- February 14, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Siemens, Germany’s third-largest publicly traded company by market cap, has issued its first digital bond worth €60 million ($64 million) on the Polygon blockchain.

The bond was issued in accordance with Germany’s Electronic Securities Act, which came into force in June 2021 and allows the sale of blockchain-based debt to take place.

Blockchain-based bonds are expected to reduce paperwork and enable direct reach to potential purchasers without the need for intermediaries like banks.

The blockchain bond, which CoinDesk reported has a maturity of one year, “makes paper-based global certificates and central clearing unnecessary,” the company said in the statement. “What’s more, the bond can be sold directly to investors without needing a bank to function as an intermediary.”

The company did not specify an interest rate for the bond but did say it hopes that this will quicken and make more efficient future such transactions.

“By moving away from paper and toward public blockchains for issuing securities, we can execute transactions significantly faster and more efficiently than when issuing bonds in the past,” said Peter Rathgeb, corporate treasurer at Siemens.

Siemens, a German engineering and manufacturing giant, has been actively exploring the potential of blockchain technology in various areas, including payments and debt issuance, since 2021.

In 2021, Siemens partnered with JPMorgan Chase to develop a blockchain-based system for payments, which is used to automatically transfer money between Siemens’ own accounts. This system aims to simplify and streamline payments, reducing the need for intermediaries and enabling faster and more efficient transactions.

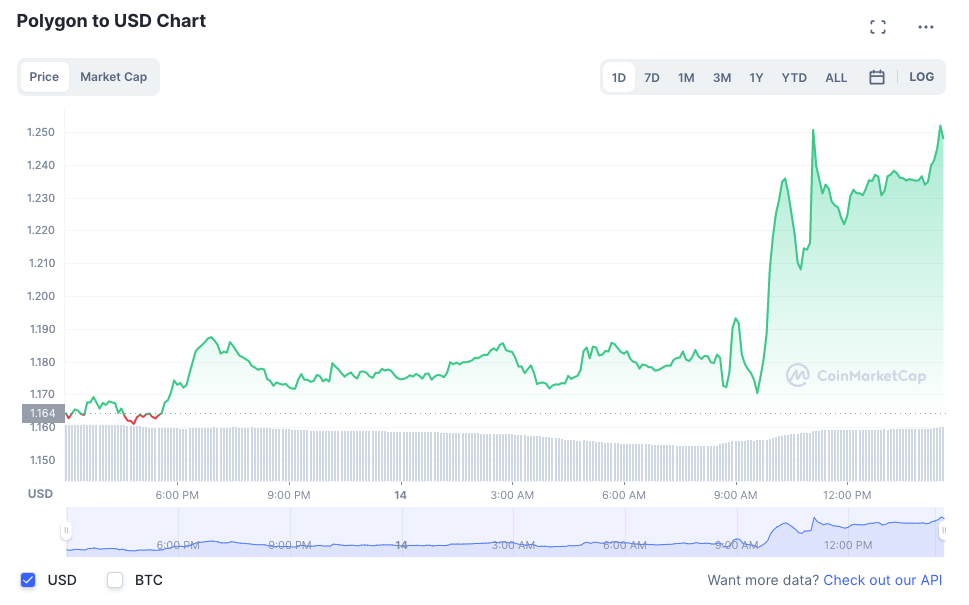

Following news of Siemens’ issuance of its first digital bond on the Polygon network, the token price of MATIC increased 7.21% during trading on Feb. 14. The current price of MATIC is $1.25.

The post Siemens announces issuance of 1st digital bond on Polygon appeared first on CryptoSlate.