- December 22, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Despite one of the worst possible events happening in November—the complete collapse of the world’s largest crypto company—the GameFi market did not fall significantly compared to October.

This may indicate that the market, barring a systemic collapse, has reached a limit of its downside risk.

Nevertheless, decreasing investment in space continued, with the amount of investment and the number of funds reaching a historic low.

Amid the downturn, Polygon has performed relatively well as a gaming chain, with several large titles gaining users in November.

Overall, November was a relatively uneventful month for GameFi, especially considering what happened in the CEX sector.

Crypto Macro Overview

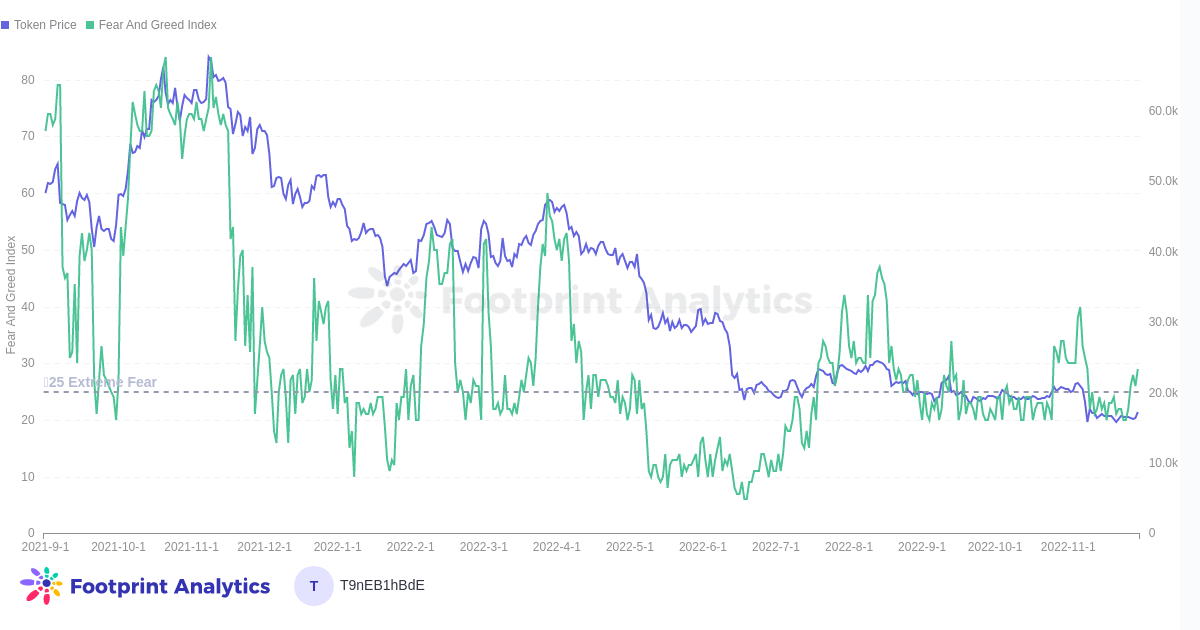

- At the end of November, the F&G index closed higher than at the end of October.

- The FTX collapse stopped the F&G index recovery, causing it to fall from 40 to 20.

- Hitting $1,091 on Nov. 9th, Ethereum was close to dropping beneath the thousand-dollar mark but did not.

The FTX collapse did not cause the price of ETH to drop below its June lows, despite this event being arguably more significant than the Terra Luna collapse that happened.

Interestingly, BTC did drop below its June lows, which is unexpected because altcoins would previously bear the greater brunt of negative market sentiment and volatility.

One possible explanation is that this seemingly minor price action news is the first evidence of something huge: the tokenomic effects of the Merge coming to fruition. For the first time, Ethereum is less volatile than BTC.

