- August 8, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

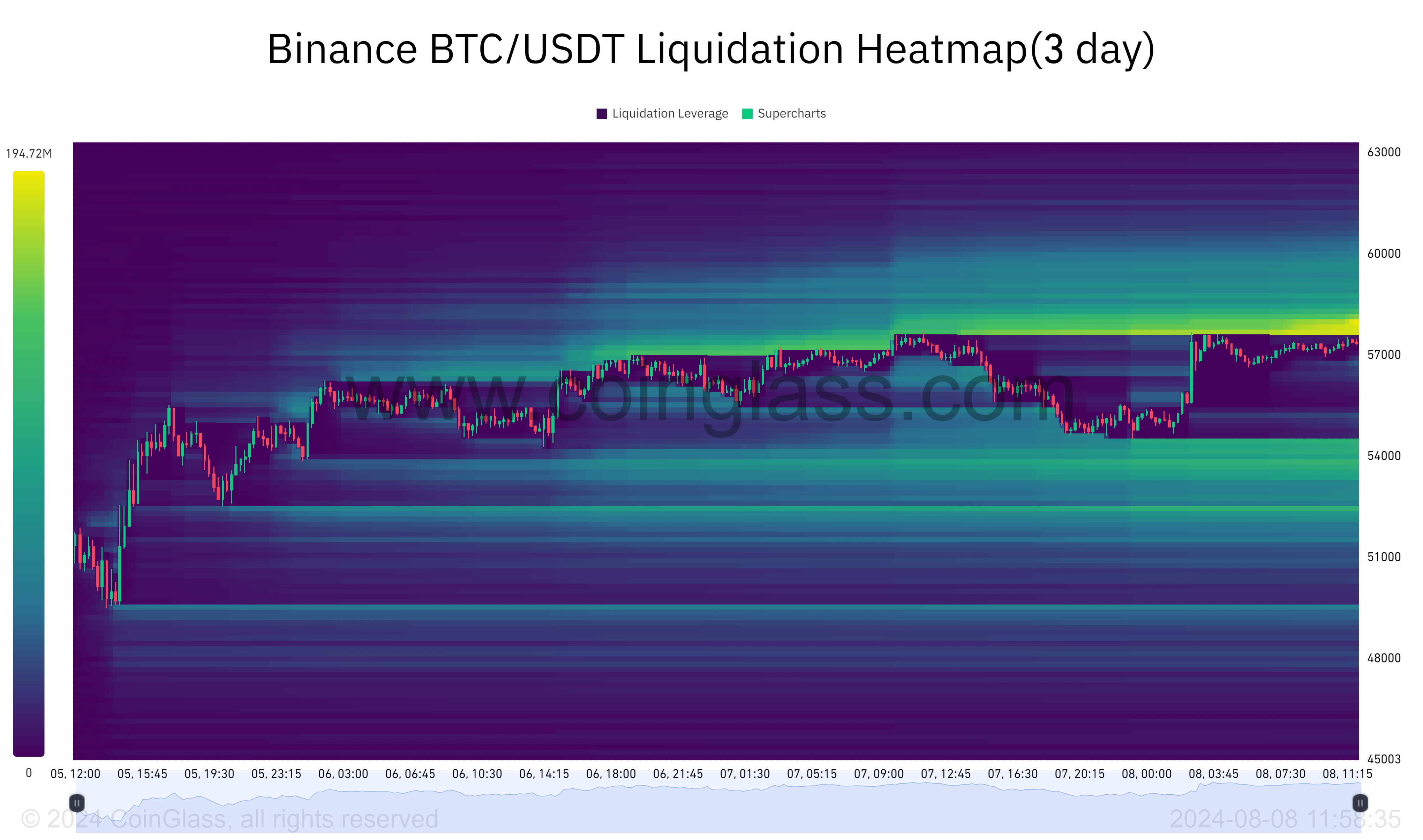

Bitcoin experienced a notable drop on Aug. 5, falling to $49,000—the lowest price since mid-February. However, it has since rebounded and is currently trading at over $57,000, about 22% shy of its all-time high. This significant recovery reflects Bitcoin’s ongoing volatility and the dynamic nature of its market.

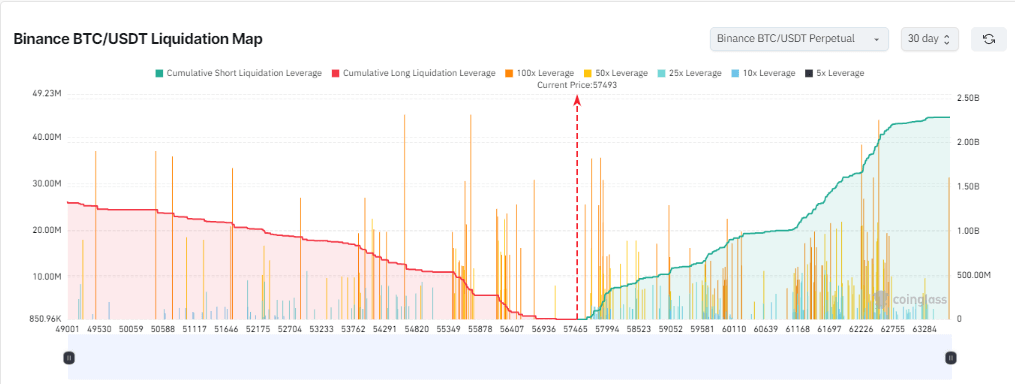

Data from Coinglass highlights that Binance, the most liquid exchange, using the BTC/USDT pair for Bitcoin trading, shows approximately $1 billion worth of short positions facing potential liquidation at the $58,000 price mark. This indicates a concentrated risk of liquidation leverage between $57,700 and $58,000.

Coinglass data shows that the liquidation map for Bitcoin on Binance over the past 30 days reveals a cumulative short liquidation leverage of just under $2.5 billion from around $57,800 to $64,000.

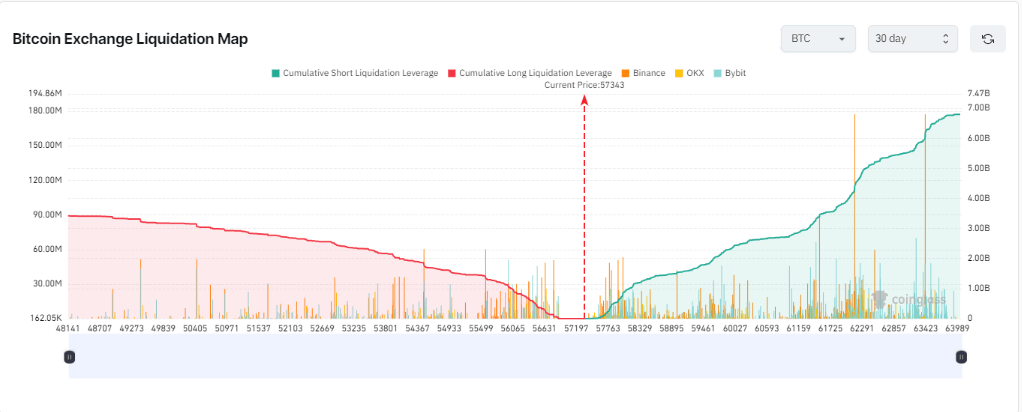

Expanding this view across all exchanges shows almost $7 billion in leverage in notional value over the past 30 days.

The post Leveraged short positions close to $1 billion liquidation as Bitcoin climbs appeared first on CryptoSlate.