- June 28, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin has been recovering from a bloody weekend in the daily chart. At the time of writing, BTC trades at $34,483 with losses in higher timeframes. The general sentiment in the market seems to be flipping bullish, but the bulls require more conviction to make a decisive push against the bears.

In the short term, the outlook is unclear. During the recent sell-off $30,000, $31,500, and $33,500 operated as levels of critical support for Bitcoin.

The price must remain above these levels as it makes its way up and faces resistance at $35,500, $37,000, and $40,000. A push above the latter will potentially mark the beginning of a more sustainable bullish price action.

Anonymous trader “NebraskanGooner” claims that the recent bounce on BTC’s price has occurred “overnight”. In the lower timeframes, the selling pressure continues to increase. He added:

Just a bunch of low time frame whip-sawing back & forth on Bitcoin. I’m still taking it easy with leverage trading and mostly interested in spot positions for now if I find good long opportunities.

Former Goldman Sachs employee Raoul Pal reviewed the macro-outlook and believes a change will inevitably come. He recommended investors pay attention to the U.S. dollar and the Federal Reserve treasuries.

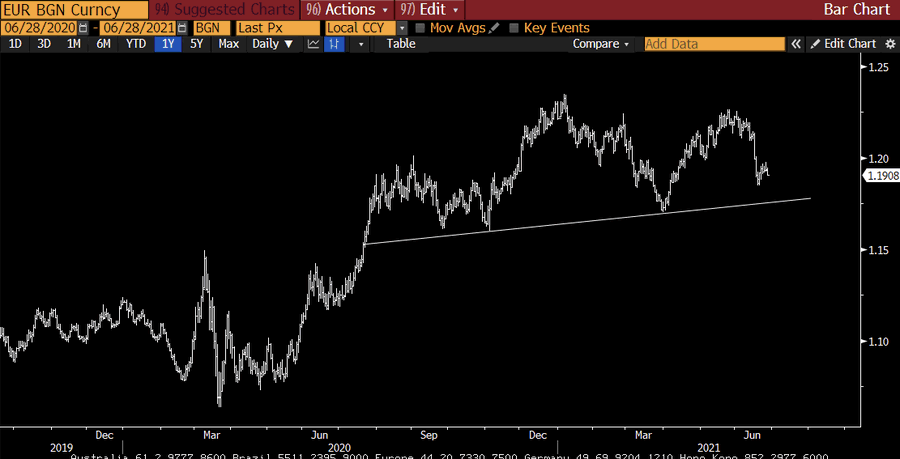

These assets seemed poised to make big moves. Pal used the USD/Euro chart as a proxy to look into the U.S. dollar performance. This currency could be forming a “very large head and shoulder” pattern and could drop suggesting weakness in treasuries.

The former Goldman Sachs employee will also wait for the performance in the Citi Economic Surprises Index. A dropped below 0 could indicate that experts have “over forecasted growth and inflation”. Pal added:

(…) 10 year rates look like they are going to test the uptrend. If my hunch that H2 is going to be weaker than expected is correct, this trend line will confirm. After all, bonds speak the economic truth.

If Pal’s predictions are confirmed, he expects a sell-off in equities, appreciation in bond, and a bullish effect for Bitcoin and Gold. Other commodities could face a downside trend. Pal expects this theory to confirm or invalidated in July.

Bitcoin And The Persistent Menace Of Covid-19

In the past year, BTC has positively responded to the store of value narrative. The Covid-19 pandemic has forced major banking institutions around the world to adopt policies to counter the effects of the lockdowns in the economy.

The lockdown in most of the western world has been progressively lifted. Some experts claim that this event, Bitcoin miners leaving China, and the arrival of the summer, a season of travels and vacations, have placed extra selling pressure in the crypto market.

However, there is evidence of potential vaccine resistance strings of the virus. The market has begun to react to these reports. The expectation, as Holger Zschaepitz reported:

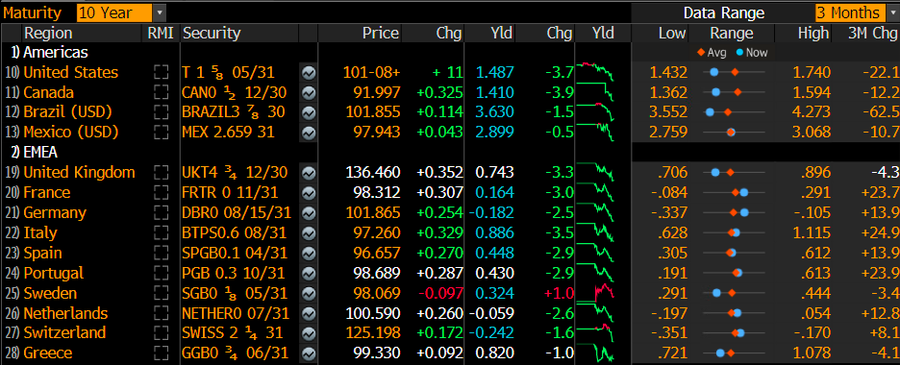

The fear of the Covid delta variant in a chart: Global bond yields fall for fear of further lockdowns. US 10y yields again <1.5%.

Thus, the Covid-19 narrative could also favor Bitcoin. Investors could once again feel attracted to assets capable of providing high yields and successfully operate as a hedge against inflation.

Whatever the conditions are at the moment, the bullish bigger picture for BTC’s price remains intact. By the end of 2021, the most conservative predictions place Bitcoin at around $75,000 to $100,000.

$20,000 or $100,000 Next for #Bitcoin? The Trend Is Upward –

This year has many of the typical earmarks for a strong advance in Bitcoin, and we see the dip toward $30,000 as a discount within a bull market. Supply was cut in 2020, demand and adoption are rising… pic.twitter.com/mk5rKeMD25— Mike McGlone (@mikemcglone11) June 13, 2021