- January 9, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Glassnode data analyzed by CryptoSlate showed a significant trend difference between Bitcoin (BTC) and Ethereum (ETH) shrimp and crab cohorts.

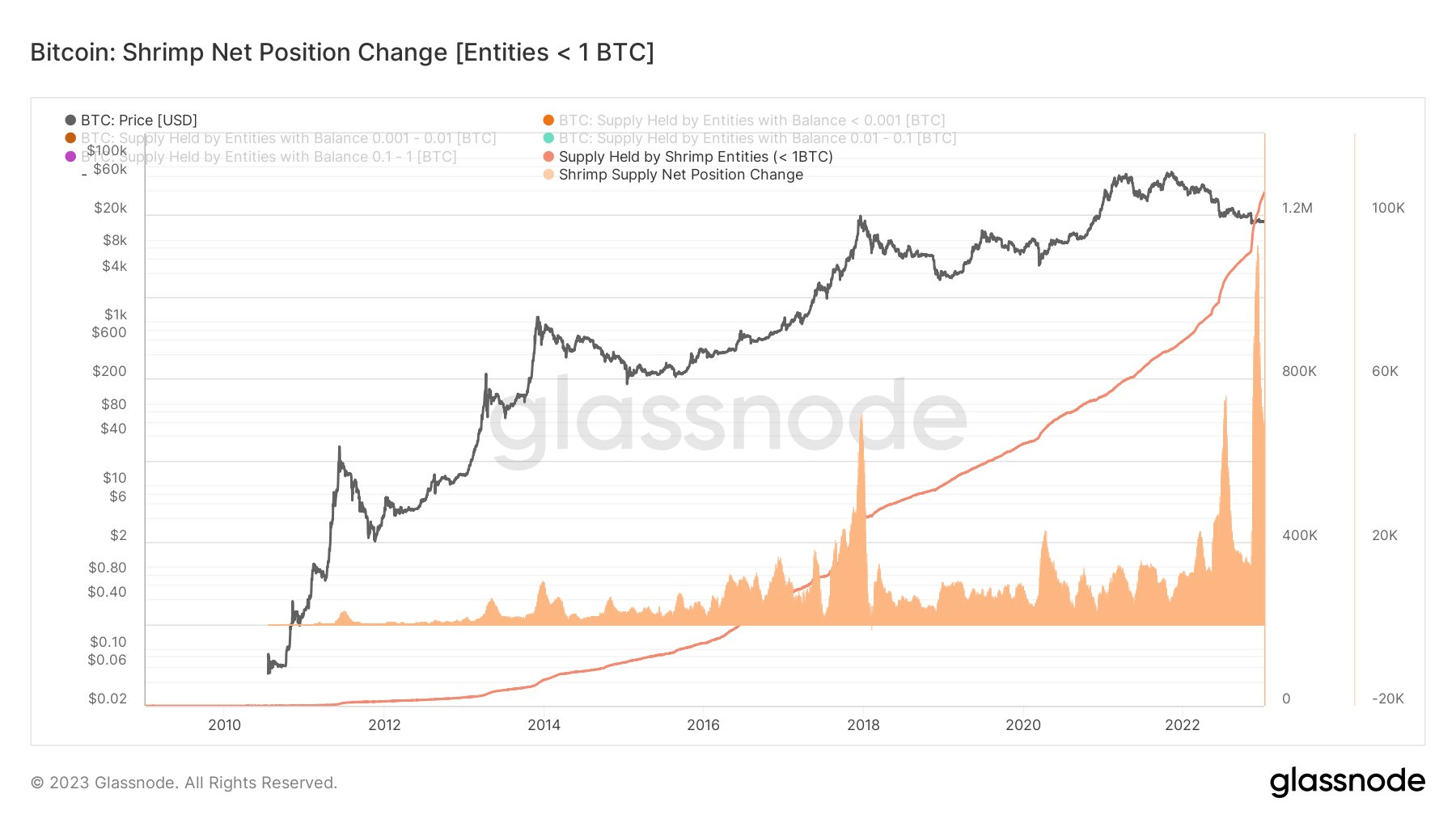

BTC fundamentals’ core narrative is the reason that so many investors believe in the asset — and buy regardless of the price. Evidence of this can be seen below as Shrimps (who hold one BTC or less) buy BTC more aggressively than ever before, according to Glassnode on-chain data.

