- August 5, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

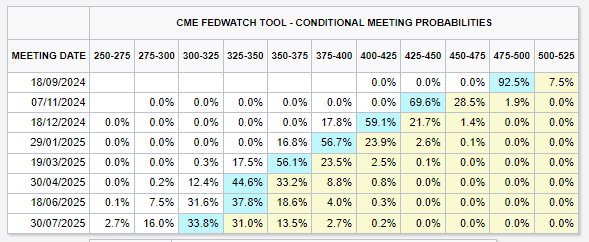

The Federal Reserve recently maintained the federal funds rates at 5.25-5.50%. However, a continuation of poor US data, including weak US jobs data, has triggered the Sahm Rule, signaling a potential recession. Consequently, the market anticipates roughly 50 basis points (bps) of rate cuts in the upcoming September meeting, which is 44 days away.

Polymarket indicates a 57% probability of an emergency rate cut in 2024.

In Asia, the Nikkei experienced its most significant two-day drop in history following Japan’s decision to raise interest rates to 0.25%. This move strengthened the Japanese yen against the US dollar, hitting 142, contributing to the unwinding of the yen carry trade. This trade involved borrowing yen at near-zero interest rates to invest in higher-yielding global assets like US equities and treasuries. With the Bank of Japan (BoJ) increasing rates, traders face higher interest payments and significant forex losses, unwinding their trade positions and prompting a massive sell-off in US stocks to cover their positions. It’s speculated that the yen carry trade could be worth trillions of dollars, in addition to Japan being the largest holder of US treasuries.

Amid these developments, US equities are down a few percentage points in pre-market trading, while European indices, including the FTSE and DAX, are also declining. Analysts will closely monitor the US yield curve (US 10Y-2Y), normalizing a historical predictor of recessions over the past 50 years.

Bitcoin is down roughly 10% on Aug. 5, trading below $52,000.

The post Japan’s historic rate hike prompts yen carry trade unwinding, impacts global markets appeared first on CryptoSlate.