- May 28, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Earlier this week, head of South Korea’s central bank Lee Ju-yeol warned that leveraged crypto trading was a threat to the country’s financial system.

“An excessive level of leveraged cryptocurrency trading puts households at risk of financial damages considering the instability of [crypto],” he said. We expect [the increasing amount of crypto trading] to have a negative impact on the financial system in any respect.”

The governor also promised that Korea’s central bank will closely monitor the financial institutions associated with leveraged trades, suggesting that new frameworks may be put in place to ensure that there will be no defaults that could have a domino-effect on Korea’s financial system.

While fears of a system collapse as a result of overleveraged traders may appear to be over exaggerated, it’s certainly within the realm of possibility.

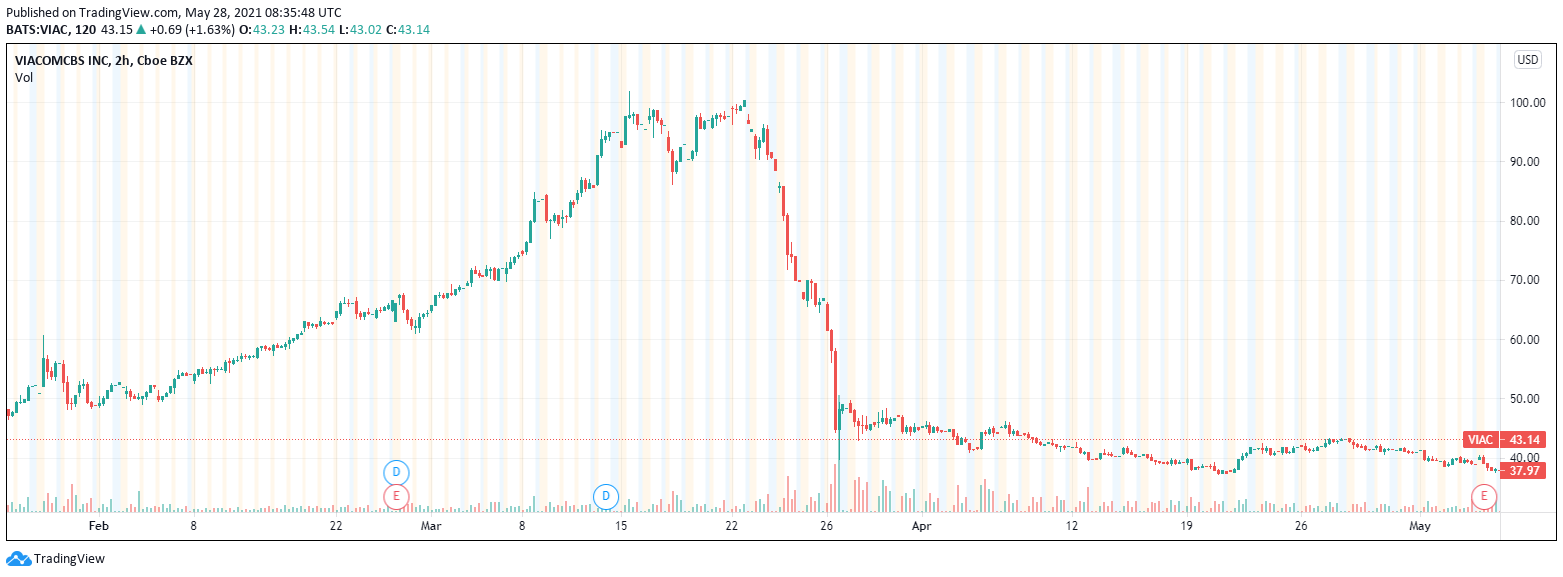

Earlier this year, a hedge fund called Archegos Capital imploded due to its high leverage positions getting margin called, leading to a massive unwinding by financial institutions such as Goldman Sachs, Credit Suisse, and UBS, among others.

The sudden $10 billion implosion not only led to stocks of lending banks to crumble, but shares of ViacomCBS, Discovery — companies in which Archegos capital were heavily leveraged up on — also lost half their value.