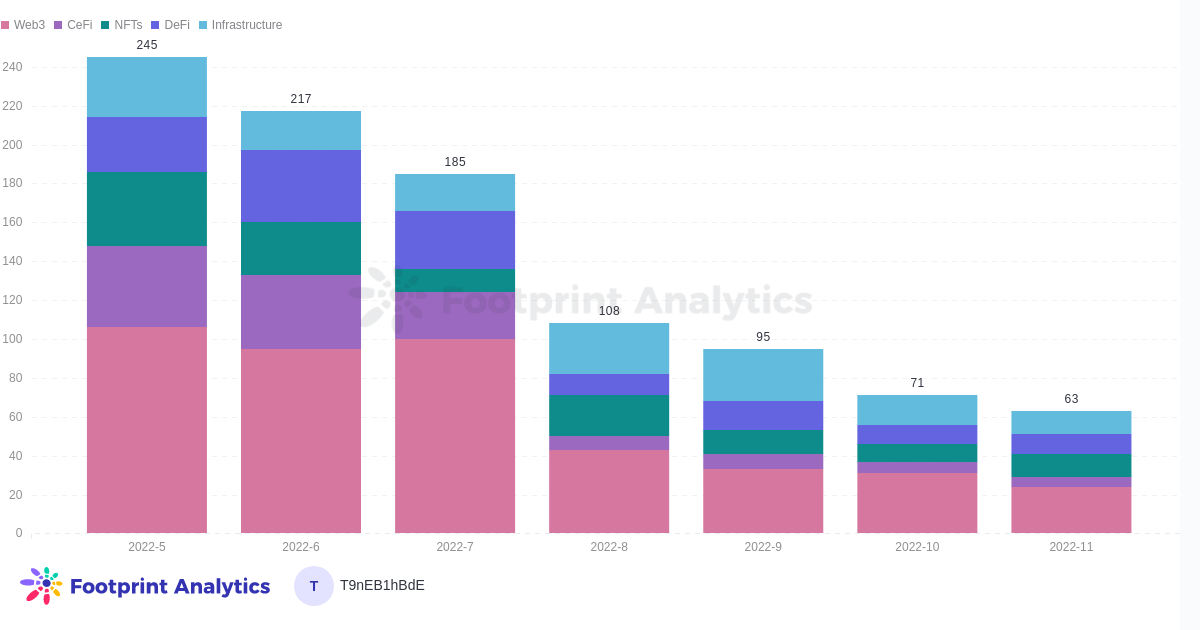

GameFi Financing & Investment

- GameFi funding continued to fall and dropped to an ATL of $60 million in November, a decline of 69% MoM.

- There were just 9 rounds in the GameFi industry, led by Roboto Games and Thirdverse.

- Thirdverse is a Tokyo-based development studio focusing on Web3 and VR games. It received a $15 million round led by MZ Web3 Fund.

- A16z was the lead investor in Roboto Games’ $15 million Series A. The traditional gaming studio hopes to expand into Web3 and blockchain.

Funding for GameFi has dried up a fraction of what it used to be. Funds were invested in a handful of projects, most game developers and studios. Most of those rounds were for established developers with a record of publishing successful projects in Web3 or Web2.

