- October 28, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Comments from Senator Ted Cruz underscore the potential that Bitcoin mining has to integrate with the Texas energy grid in a transformative way.

Recently, Ars Technica published an article from staff writer and environmental science PhD Tim de Chant, aiming to rebut Texas Senator Ted Cruz’s comments from the Texas Blockchain Summit earlier this month.

De Chant took issue with the following statement from Cruz:

“Because of the ability of bitcoin mining to turn on or off instantaneously, if you have a moment where you have a power shortage or a power crisis, whether it’s a freeze or some other natural disaster where power generation capacity goes down, that creates the capacity to instantaneously shift that energy to put it back on the grid.”

De Chant offered a number of responses, but generally seems to misunderstand the substance of Senator Cruz’s point. Additionally, he made a significant mathematical error (later retracted) that called into question his literacy on Bitcoin mining.

But first, it’s worth quoting Cruz in full, as the intent of his claims are lost without the full context. We have included a transcript excerpt of Cruz’s comments on mining from his conversation at the summit with Jimmy Song below, in which he referenced a recent winter storm that left many in Texas without access to power for days:

”There were lots of things that went wrong [during the winter storm] that I think are worthy of study, but I do think that Bitcoin has the potential to address a lot of aspects of that. Number one, from the perspective of Bitcoin, Texas has abundant energy. You look at wind, we’re the number one wind producer in the country, by far. Number two, I think there are massive opportunities when it comes [indistinct audio]. If you look at natural gas right now, in West Texas the amount of natural gas that is being flared — 50% of the natural gas in this country that is flared, is being flared in the Permian right now in West Texas. I think that is an enormous opportunity for Bitcoin, because that’s right now energy that is just being wasted. It’s being wasted because there is no transmission equipment to get that natural gas where it could be used the way natural gas would ordinarily be employed; it’s just being burned.

“And so some of the really exciting endeavors that people are looking at is ‘can we capture that gas instead of burning it?.’ Use it to put in a generator right there on site. Use that power to mine Bitcoin. Part of the beauty of that is, the instant you’re doing it, you’re helping the environment enormously because rather than flaring that natural gas you’re putting it to productive use. But secondly, because of the ability to Bitcoin mining to turn on or off instantaneously, if you have a moment where you have a power shortage or a power crisis whether it’s a freeze or some other natural disaster where power generation capacity goes down, that creates the capacity to instantaneously shift that energy to put it back on the grid. If you’re connected to the grid, they become excess reserves that can strengthen the grid’s resilience by providing a significant capacity of additional power to be available for critical services if and when it is needed. So I think that has enormous potential and it’s something that in five years I expect to see a dramatically different terrain, with Bitcoin mining playing a significant role as strengthening and hardening the resilience of the grid.

“It’s a weird point. A lot of the discussion around Bitcoin views Bitcoin as a consumer of energy. A lot of the criticism directed at it is the consumption of energy. The perspective I’m suggesting is very much the reverse, which is as a way to strengthen our energy infrastructure. And it also has – one of the exciting things about crypto also, is the ability to unlock stranded renewables. So there are a lot of places on earth where the sun shines a lot and the wind blows a lot but there aren’t any power lines. And so it’s not economically feasible to use that energy. And the beauty of Bitcoin mining is that if you can connect to the internet, you can use that energy and derive value from those renewables in a way that would be impossible otherwise. And I think we’re going to see in the next five years massive innovations in that regard as well.”

De Chant made a number of points in reaction to Cruz’s statements. We will tackle them in turn.

De Chant starts with the admission that “it stands to reason that bitcoin mining could create enough demand that investors would be enticed to build new power plants. Those plants could theoretically be tasked with providing power to the grid in cases of emergency.”

But this isn’t really the point that Cruz and the Bitcoin community are making. Instead, we are pointing out that power providers will have improved economics from the existence of bitcoin mining as an additional source of offtake. These improved economics could induce extra construction. But we haven’t come across the suggestion that mining would finance the construction of bitcoin-only plants that would be directed to the grid in emergency situations.

The other claim is that bitcoin miners represent a unique type of interruptible load, whose ability to dial back energy consumption can help safeguard the grid from instability.

