- December 17, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Following a Federal Reserve announcement on tapering acceleration, the bitcoin price and equities rallied in tandem.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

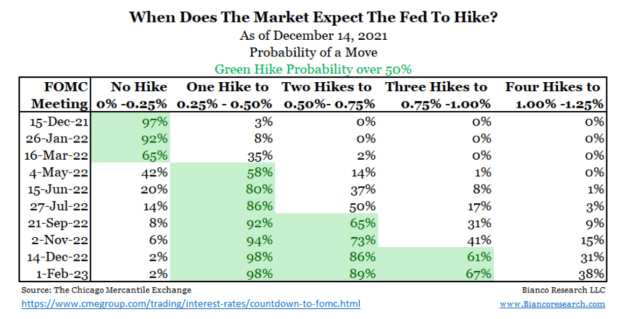

Yesterday, the Federal Reserve Board announced doubling the pace of its asset tapering to $30 billion a month, which was slightly more hawkish than consensus expectations. Rather than end all asset purchasing today, Jerome Powell highlighted that a calculated, methodical approach to winding down asset purchasing is a more stable approach for markets. The current plan is for asset purchases to end by March 2021 with the market expecting a high probability of three interest rate hikes in 2022, up to 100 basis points.

On cryptocurrencies, Powell commented that he doesn’t see them as a major financial stability concern, but that the leverage in the system is worth watching. He noted they are risky and speculative while highlighting the potential benefits of stablecoins if they were to be regulated.

All that said, Powell had a tremendous amount of dovish commentary in his Q&A despite the more hawkish actions, indicating the Federal Reserve is ready to pivot their policy as necessary with more accommodative monetary policy. This was a favorable short-term signal to markets. We’ll see real monetary tightening policy start to play out in markets if rate hikes happen in March.

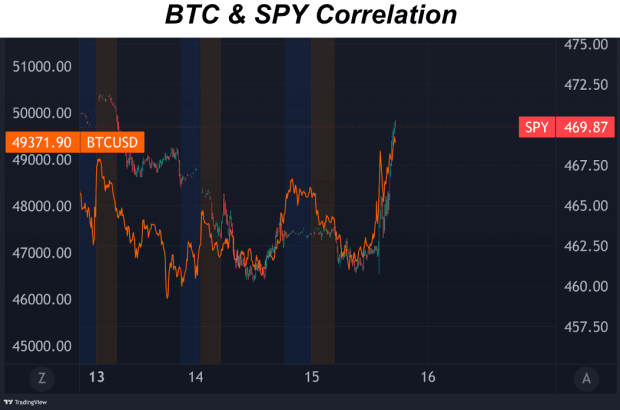

Following the announcements of the Fed’s expected taper policy, both bitcoin and equities rallied in tandem, indicating the meeting was a sell the rumor and buy the news type of event.