- March 2, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Definition

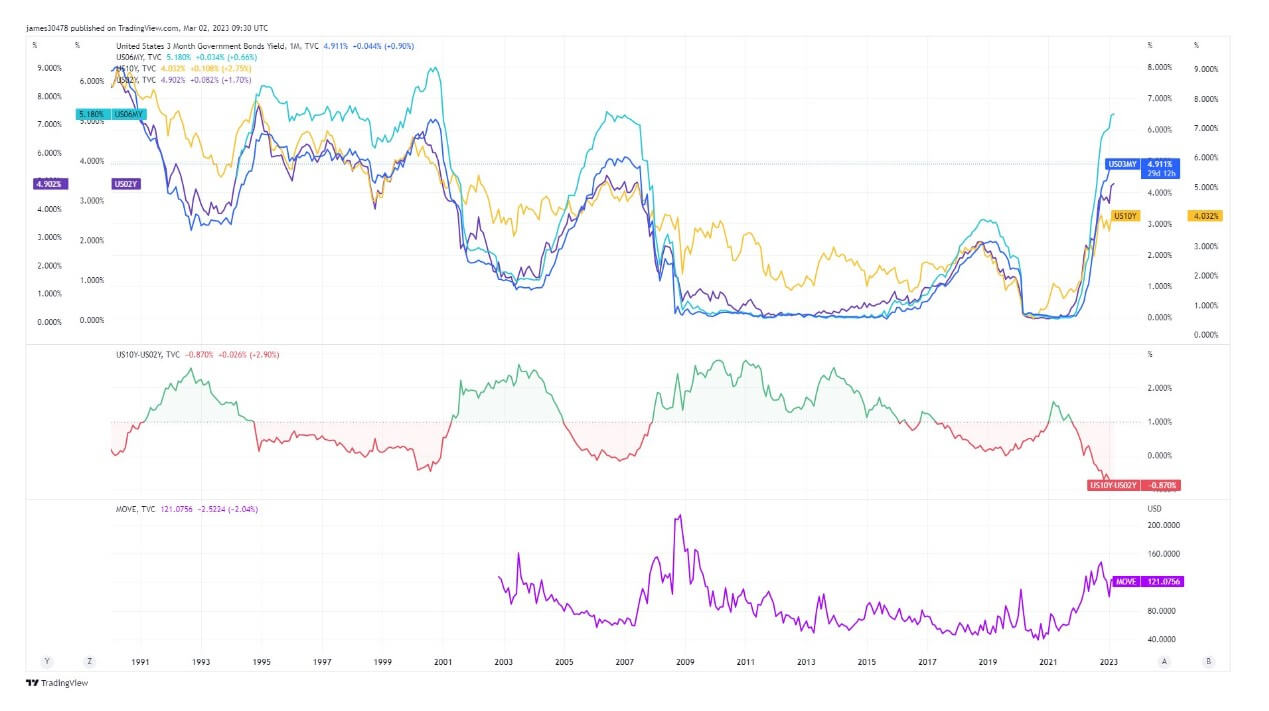

The MOVE index tracks the movement in U.S. Treasury yield volatility.

Quick Take

- As yields continue to rise and approach 2022 highs, eyes will be on the Move Index to understand how the bond market functions.

- The Move Index is currently at 121, while the 2022 high was roughly 158 in September 2022, during the same period as the Liability Driven Investment fiasco in the UK.

- The 10-year treasury constant maturity minus the 2-year treasury constant maturity (T10Y2Y) is currently inverted at -0.86%, further than the three previous recessions; 2020, 2008, and 2000.

- Many investors take that as a sign that a recession is heading, roughly 12-18 months after the first inversion.

- While according to BofA Global Research, the fed might raise policy rates to 6%.

The post Investors closely monitor the MOVE index amidst surge in US yields appeared first on CryptoSlate.