De Chant continued by pointing out that the February blackout in Texas was caused by significant winter storms in conjunction with a poorly weatherized grid — although Cruz completely acknowledged this in his remarks. This doesn’t score a point against Cruz — he’s fully aware of why the grid failed: significant winter storms in conjunction with a poorly weatherized grid, alongside other contributing factors such as natural gas delivery. What happened was that, alongside power plant failures, the natural gas infrastructure was unable to deliver natural gas to power plants. Additionally, the Electric Reliability Council of Texas (ERCOT) underforecasted its high case peak load scenario by around 10 gigawatts (GWs), which was a huge miss.

Cruz was not claiming that Bitcoin would prevent a black swan weather-driven grid meltdown. Ultimately, only better planning can do this.

De Chant continued by pointing out that Bitcoin miners wouldn’t spend extra cash to winterize their operations. But this is a confusing point: De Chant appears to be conflating miners and energy producers. In practice, the two are distinct. General grid failures have nothing to do with Bitcoin, and no one is suggesting that Bitcoin will cause power plants to fully avoid two-sigma tail events.

The Economics Of Accepting Lower Uptime

The main line of argument from De Chant is simply his claim that the economics of mining don’t support curtailment, even when prices are high. In his words: “Bitcoin miners would be unlikely to offer their generating capacity to the grid unless they were sufficiently compensated.” In the first version of his article, he originally claimed that miners would need to be paid $31,700 per megawatt hour (MWh) during the February 2021 winter storm to turn off their machines, an estimate which he revised to $600 per MWh later on. But both estimates are erroneous.

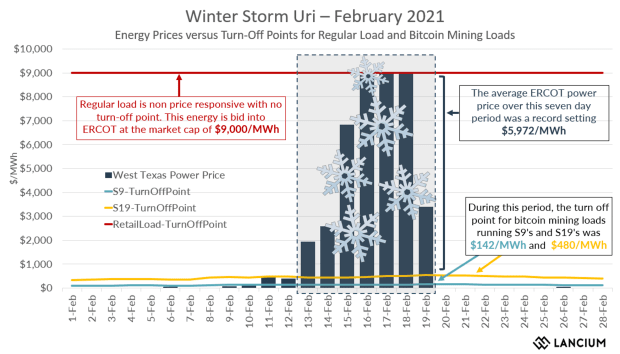

Even for the highest-end equipment (Antminer S19s), the “turn-off point” in February 2021 for miners would have been $480 per MWh. Older equipment has a lower turn-off threshold as it is more sensitive to electricity prices. When electricity prices reach a certain threshold, miners are no longer breaking even and turn off their machines — whether or not they are enrolled in a formal grid program to compensate them for downtime.

Miners are acutely aware of their economics and can adjust to grid conditions in real time. De Chant was off by a factor of 66 in his initial estimate. In his revised estimate, he maintained erroneously that miners would turn off their rigs at $600 per MWh, which is still an overestimate. Put simply, Bitcoin miners are highly price sensitive and engage in “economic dispatch” — meaning that they react to prices and simply do not run their equipment if electricity prices get too high. This is independent of whether they are participating in a “demand response” program, which formally employs power consumers to curtail their usage during periods of electricity scarcity.

In the below chart, you can see that miners would have turned off their machines well before the $9,000 per MWh price cap was reached for electricity in ERCOT.

The precise threshold at which miners curtailed their usage depends on the types of machines employed — higher-end machines have a higher opportunity cost, and are hence kept online through more expensive periods of power pricing.

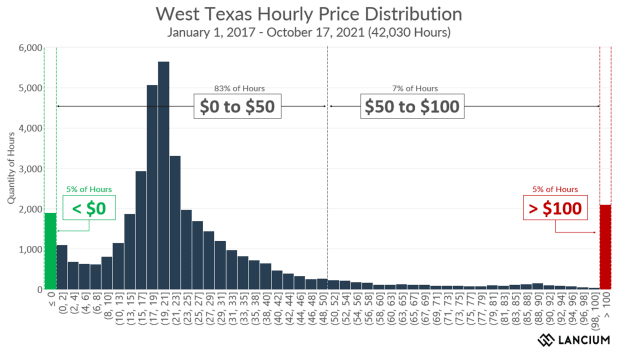

Electricity is generally cheap in ERCOT, which might imply relatively few instances in which miners would curtail their usage. But of course, the average doesn’t tell the story. The nature of the spot-driven grid is that much of the time, energy is cheap or even free (depending on where it’s being consumed), and a small fraction of the time it’s very scarce and expensive (this is a feature — the high prices are a signal to incentivize new generation to be built).

