- December 30, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

In the hot debates in the crypto space, one of the talking points that Bitcoiners love to throw at Ethereans is that it’s difficult, if not impossible, to calculate the exact total supply of ether (ETH) in the market, especially compared to how relatively easy it is to calculate the total supply of bitcoin.

This is a crucial point among proponents of sound monetary systems and sovereign money, since controlling the supply is essential to the soundness of money. Anyone hit by high inflation, that is insufficient control of the supply, is a witness of the opposite.

There has been some debate about the ether supply in the last few years. The debate often boils down to questions such as: Is the current ether supply known with sufficient precision? Is the future supply known? And, can users audit the Ethereum supply?

Bitcoin is easy to calculate

Thanks to research done by BitMEX Research, it now seems possible to calculate the total supply of ether with precision.

The debate around the supply of ether certainly didn’t cool down by the release of EIP-1559, an upgrade to the Ethereum protocol which includes a token burn mechanism. Due to the lower net issuance rate resulting from the token burn, many in the Ethereum community claim ether to be “ultrasound money,” stirring wrath among Bitcoiners and their “sound money” claim.

In contrast, calculating the total supply of bitcoin is reasonably easy, and it can be done to a high degree of precision. BitMEX Research has created a service that automatically runs this check on each block and sends out alerts if there are unexpected changes in bitcoin’s supply. In Ethereum, this process is far more complicated and time-consuming.

