- April 5, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

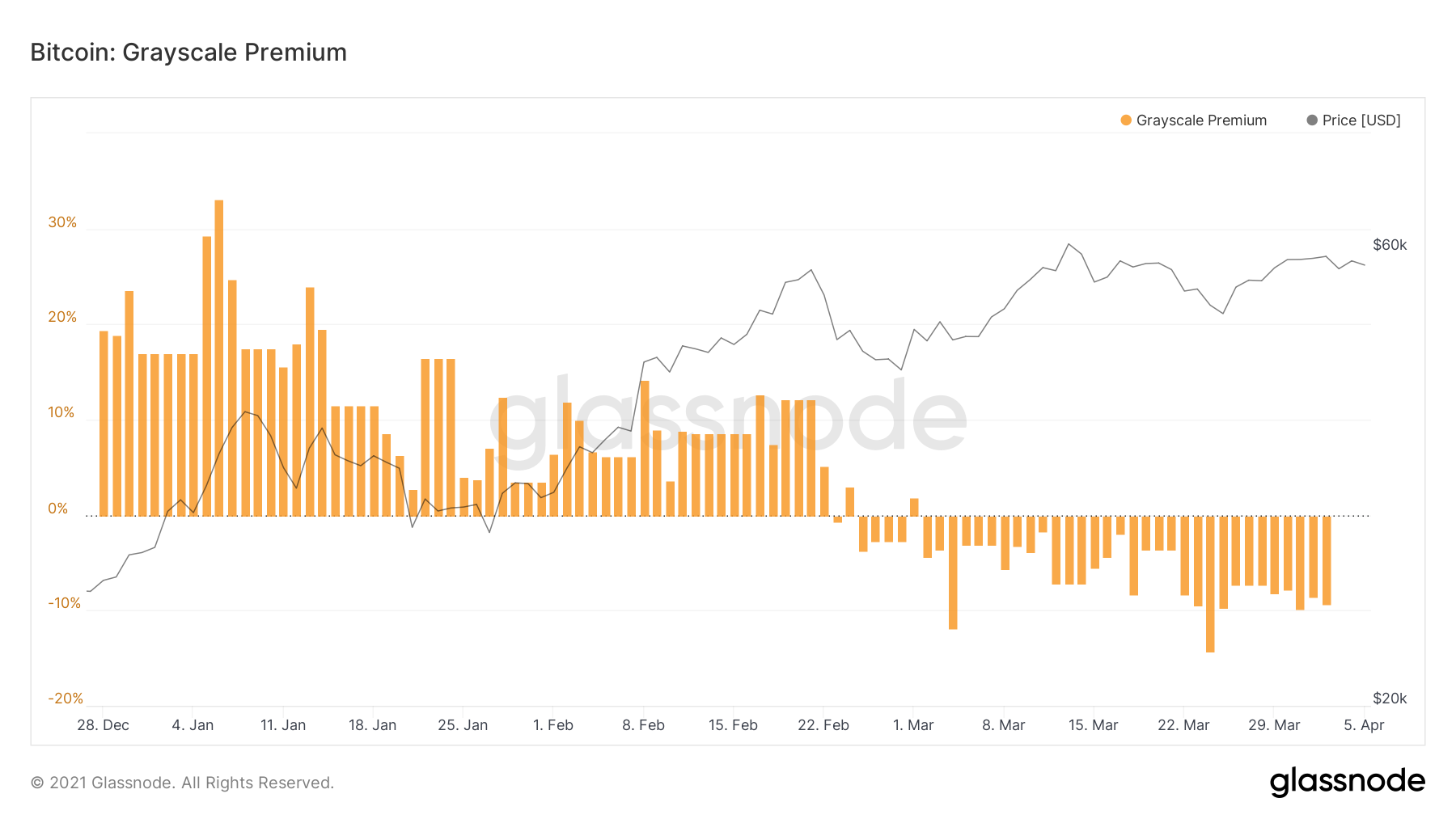

Since February, Grayscale Bitcoin Trust (GBTC) has continued to trade at a negative premium. The Bitcoin fund, available to institutional investors on the traditional stock market, has traded below the price of Bitcoin since February 22, 2021 — a telling sign that its demand was drying up.

Just four months ago, GBTC”s premium was at a whopping 33.12%. Since then, its premium has fallen into a downward spiral, hitting an all-time low of -14.34% on March 25 and currently trading at -9.32%. What’s surprising is that, in the exact same time period, Bitcoin’s price has appreciated 57% — from $36,850 to $57,891. So what exactly happened?

Analyzing Why Premium Continues to Trade at a Discount

Institutional buyers were always the biggest proponent to the fund’s past success. According to GrayScale’s third quarter report in 2020, 80% of investments in the trust were from institutions. Institutions often leverage their investments, taking out massive loans in the process. For some firms, the goal was for GBTC’s rising premium to mitigate the loan’s interest rate — which clearly hasn’t worked out since late February.