It’s during those right-tail events that Bitcoin miners can significantly benefit the grid by interrupting their load. Running the rest of the time means that energy is generally more abundant, because the presence of miners is an economic pressure that improves grid economics, making it more worthwhile to build new energy projects (who can now for the first time have the option to sell their full generation capacity to the grid or to Bitcoin).

For example, Lancium is a Houston-based technology company that is creating software and intellectual property solutions that enable more renewable energy on the grid. In 2020, it was the first company ever to qualify a load as a controllable load resource (CLR) (more on these later).

As of today, the company owns and/or operates all load-only CLRs in ERCOT with approximately 100 MWs of Bitcoin mining load under control for CLR. These mining facilities are being optimized on both a daily and hourly basis to mine when it is economic to do so and to turn down when it is not.

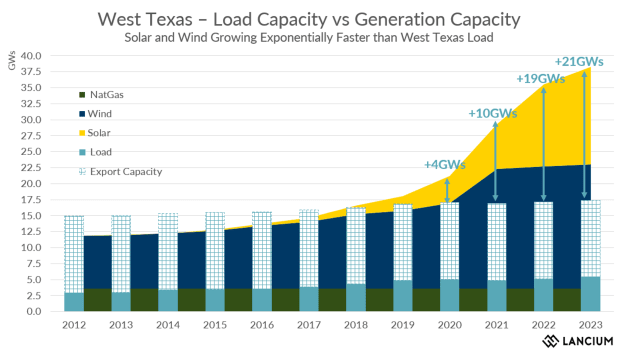

It’s worth diving into the distribution of power prices on a grid like ERCOT to fully understand how miners engage with the grid. Much of the time, energy is abundant and cheap. In West Texas, prices are routinely negative, as the supply of wind and solar periodically vastly outstrips demand, and there’s a limited ability to export the supply to load centers elsewhere in Texas.

What the miners do is provide a load resource which eagerly gobbles up negatively priced or cheap power (everything on the left side of the chart), while interrupting itself during those right-tail events (you can see the winter storm to the right).

On the one hand, this improves the economics of energy producers who for the first time have a new buyer to sell their electricity to, beyond just the inflexible grid. This promotes the construction of more renewable energy infrastructure and improves the prospects for existing installations. On the other hand, a highly interruptible load that can tolerate downtime means there’s more power available for households and hospitals during periods of scarcity, when supply trips offline through weather or other interruptions.

From the miner’s perspective, accepting interruptions to their service is actually an economically rational decision, for two reasons:

- They avoid paying extremely high prices for electricity during a shortage

- In some cases, they are actually paid for the service of providing “insurance” to the grid

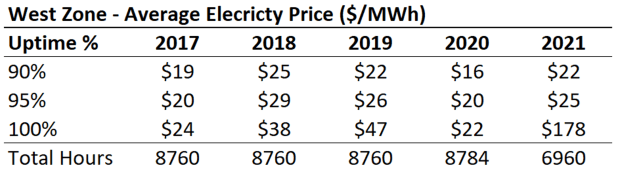

The below table shows the average yearly electricity price for consumers willing to tolerate various amounts of downtime. You can see that if you strategically avoided high-priced periods (as miners are motivated to do), you dramatically saved on power overall.

In 2021, with the right-tail event due to the winter storm causing prices to spike, if you reduced your uptime expectation from 100% to 95%, you were able to drive your overall power cost for the year from $178 per MWh to a mere $25 per MWh. So, the grid does not need to rely on the beneficence of miners to expect them to turn off their machines during times of grid stress: as profit-maximizing entities, they have a clear economic motive to do so.

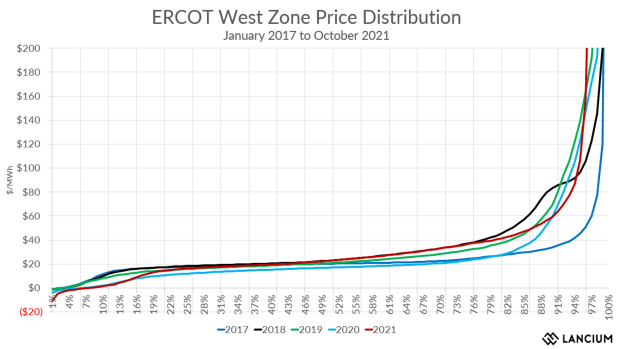

For a more holistic look at what prices in ERCOT have done during the last five years, we have included a chart showing the cumulative distribution by year below. Given that it hosted the winter storm, 2021 has the “fattest” right tail, with 5% of hours being priced over $100 per MWh.

