- December 20, 2025

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The post New Whale Buyers Now Drive 50% of Bitcoin’s Realized Cap – A Shift From Old Cycles? appeared first on Coinpedia Fintech News

Bitcoin’s price has been volatile, but the bigger story right now isn’t the chart. It’s who’s buying and at what levels.

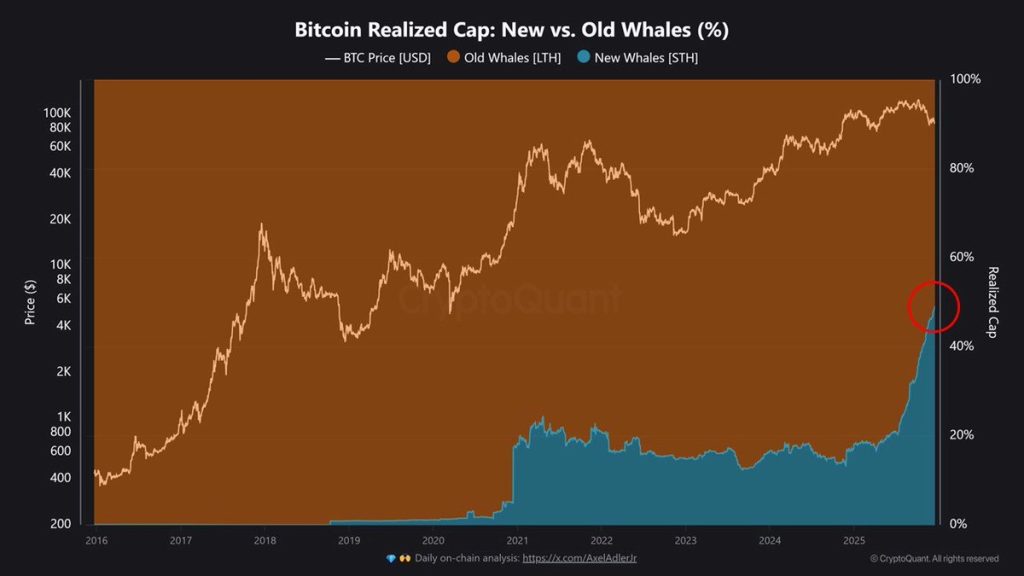

New on-chain data shows that nearly 50% of Bitcoin’s realized cap now comes from new whale buyers, a sharp break from how past Bitcoin cycles played out.

Realized cap tracks the value of Bitcoin at the price each coin last moved on-chain. So when new whales approach a 50% share, it means half of the capital invested in Bitcoin was formed at recent price levels, not during early low-cost accumulation phases.

New Whales Are Playing a Different Game

According to the data, these new whales are mainly institutions and ETFs buying Bitcoin at higher prices and in larger volumes. That alone sets them apart from long-term holders who accumulated cheaply and sold into strength during previous bull runs.

More importantly, their behavior during pullbacks looks different.

“Even during corrections, the Realized Cap share of new whales has continued to rise,” the analysis notes.

This should not be interpreted as a short-term bullish or bearish signal, but as evidence that the structure of the Bitcoin market itself is changing, the report adds.

Demand Is Rising, Not Rotating

Short-term holder data backs this up. Supply held by coins younger than 155 days grew by roughly 100,000 BTC in 30 days, reaching an all-time high. That suggests fresh demand is still coming in, even as prices fluctuate.

At the same time, long-term holders remain mostly inactive. Exchange flows show that selling pressure came largely from smaller participants, while large wallets stepped in to absorb supply.

Cumulative volume delta data reinforces this split. Whale wallets posted a positive $135 million delta, while retail and mid-sized traders showed negative flows.

What This Shift Really Signals

This data points to something deeper.

Bitcoin is entering a transition toward a more mature asset shaped by sustained institutional accumulation.

For a market long defined by boom-and-bust cycles, that change matters. And it may explain why Bitcoin’s behavior is starting to look less familiar and more structural with each passing month.