How to calculate the total supply of ether

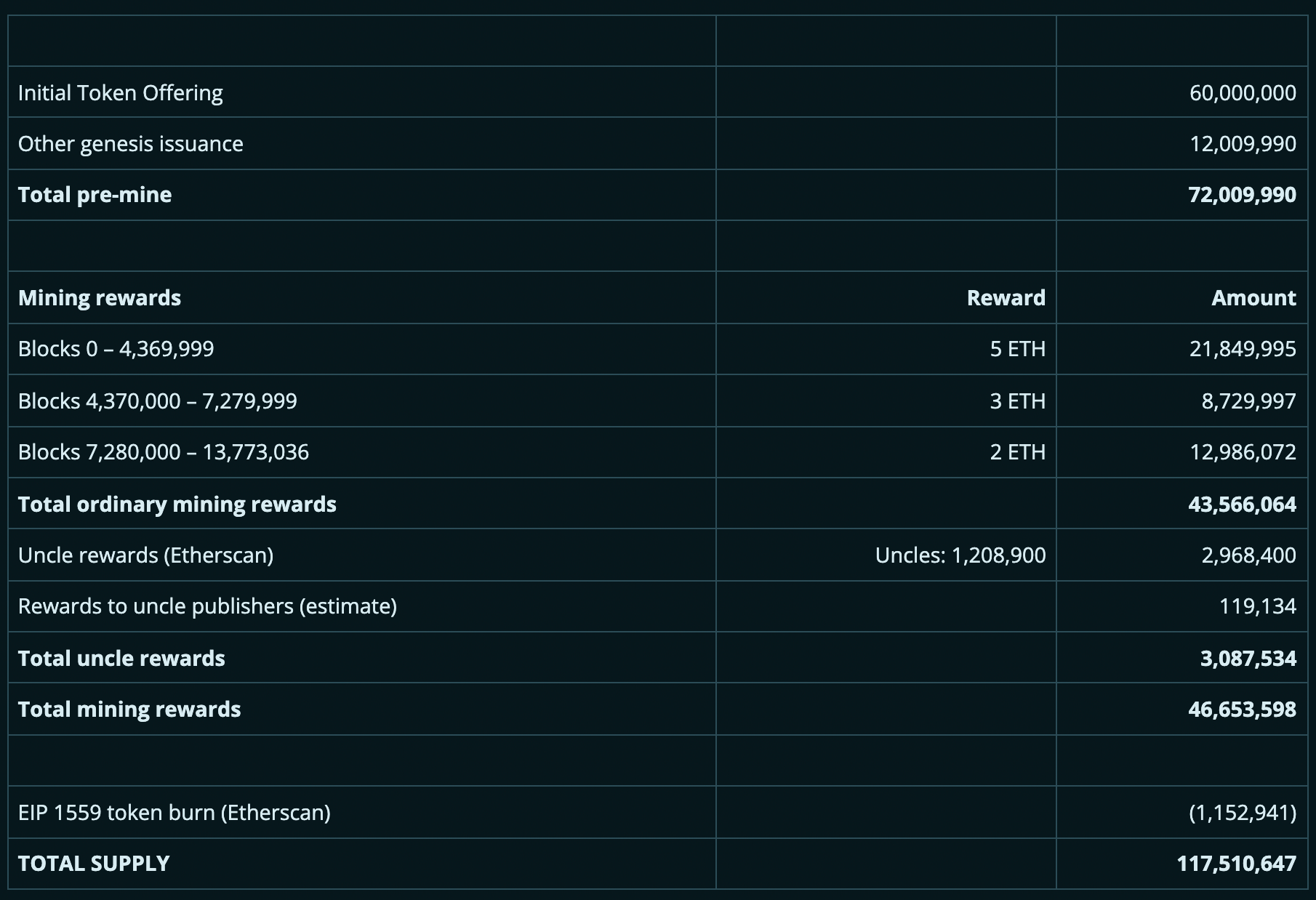

According to BitMEX Research, the first step in checking the supply is calculating the expected supply using the net issuance rules. This is the total number of ether tokens ever created. As the Ethereum nodes should have correctly implemented the issuance rules and therefore enforce them on each block, the total ether supply never breaches the expected level. As far as BitMEX Research can tell, there are five major areas of net issuance to consider in Ethereum:

- The pre-mine (which should be reasonably simple as this is a constant).

- Ordinary proof of work mining rewards (very similar to Bitcoin).

- Uncle proof of work mining rewards (more complicated than one might expect).

- The EIP-1559 token burn.

- Eth2 proof of stake rewards and penalties.

In the below table BitMEX Research have attempted to calculate the Ethereum supply from the above principles. The calculation was done at block height 13,773,036, which was mined on 9 December 2021, at 20:05 UTC. The research ignored the issuance related to staking rewards on the Proof-of-Stake Eth2 beacon chain.

As per the BitMEX Research report, “the above methodologies are calculations of the expected supply. This does not check or verify that these expected rules are being followed. In order to do this, one would need to scan through each Ethereum account and sum up all the account balances to get a grand total. This number should then be less than or equal to the expected amount, thereby providing assurances as to the integrity of the Ethereum issuance mechanics.”

More than 63 hours of calculation

The calculation of all account balances took BitMEX Research an astonishing 63 hours and five minutes to complete, running the calculations on BitMEX Research’s Ethereum node.

“This obviously compares somewhat unfavourably to the one minute the equivalent task takes a Bitcoin node to complete. It should also be noted that the supply figure includes ether sent to the Eth2 staking contract, but excludes any Eth2 staking rewards,” the report says.

The result from the above audit returned the following ether count: 117,517,111.849,631,382,298,107,434 ETH or 117.5 million ETH.