You can see that wholesale spot prices are low much of the time, but are characterized by extreme spikiness as you get to the last 15% of the distribution. Neither tail is desirable: negative or low prices indicate an excess of supply causing a mismatch, and imply poor economics for energy producers; extremely high prices are indicative of blackouts and households not getting the energy they need. The presence of flexible load on the grid chops off both tails of the distribution. It is not a panacea and it cannot stop poorly-winterized equipment from failing during once-a-century storms, but the net effect is positive regardless.

Demand Response And Controllable Load

Additionally, the existence of flexible load is so useful to grid operators that they have designed specific programs to pay these load centers for a type of grid insurance. Broadly, these programs are known as “demand response” (DR). This term covers a range of load responses that generally reduce load at the instruction of the grid operator. Virtually all independent system operators maintain demand response programs, but most of them have programs that require 10 to 30 minutes of response time on the load.

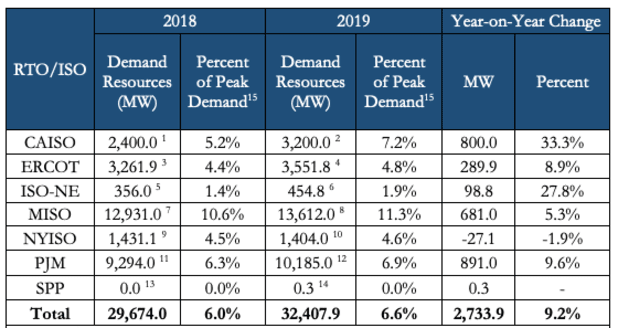

In fact, on a percentage of peak demand basis, ERCOT lags its peers like MISO (the Midcontinent Independent System Operator) when it comes to enrolling utilities in demand response.

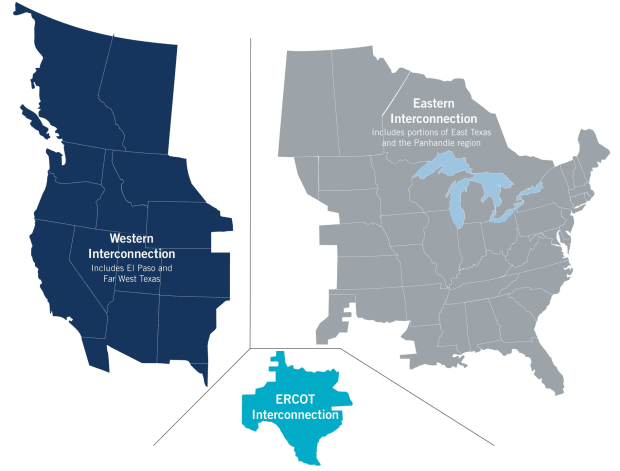

As ERCOT is a single balancing authority interconnection that is not synchronously connected with any other interconnection, it is essentially an islanded electrical grid. This means that ERCOT cannot lean on its neighbors for help when faced with an expected energy shortfall and instead must balance on its own.

Texas leads all states in having the highest levels of installed wind generation capacity in the country and is expected to double its renewable capacity over the next three to five years. Being an islanded grid with a significant portion of energy supply coming from renewables requires ERCOT to procure and utilize more responsive DR products, with requirements to respond in seconds or even at the sub-second frequency in addition to the more traditional 10-to-30-minute response times.

What De Chant simply failed to mention — but Ted Cruz hinted at — is the remarkable ability of miners to act as these controllable load resources.

In ERCOT parlance, this is a type of power consumer that can dial down their consumption and back up again in response to grid operator commands on a second-by-second basis. Most data centers can’t do this — in fact, the selling point for many data centers is precisely their high uptime and non-interruptibility.

The Bitcoin network is a much more forgiving client: it doesn’t really care if you interrupt the action of mining, because each successive hash is statistically independent of the last (this is known as “memorylessness”). Aside from making slightly less revenue, nothing adverse happens if a Bitcoin mining data center only runs at 60% or even 0% capacity for a few minutes or hours. Compare that to a hospital, a smelter, a factory, or commercial real estate. These sources of load need constant uptime, and cannot tolerate interruptions.

Due to the statistical properties of mining and the physical tolerance for mining hardware to deal with interruption, Bitcoin data centers can therefore dial up and down their consumption on a highly-granular basis and on short notice.

