- March 1, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Definition

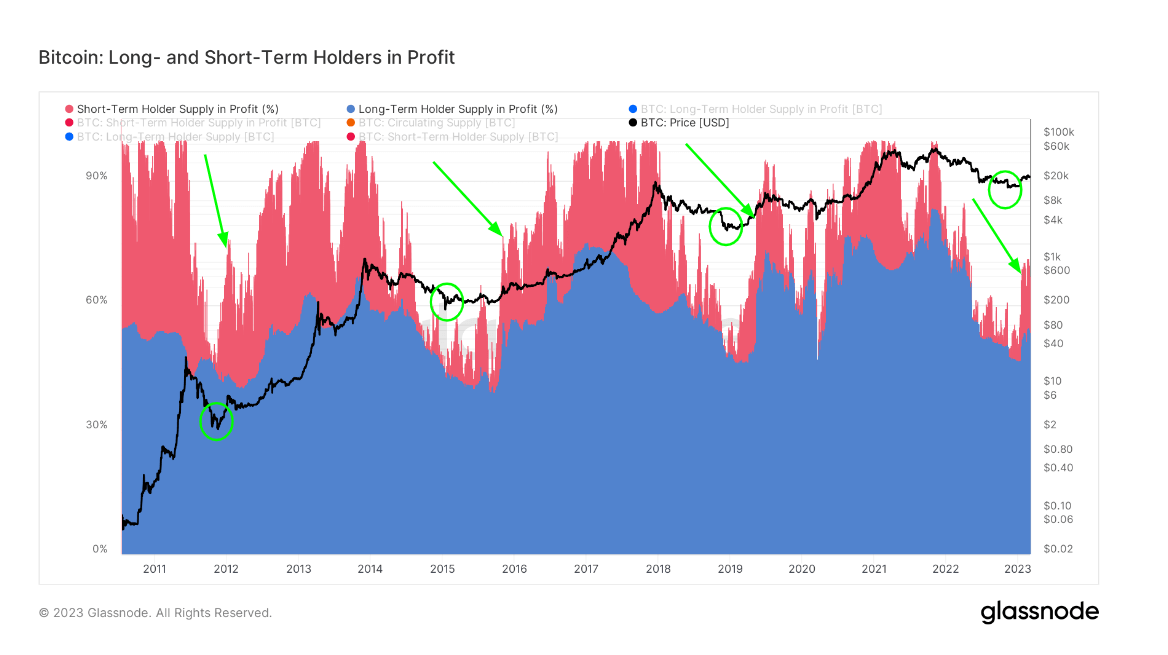

This metric provides a breakdown of the percent of Sovereign Supply that is in profit and held by Long-Term Holders (blue) and Short-Term Holders (red). Sovereign Supply is defined as Long-Term Holder Supply plus Short-Term Holder Supply (both of which exclude Supply held on Exchanges).

Quick Take

- The short-term holder cohort is at 70% profit; this is the highest level for almost a year, just before the collapse of Luna.

- Short-term holders are investors that have held Bitcoin for six months or less, and we tend to attribute them as a cohort that FOMO in at the top of bull markets and sells when prices are depressed.

- But short-term holders also start the new cycle, buying Bitcoin when they see value; and eventually turning it into LTH. Not always, but sometimes.

- Short-term holder profits rise, which can be seen after each bottom in Bitcoin, highlighted in green.

- Roughly six months prior was Sept. 1. We would expect STH profit to continue rising significantly in around April, six months after the FTX collapse, from investors who bought Bitcoin for around $15,500.

- CryptoSlate has referred to STH and LTH cost basis. STH cost basis will then tend to rise above-realized price and LTH realized price, potentially signaling the end of the bear market.

The post Short-term holder profit exceeds 70%; similar trend seen after each bear market bottom appeared first on CryptoSlate.