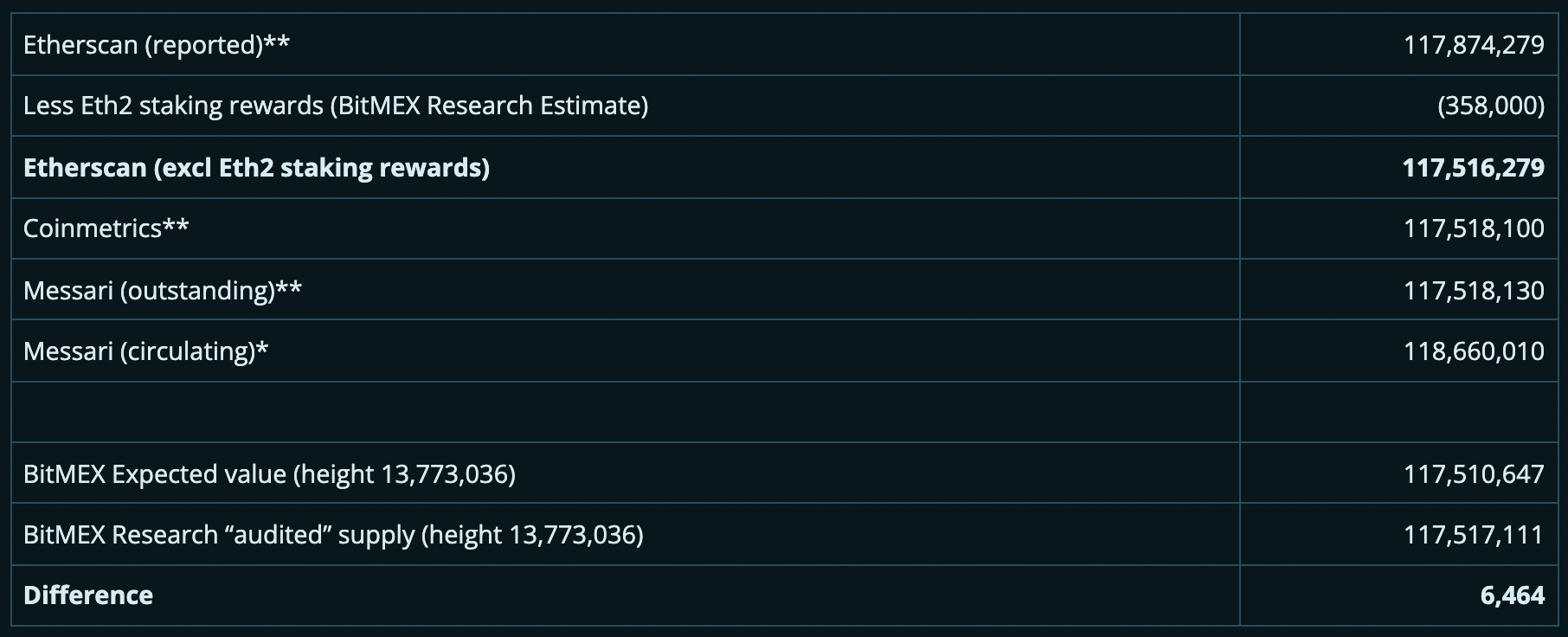

The result is very close to the 117.5 million ETH calculated in the table above. As the summary result table below indicates, this is a miss by only 6,464 ETH.

Unfortunately, as per the research report, this miss is in the wrong direction, in that the audited balance is greater than the expected balance. However, this miss is easily explained by errors or approximations in the calculation methodology for the expected value.

The result constituent with the known issuance formulas

According to BitMEX Research, third-party data providers such as Etherscan, Coinmetrics, and Messari have performed similar expected supply calculations, which they update daily.

“These providers probably have a more accurate figure than us and their results are also closer to the audited figure. In the case of Messari and Coinmetrics, the miss is in the correct direction.”

“Despite the long amount of time the calculation took, our audit of the Ethereum supply did yield a result constituent with the known issuance formulas, which provides positive assurance over the Ethereum supply,” the research report continues.

In the view of BitMEX Research, as stated in their conclusion, whatever your view of Ethereum, whether it’s ultrasound money, a DeFi platform, a public company or somewhere in between, being able to effectively check the supply of ether is probably a good feature and developers could focus more on this area. However, BitMEX Research does not share the view that the lack of precision or the significant time it takes to verify Ethereum’s ether supply is a critical factor when evaluating Ethereum from an economic perspective.

The post Research: Yes you can calculate the total supply of ether appeared first on CryptoSlate.