GameFi Market Overview

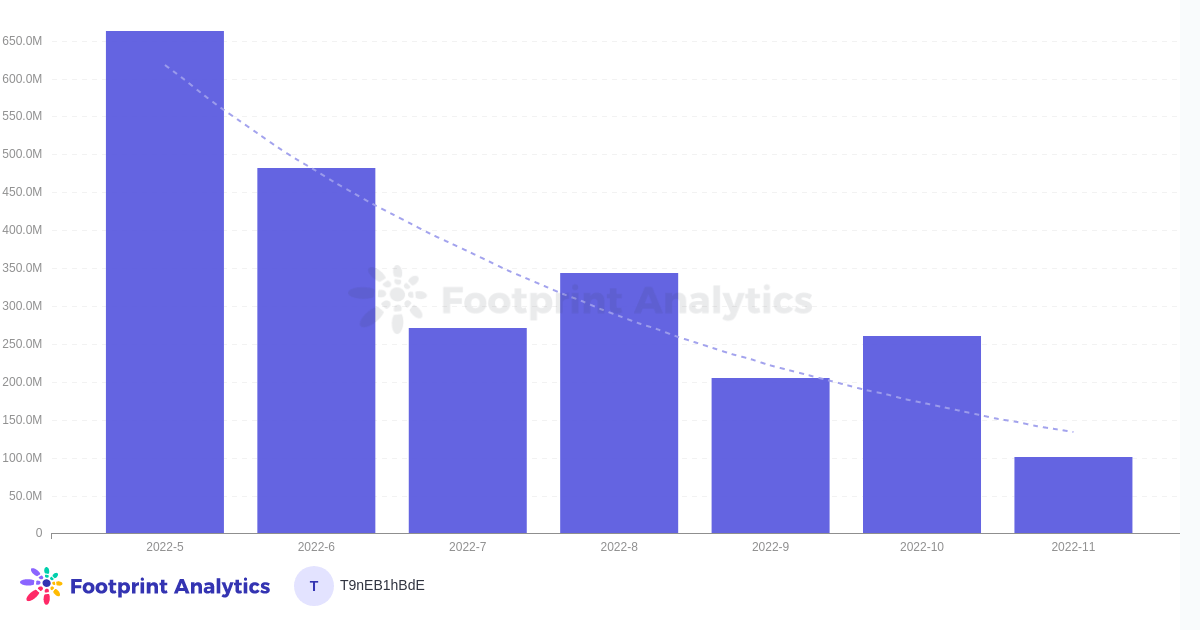

- The total volume in GameFi dropped from October, declining from $260 million to $100 million.

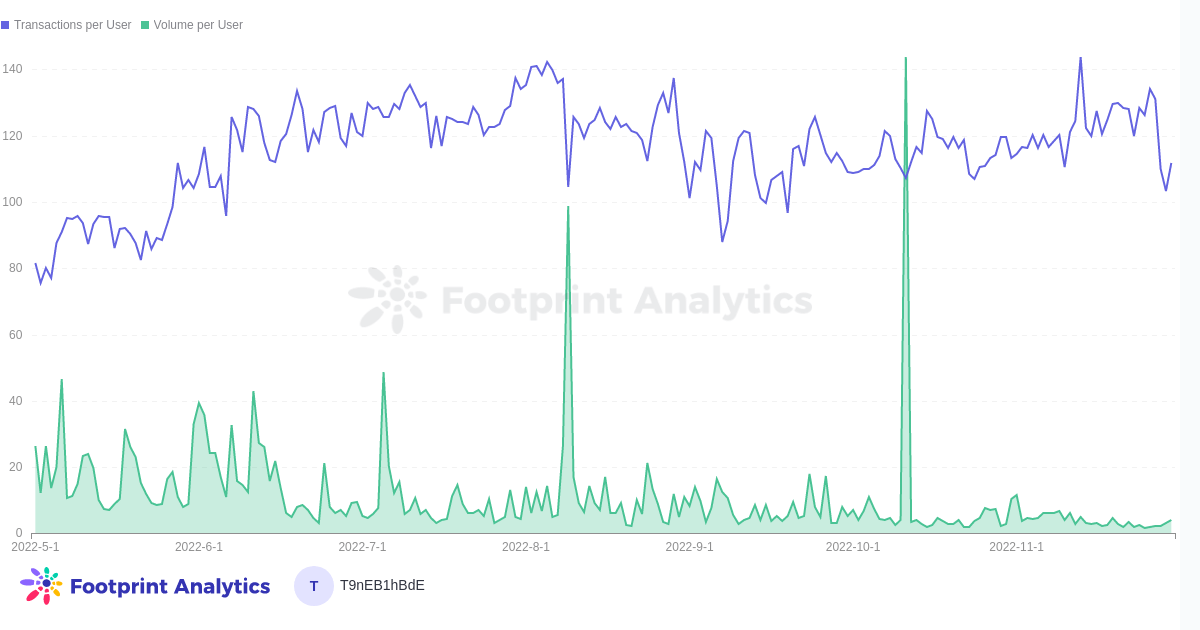

- Transactions per user also declined sharply at the end of November but are still higher than 6 months ago.

- In October, Axie Infinity’s unlocking event caused an unusually high amount of traffic on Ronin. In November, the breakdown between chains went back to a more regular distribution.

The total volume of GameFi more than halved. A large part of this was unusually high volume in October driven by the Axie Infinity unlocking event—with the market now coming back to its normal state.

