- May 12, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

As a result of the recent cryptocurrency market fall, Michael Saylor’s company, MicroStrategy, now has an unrealized loss on its bitcoin assets. With approximately 130,000 BTC, the company is the largest corporate owner of the principal digital asset.

Despite the carnage in the market, Michael Saylor remains optimistic, saying that bitcoin will recover and return riches to its owners.

Microstrategy In Macro loss

MicroStrategy’s large bitcoin bet has lost money after bitcoin’s price fell below the software company’s average buying price.

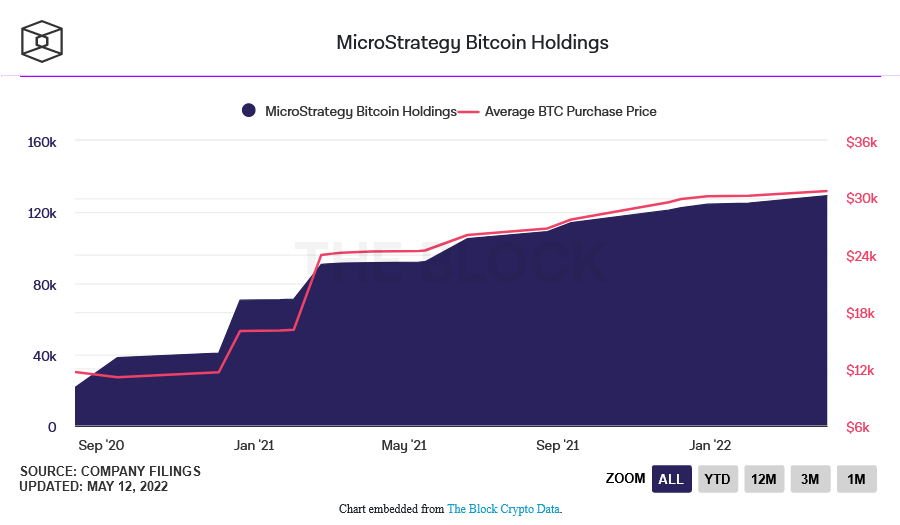

MicroStrategy and its subsidiaries presently own 129,218 bitcoins, which they purchased for an average of $30,700 each. The current bitcoin price is around $28,200, resulting in a $330 million loss on paper — despite the fact that Michasn’t sold any bitcoin.

Microstrategy's BTC Holding. Source: The Block Crypto

The software company’s stock price has plummeted in recent days as a result of the larger market turmoil. On Wednesday, it finished at $168, extending the week’s loss to 45%.

After going all-in on bitcoin, Microstrategy and its CEO Michael Saylor have become poster children for bitcoin enthusiasm. When Saylor said that bitcoin is a superior asset for a treasury since it is deflationary by design, MicroStrategy first bought bitcoin on its balance sheet in August 2020.

BTC/USD plummets below $30k. Source: TradingView

Saylor, true to himself, does not appear to be concerned about the market’s collapse. MicroStrategy will not sell its bitcoin investments, according to the CEO, who believes bitcoin will recover and reward those who held it during the tough times.

The #bitcoin price is set by those with more money and less knowledge than you. In time, they will get the knowledge and you will get the money.

— Michael Saylor

(@saylor) May 11, 2022

Related reading | Is Microstrategy Secretly Selling Off Their BTC Stash?

Loss Backed By Debt

MicroStrategy’s bitcoin bets, in particular, have been backed by more than $2 billion in debt. To purchase the bitcoin, the corporation took out multiple convertible and secured loans.

MacroStrategy (a subsidiary of MicroStrategy) took out a $205 million loan secured by BTC holdings earlier this year. Silvergate Bank, an American fintech startup, provided the funding.

MicroStrategy promised to put the funds toward buying more shares of the top digital asset. Silvergate CEO Alan Lane had this to say about the strategy:

“Their innovative approach to treasury management is an exceptional example of how institutions can utilize their bitcoin to support and grow their business.”

Concerns grew, however, as bitcoin’s price fell, that the corporation may be forced to repay its multimillion-dollar loan. If BTC’s price falls below $21,062, Saylor explained, this will happen. Nonetheless, the corporation might extend the margin call by using its other bitcoins as collateral.

The firm has 115,109 bitcoins it can pledge, and even if the price of bitcoin falls below $3,562, the company “could post some other collateral.” Saylor tweeted earlier this week.

On paper, Saylor’s company isn’t the only corporation experiencing bitcoin losses.

During the turmoil in the cryptocurrency market, Elon Musk’s Tesla and cash-strapped El Salvador both lost money on their bitcoin holdings.

Related Reading | Bitcoin Is Being Pummeled – Will Tesla And MicroStrategy Sell Their BTC?

Featured image from Pixabay, chart from TradingView.com