- April 10, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Korea-based crypto exchange GDAC was hacked for roughly $13 million worth of digital assets during the early hours of April 9.

According to an April 10 statement, the exchange said the stolen assets accounted for 23% of the total assets it managed.

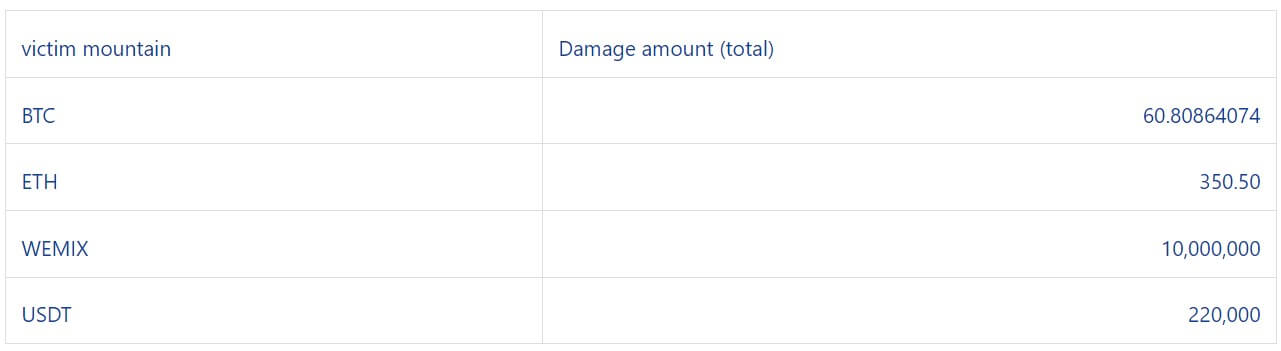

The exchange said the stolen assets included nearly 61 Bitcoin (BTC), 350.5 Ethereum (ETH), 10 million WEMIX, and 220,000 USDT.

Due to this incident, the exchange has temporarily suspended deposits and withdrawal services, adding that it would perform emergency server maintenance.

GDAC said it had informed the authorities, including the Korean police and the Korea Internet & Security Agency (KISA), about the hack and has requested a cyber investigation.

“We ask those in charge of exchanges handling virtual assets to immediately block the deposit from the address where the withdrawal occurred, as stated in the official notice.”

GDAC further urged other exchanges, DeFi platforms, etc., to help it freeze the stolen funds if sent to their platforms.

Meanwhile, the hacked exchange said it was unsure when its services would be resumed as investigations are underway.

According to CEO Seunghwan Han, the exchange is doing its “best by collaborating with various organizations” to track the stolen funds.

Crypto exploits in 2023

Crypto hacks have begun to pick up after a quiet start to the year. In March, blockchain security firm Peckshield reported that 26 crypto projects were hacked for $211 million.

According to Peckshield, Euler Finance’s (EUL) March 13 hack was responsible for over 90% of the losses. However, the hacker has since returned all of the stolen.

Meanwhile, DeFillama data shows that malicious players have stolen $1.57 million from two crypto projects in April — Sentiment lost $1 million while Allbridge was hacked for $570,000.

The post Korea-based exchange GDAC suspends withdrawals, deposits after $13M hack appeared first on CryptoSlate.