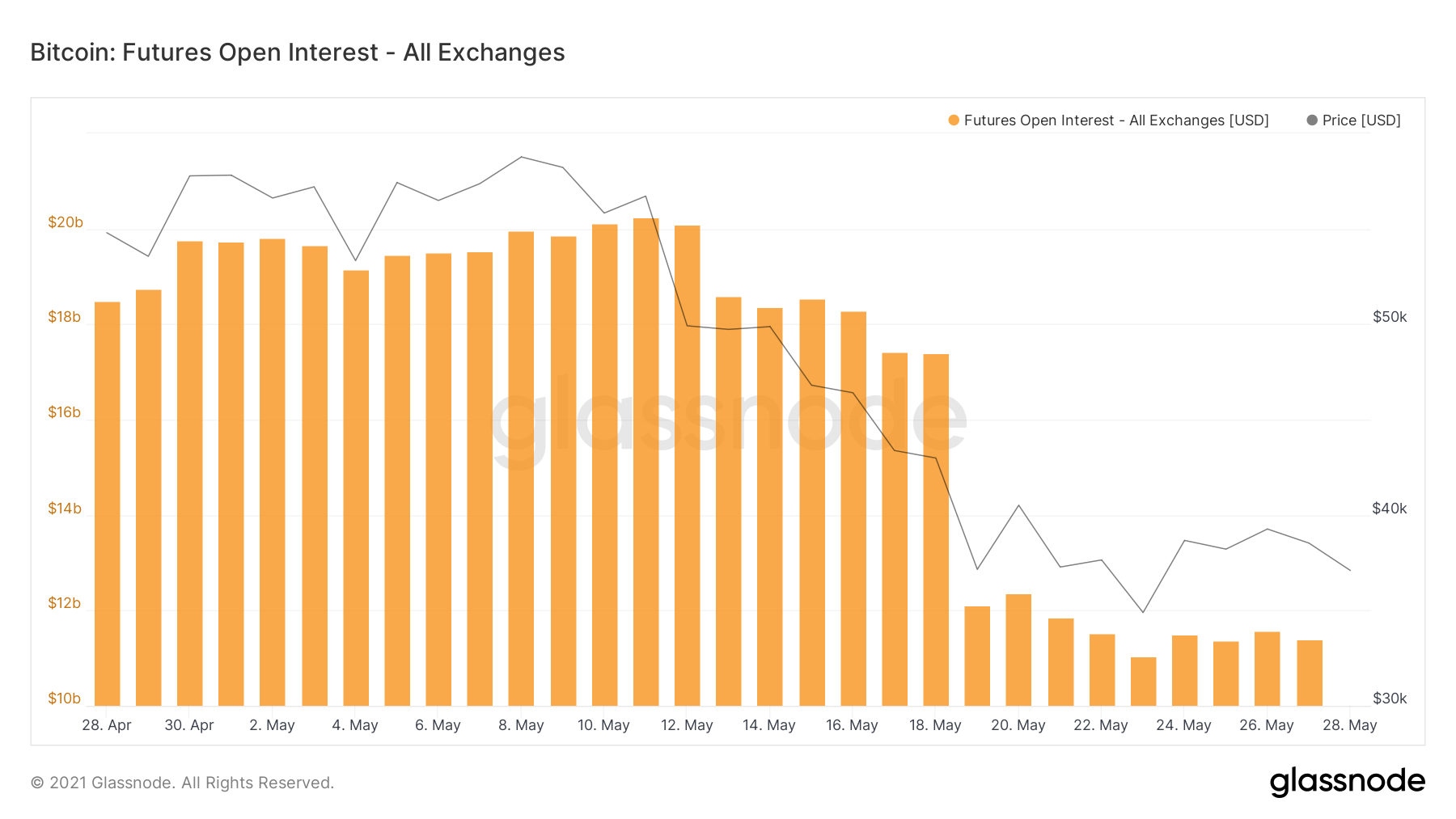

Following Tesla’s decision to no longer accept Bitcoin payments and China’s ban on Bitcoin miners, the crypto markets have also shed nearly 40% of its value within weeks. The gut-wrenching volatility led to more than $9 billion in futures liquidations, wiping out leveraged traders positions.

Related Reading | Tesla Halts Bitcoin Payments over Environmental Concerns, Sending the Cryptocurrency to Session Lows

For Bitcoin alone, Glassnode data revealed that futures open interest dropped from $20 billion to $11 billion within the week of May 12 to 19.

Given South Korea’s regulatory disdain for cryptos and the digital asset’s volatility on full-display, there’s no surprise that officials are looking to enforce more stringent laws on leveraged trading.

Featured image from UnSplash