For a grid operator, such a load type is a dream, because it gives them the ability to balance supply and demand from the demand side, rather than having to tweak supply (typically by spinning up and down natural gas turbines). There have historically been some semi-interruptible loads that grid operators relied on for similar programs, like arc furnaces, wood pulp production, cement mills, or aluminum electrolysis, but none could provide the flexibility or response times Bitcoin miners can.

The industries mentioned are industrial loads which cannot easily power up and down, and certainly not on extremely short notice, as is necessary for a modern CLR. For context, CLRs have to be able to curtail their targeted load reduction by 70% within 16 seconds. Before Bitcoin mining, no load type qualified in ERCOT.

You can think of a CLR as a power generator in reverse. Instead of adding expensive power to the grid during a period of scarcity, the CLR receives a real-time price signal from the grid operator and if it’s above its economic turn-off point, it will automatically “dispatch down” (curtail consumption) to make way for other, more critical loads. Therefore, instead of only having flexible (and CO2-emitting) thermal energy from a coal or natural gas generation available to the grid operator during peak demand periods, the CLR capacity not reserved as grid insurance is offered into ERCOT’s security-constrained economic dispatch (SCED) and will automatically dispatch down when the real-time price is higher than the turn-off point for the bitcoin mining load.

An added benefit to ERCOT in having bitcoin mining loads as a “load resource” is that during local shortages or system emergencies, ERCOT can directly turn down the load. This is a very big deal. For the data center, it’s a great deal, because they can sell “ancillary services” (basically, a bundle of products that give the grid operator the right to curtail the data center’s production should they need to), collect a premium for doing that, and mine the rest of the time. So, they collect a premium on an ongoing basis (even if not called upon to curtail their usage), effectively lowering their all-in power cost, while also providing a valuable service to the grid.

In contrast, a generation resource which sells ancillary services has a real opportunity cost: it has to run below its maximum in order to retain some slack in case it is called upon to increase its power.

So, when Cruz mentioned the possibility of Bitcoin mining “playing a significant role as strengthening and hardening the resilience of the grid,” he is likely referring to the strong benefits that interruptible load offers to a grid operator. The existence of qualifying CLRs means that policymakers can target structurally-higher renewable penetration and feel comfortable in the grid operator’s ability to procure more insurance against adverse events. As grids become increasingly renewable and move from fossil-fuel-powered steady baseload to more volatile wind and solar power, these kinds of controllable loads will become increasingly critical.

Additionally, the ability of Bitcoin miners to colocate with renewable assets and act as an independent buyer when the grid has no demand provides a base level of monetization which was not available previously. This incentive means that intermittent energy sources like wind and solar (which are often curtailed, as they are frequently distant from load centers) have improved economics.

Indeed, an analysis from Dr. Joshua Rhodes and Dr. Thomas Deetjen with IdeaSmiths LLC demonstrated that flexible data centers would actually promote the stability of an increasingly-renewable grid and allow for more renewable penetration than the grid could otherwise support.

The analysis from Rodes and Deetjen found that “operating data centers in a flexible manner can result in a net reduction of carbon emissions” and can “increase the resilience of the grid by reducing demand during high stress times (low reserves) on the grid.”

Under the scenario where 5 GWs of flexible data center growth was added to the base case with a range of uptimes between 85% to 87%, the flexible data center “consumes about 35.5 million MWh, but supports the deployment of an additional 39.5 million MWhs of wind and solar energy.”

In simple terms, the incremental MWh output from solar and wind is greater than the incremental MWh consumption from the flexible data centers — hence, carbon negative.

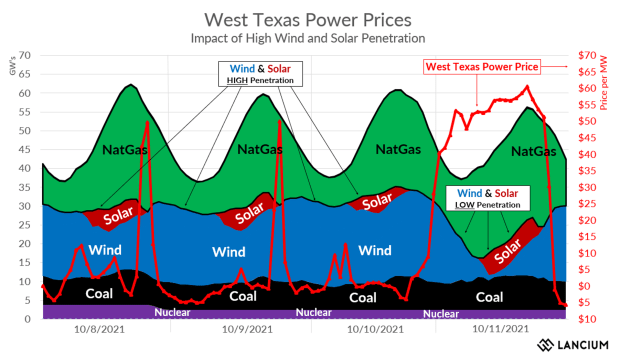

For a visualization of how the intermittency of wind and solar affects electricity pricing, we have assembled real data from earlier in October in West Texas in the chart below:

Between October 8 and October 10, wind and solar generation averaged over 20 GWs with the power lines that connect West Texas to the major load centers in the east being at maximum capacity. With so much wind and solar online, West Texas power prices averaged $3 for these three days with several hours settling negative. On October 11, wind generation was 20 GWs at around midnight, 2 GWs by noon and back up to 20 GWs by end of day. As wind dropped, power flowing across the West Texas power lines also dropped, which caused West Texas prices to be on par with the rest of ERCOT.