GameFi Users Overview

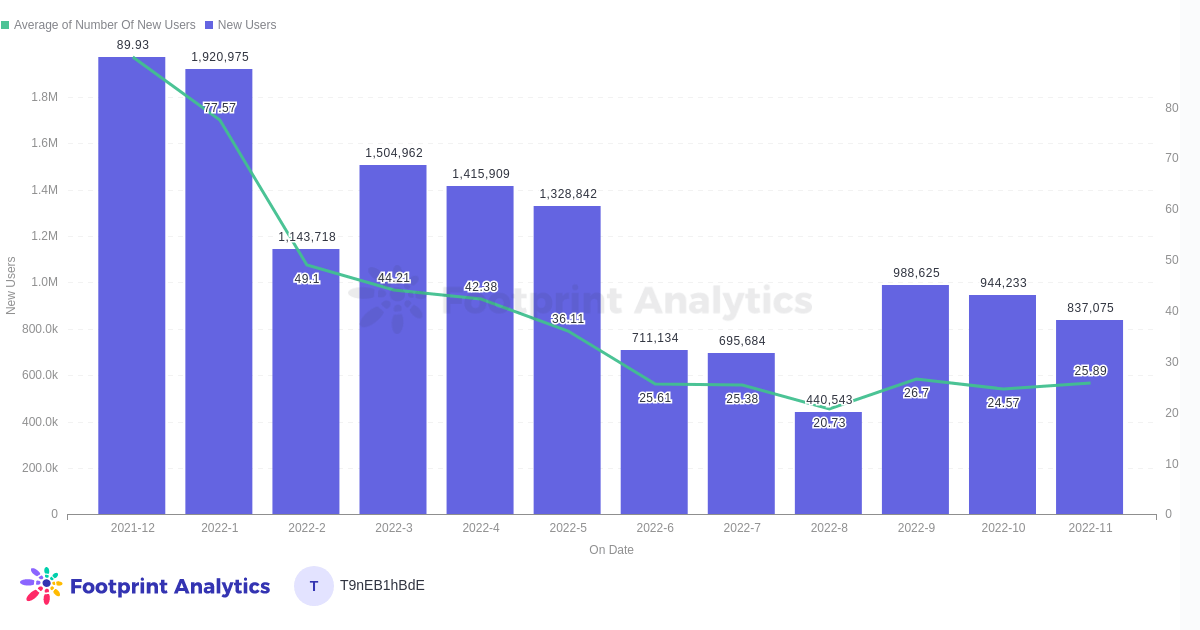

- MAU declined from 2.2 million percent in October to 2 million, while new users declined by just over a hundred thousand.