At press time, BTC Shrimps hold a total of 1,200,000 BTC and have bought roughly 90,000 BTC over the last 30 days. Evidence of this trend was seen as BTC Shrimps accumulated 60,000 BTC over 30 days in December 2022.

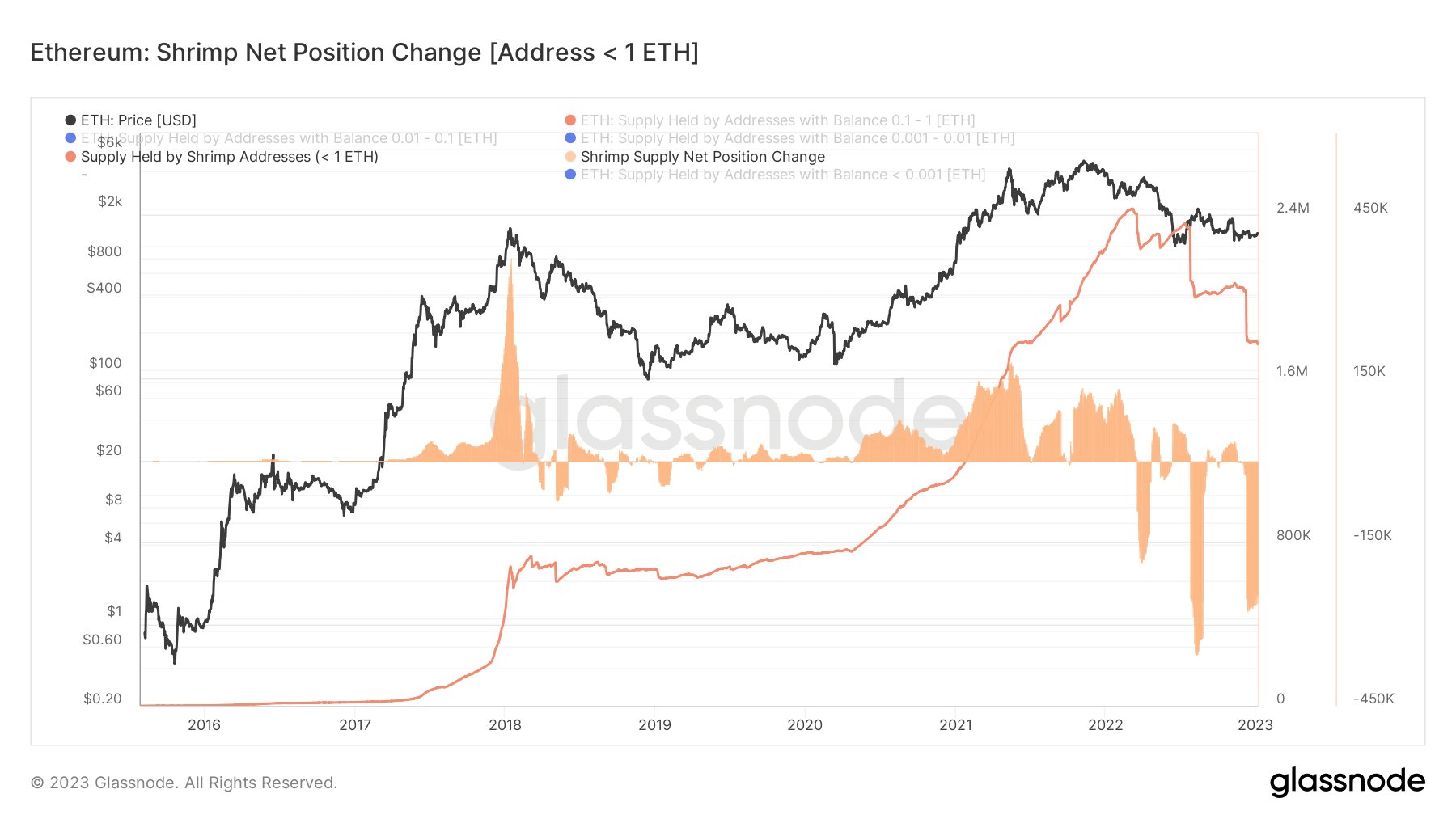

However, when compared to ETH Shrimps (who hold one ETH or less), the trend is reversed — witnessing a selloff of 300,000 ETH over a 30-day period. ETH Shrimp mentality is vastly different from BTC holders. as Shrimps become net sellers — holding roughly 1,600,000 ETH at press time.

