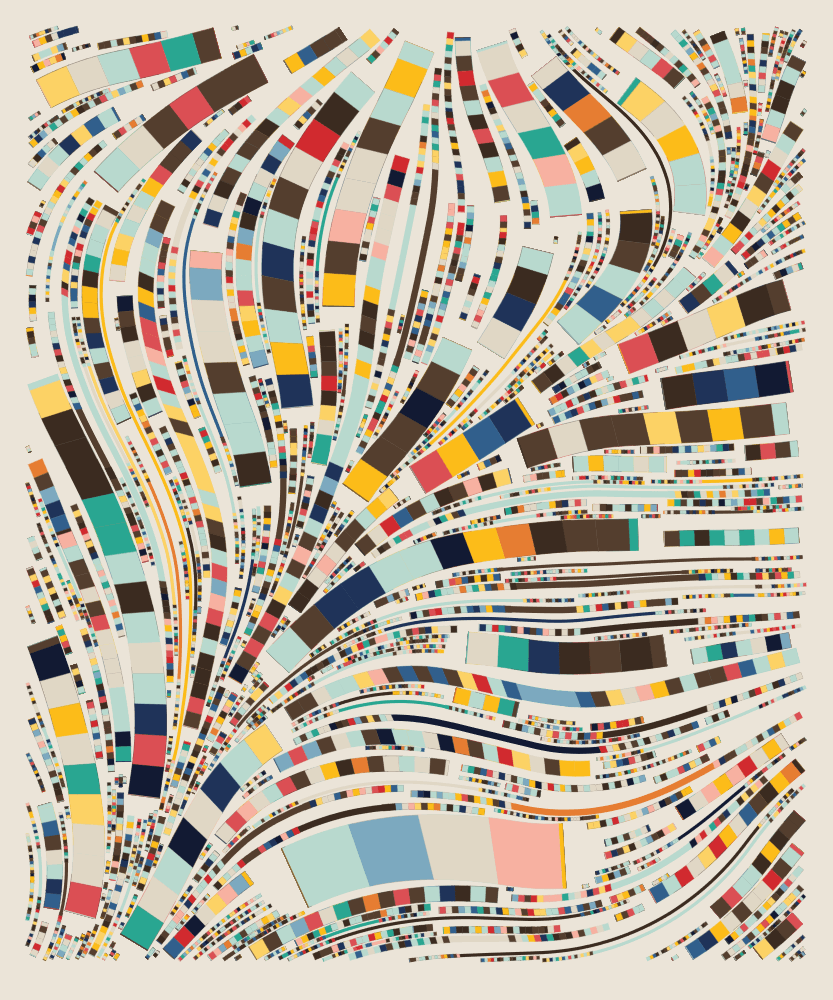

The Fidenza collection launched in June this year and comprises 999 different NFT artworks. Each piece is formed using an algorithmic technique to create unique colored rectangles and squares patterns to fill the canvas space.

Hobbs described the technique as capable of producing an extensive range of scale, texture, and color. In turn, this melds together to “create a wide array of generative possibilities.”

“Fidenza is by far my most versatile algorithm to date. Although the program stays focused on structured curves and blocks, the varieties of scale, organization, texture, and color usage it can employ create a wide array of generative possibilities.”

The NFT market is making a comeback

While the NFT market had gone south for a brief period, a series of high-profile sales recently suggests a comeback is in the making.

For example, the Stoner Cats collection sold out within 35 minutes of release, earning $8 million in the process. What’s more, demand was such that congestion on the Ethereum network pushed gas prices to 600 gwei at the time.

There’s also a buoyant appetite for CryptoPunks, with demand creating an average selling price of $135,000 per punk.

OpenSea co-founder and CEO Devin Finzer said his platform had processed $95 million in volume, in two days, from the start of this month.

“In 2020, OpenSea did about $21M in total transaction volume. In the last two days, we did $95M. The growth curve for NFTs is insane.“

At the same time, data analysts Messari released data showing OpenSea had topped $1 billion in volume year to date.

OpenSea has officially surpassed $1 billion in gross market volume after a record few days.

More impressively @opensea facilitated $1 billion in volume in 2021 alone!

2018 – $473k

2019 – $8 million

2020 – $24 million

2021 (YTD) – $1.02 billionJust absolutely insane growth. pic.twitter.com/loH0jw5cqr

— Mason Nystrom (@masonnystrom) August 2, 2021

Coinciding with a return of bullishness in cryptocurrencies, the NFT sector also appears to be on the up.

Opinions are still heavily divided

Having said that, when it comes to overpriced NFT artwork, social media chatter continues to paint a picture of disdain.

In response to the sale of Fidenza #313, the most liked Twitter comment pointed out that it’s free to save the picture.

“Cost me 0 ETH to save this to my computer just now.“

Also, another comment posed the possibility that the sale of Fidenza #313 was a wash sale to price inflate the piece/collection artificially. This user then mentioned money laundering, which is now becoming a recurrent theme with expensive NFTs.

Who can tell the buyer and seller are not the same person with different wallet

Who can tell this is not used for money laundering

For me the only #NFT that can have tangible value are the ones that have real utility or are part of a multiverse where you can't copy them

— Crypt Stylo

(@crypt_stylo) August 24, 2021

Art in the digital age, or money laundering technique? Perhaps a bit of both. In any case, the jury is still out on NFTs.

The post Speculator turns $1,100 into $3.35 million selling Fidenza #313 NFT appeared first on CryptoSlate.