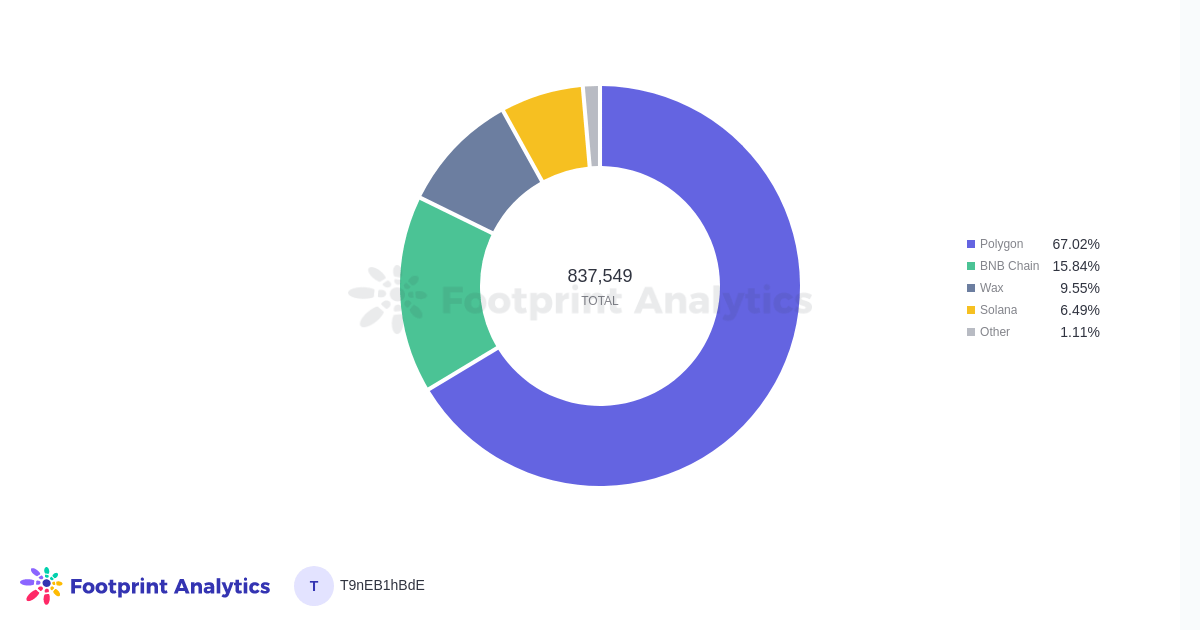

- Polygon saw the highest amount of new users thanks to several titles rising in popularity, namely Benji Bananas and Planet IX.

Polygon has established itself as a potential winner in the GameFi space if it can continue attracting solid projects. Some notable Polygon-based titles that have grown quickly in the past few months are Benji Bananas, Arc8 by GAMEE, and Planet IX.

GameFi Projects Overview

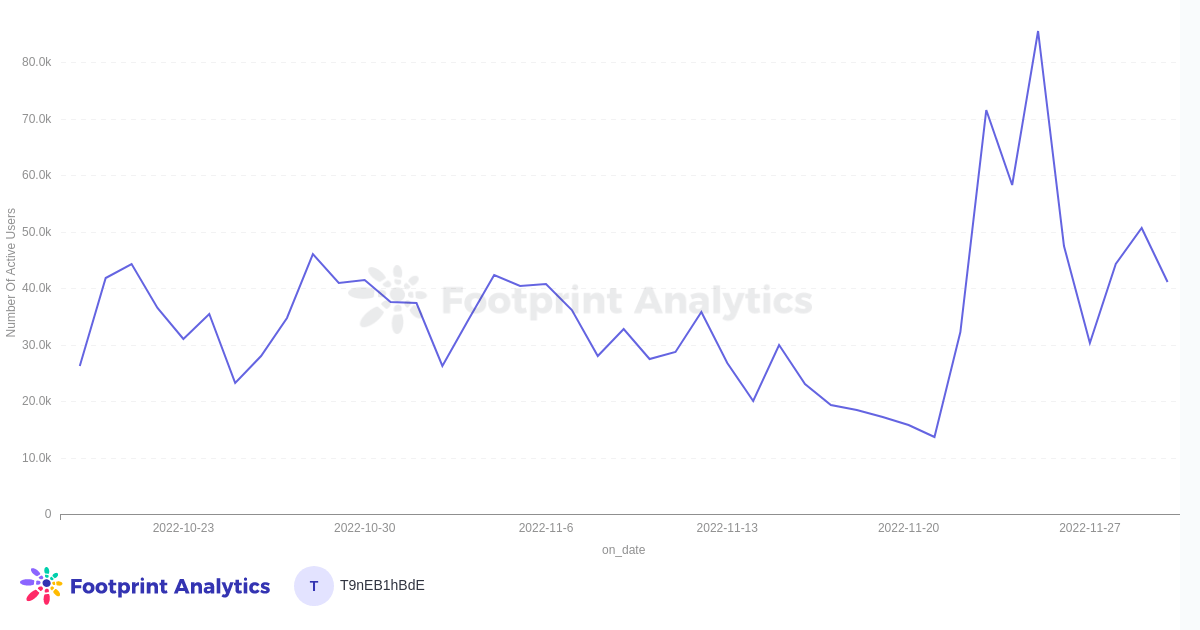

- The sharp increase in volume on Polygon was driven by Benji Bananas gaining users and volume. The number of users grew to over 80K.

- Planet IX, a space-themed strategy game, more than tripled its users in November. Note that the price of the game’s token, IXT, did not increase.

Benji Bananas has significant growth in users in November, which was reflected in its token price. On the other hand, Planet IX also saw a surge in players, but its token, IXT, continued to decline, indicating a less sustainable project.

The post November 2022 GameFi Report appeared first on CryptoSlate.