It’s also important to note that Grayscale Bitcoin Trust charges a 2% management fee, requires a 6-month redemption period, and has major price discrepancies. Previously, institutional investors interested in gaining exposure to Bitcoin had no other options. But now, exchange-traded funds are flooding the market, boasting far lower management fees and better service in general.

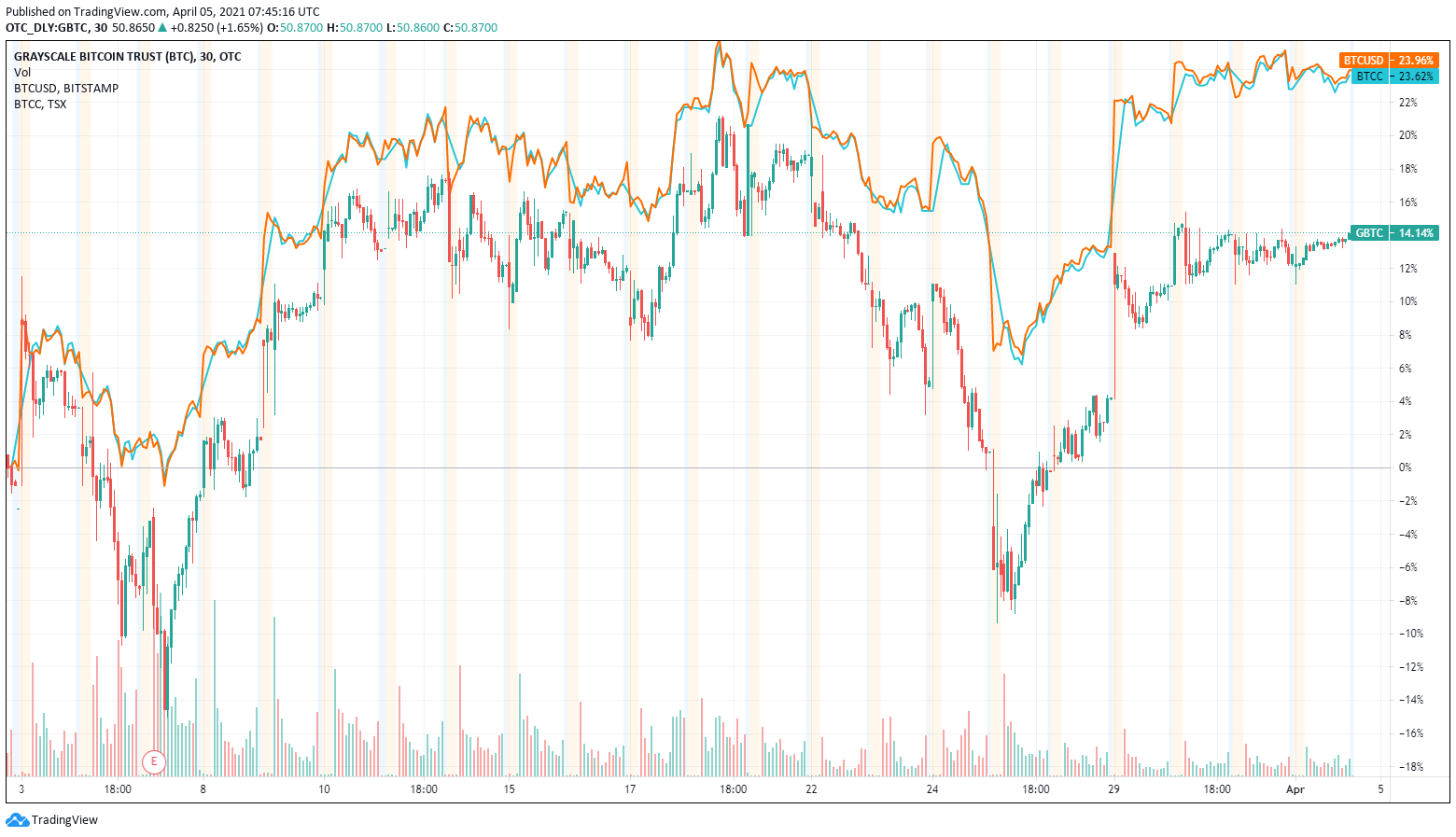

Take TSX’s Purpose Bitcoin ETF, for instance. The brand-new ETF has returned 23.62% in the past month — accurately tracking Bitcoin’s 23.96% monthly increase. Grayscale Bitcoin Trust, on the other hand, has only gone up 14.14%. Of course, the negative premium and a myriad of other factors play a role in the slippage. The opportunity cost is massive nonetheless.

What’s Grayscale Bitcoin Trust’s Future?

As a result of all this, institutions are likely looking to exit their highly-levered positions as soon as their lock-up periods end. There are plenty of better alternatives now available in Canada, and as soon as U.S. regulators approve the country’s first several ETFs, GBTC will undoubtedly lose ground as the premier Bitcoin investment fund. Will the fund become obsolete? Most likely not — not anytime soon at least. If Grayscale hopes to stay in the game, though, it’ll need to improve its services and offer more incentives to potential investors.

Featured image from UnSplash