This drop in wind means natural gas must yet again pick up the slack. A grid with even higher wind and solar penetration would face these problems in abundance. Having a significant quantity of flexible loads on the grid to dial down consumption during rapid drawdowns in renewable generation would help attenuate spikes in power prices, without requiring as much support from less efficient combustion turbine peakers.

Conclusion

In our view, contemporary industrial Bitcoin mining has four key properties that make the industry an extremely suitable buyer of energy for increasingly renewable grids. These are interruptibility, unconstrained location agnosticism, scale independence, and attenuation:

- Interruptibility: This refers to the ability of miners to tolerate downtime with a merely linear worsening in their economics. Other load centers cannot tolerate interruptibility, and certainly not on a second-to-second basis. This enables Bitcoin mining data centers to qualify for advanced grid insurance products like Ancillary Services as Controllable Load Resources in ERCOT.

- Attenuation: Bitcoin mining data centers can reduce their energy consumption on a fractional basis, dialing down from a full load to a small percentage of ASICs online at any point. Aside from the hit to their economics, they suffer no adverse consequences from doing this. This makes them suitable for participating in highly-configurable demand response programs.

- Unconstrained location agnosticism: Bitcoin miners can participate in the network anywhere, mining with limited data overhead over cellular data or satellite internet. This is completely unlike most other load centers like households, which require expensive transmission from generation resources to centers of load. This property means that Bitcoin miners can colocate with renewables even prior to grid connection; can exploit fully off-grid assets like waste natural gas; and can consume otherwise-curtailed energy in places with abundant resources like West Texas.

- Scale independence: Bitcoin mining is strongly fractionalizable, and does not maintain extreme economies of scale. This means that a shipping container of miners can be perfectly viable exploiting a sub-1 MWh source of energy. This property means that miners are highly portable and can attack stranded energy assets which would otherwise not find a buyer. Other industrial centers of load like aluminum smelting plants cannot be fractionalized.

Among industrial load centers, these qualities are unique. Prior to Bitcoin, there simply wasn’t a load resource that satisfied these four qualities. Some industrial consumers of load have some of these features, but none with such fidelity. Aluminum smelting, for instance, has a degree of location agnosticism, as has been well-documented with Alcoa smelters being colocated with abundant energy resources, effectively exporting energy via the refined metal.

Certain types of factories like aluminum arc furnaces and paper mills have a degree of interruptibility, but only for short periods of time, and only with significant latency. Certain power companies offer households and industrial consumers the ability to participate in demand-response programs, but only in a reduced capacity and never as a Controllable Load Resource. Non-Bitcoin data centers also exhibit location agnosticism to a certain degree, but require high throughput internet and cannot tolerate interruptibility.

By satisfying these qualities, Bitcoin represents a truly novel industrial load center, and offers superlative benefits to grid operators and policymakers aiming to decarbonize the grid. This permits Bitcoin miners to effectively sell high-quality insurance into the grid by participating in the ancillary service market in ERCOT, something that was mostly limited to the supply-side previously (through thermal generation resources).

Even without these more advanced CLR products, it’s clear that miners have a strong economic motive to curtail their consumption during periods of high prices, allowing households to get more power during periods of scarcity.

A joint realization is currently underway. First, Bitcoin miners are learning that there are significant economic benefits to accepting reduced uptime and going from “dumb” load to “smart” load. Beyond the merit of economic dispatch, participating in formal demand response programs is an additional source of revenue — and hardens the grid, too. Additionally, independent system operators are beginning to discover the possible importance of Bitcoin miners as a flexible load resource, one most unlike those they have historically considered for demand-response programs.

We hope and expect that many more grid operators will realize the significant benefits offered by flexible data centers and begin to design with Bitcoin mining in mind. Their ambitions for increasingly renewable grids may well depend on it.

This is a guest post by Nic Carter and Shaun Connell. Opinions expressed are entirely their own and do not necessarily reflect those of BTC Inc or Bitcoin Magazine.