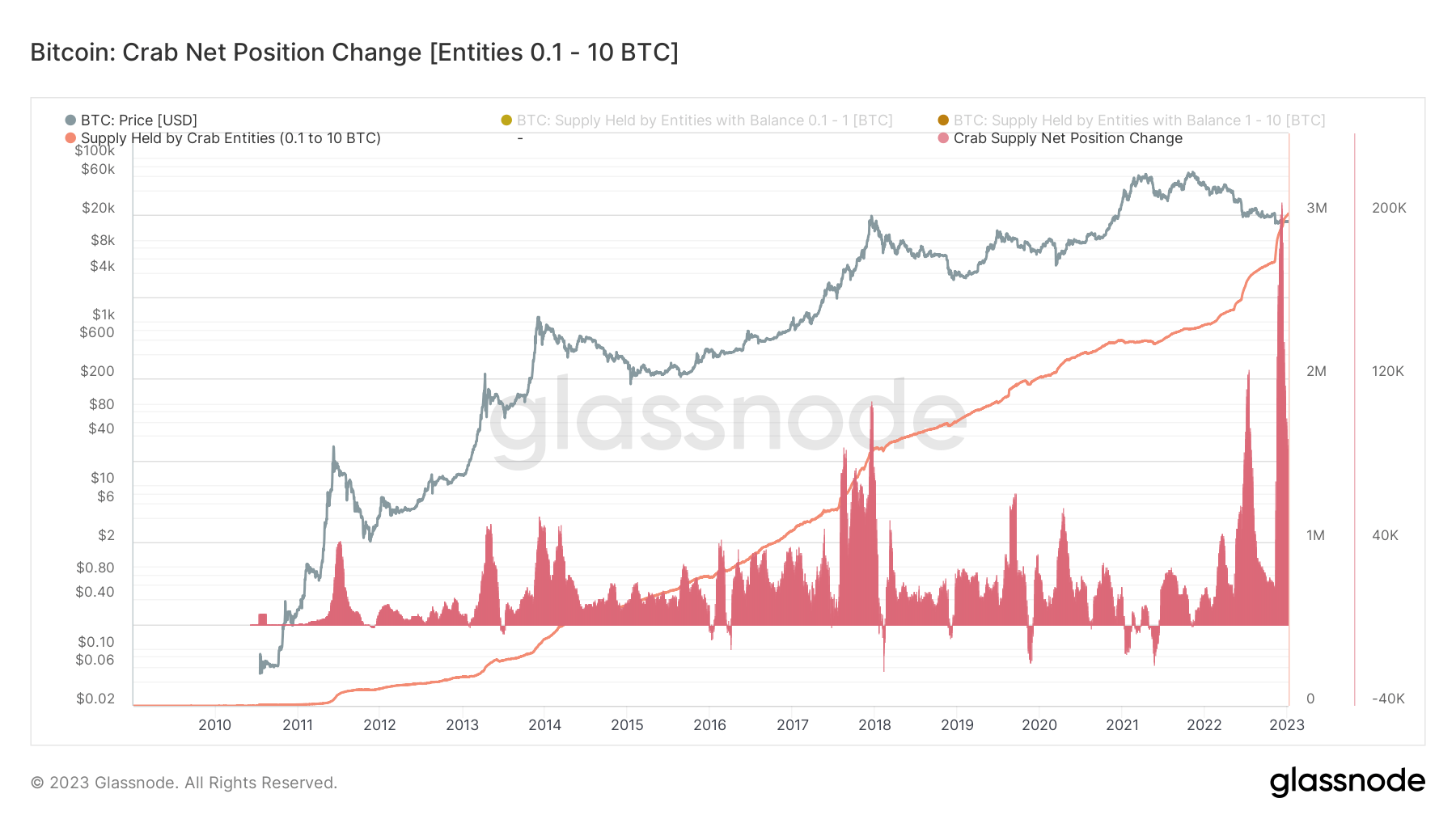

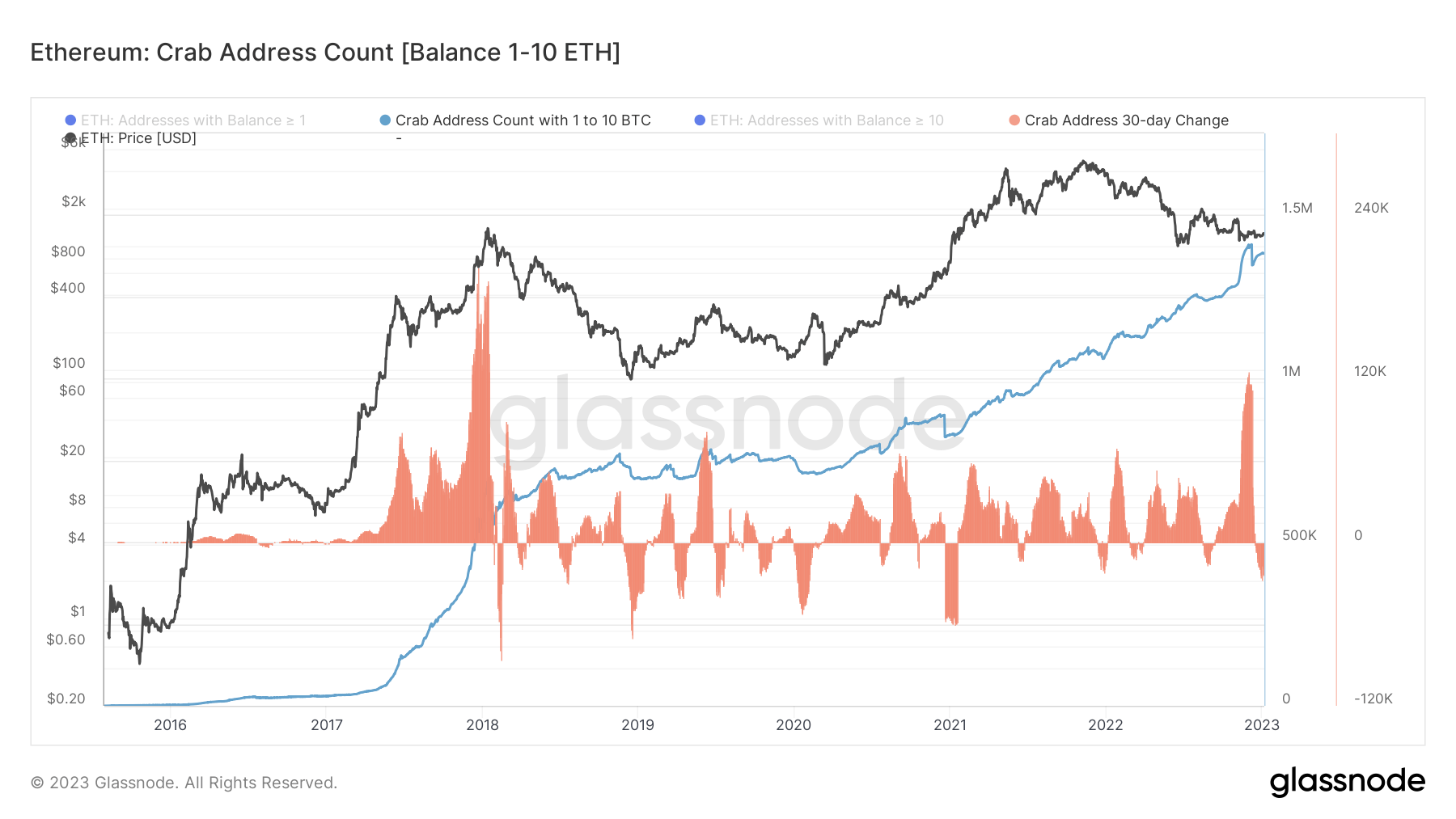

The market trend difference between BTC and ETH is further reinforced when observing and comparing the respective Crab cohorts.

The BTC Crab cohort currently holds 3,000,000 BTC and is accumulating BTC at a rate of roughly 200,000 BTC over 30 days — the fastest accumulation rate historically seen for this cohort.

The ETH Crab cohort reflects the ETH Shrimp cohort sentiment — holding roughly 1,500,000 ETH and remaining in a net seller position without sign of significant accumulation.

The distinct difference between the bullish BTC sentiment and bearish ETH sentiment reveals that BTC Shrimp and Crab cohorts remain price insensitive — dollar-cost averaging (DCA) buyers unhindered.

The post Research: Bitcoin shrimp, crab cohorts aggressively buying; ETH equivalent cohorts selling appeared first on CryptoSlate.