- May 25, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

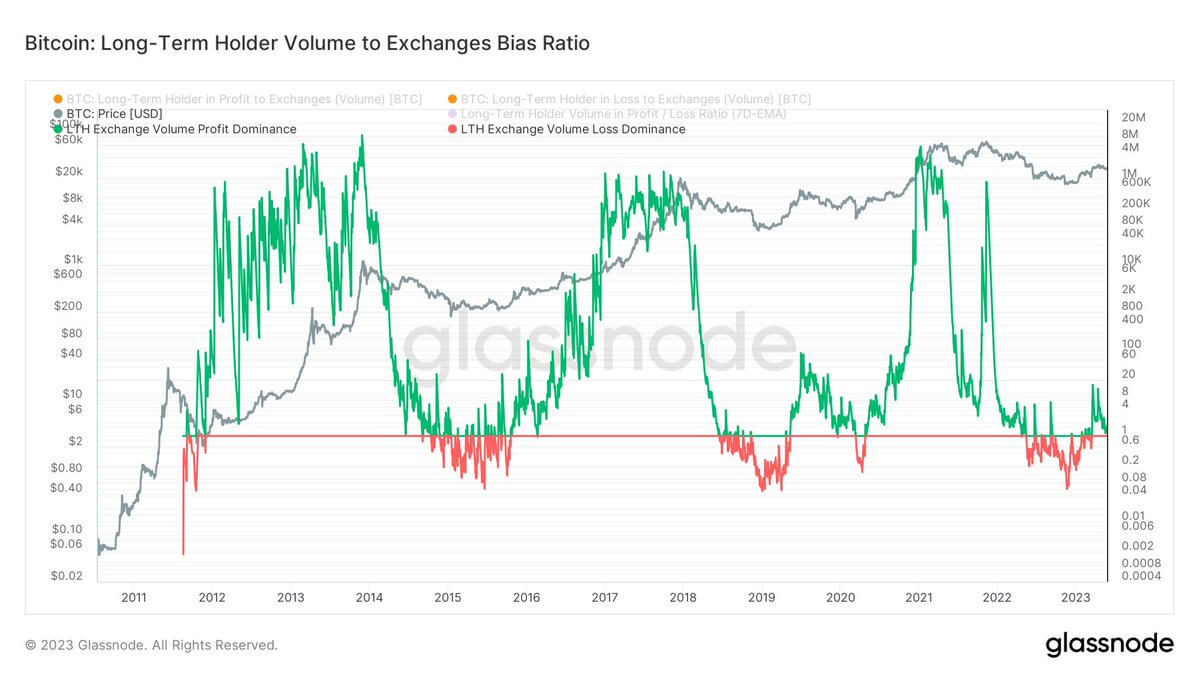

- The Bitcoin Long-Term Holder (LTH) volume-to-exchanges bias ratio shows LTHs are sending greater volumes of coins in profit to exchanges relative to coins in loss, denoted by the green.

- LTH volume-to-exchanges bias ratio is currently at 1.73, according to Glassnode data as of May 25, which shows a slight dominance in terms of long-term holders sending coins to exchanges at a profit.

- Long-term holder supply recently hit an all-time high of 14.463M, as reported by CryptoSlate on May 19.

- When the ratio is red, usually during bear markets, it shows that LTHs are sending greater volumes of coins in loss to exchanges relative to coins in profit.

- The bear market bottom occurred in November 2022 in this cycle, and a similar pattern emerged in 2016 and 2019 when the ratio of one was tested and it could be re-tested multiple times.

- For the current cycle to be deemed a new bull market, the dominance ratio has to stay positive.

The post Long-term holders’ bias ratio hints at Bitcoin’s potential return to bull market appeared first on CryptoSlate.