- June 4, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The decentralized finance (DeFi) market continues to grow and attract investors’ attention. We suggest you learn what this is, and how you can use it to make money in 2021.

What is DeFi and why is it necessary?

The whole idea behind the decentralized financial market is clear from its name – it is based on rejecting centralized control over monetary transactions in favor of automated blockchain systems.

The decentralized approach to finance was once promoted by Satoshi Nakamoto, the creator of the first cryptocurrency – Bitcoin (BTC). The movement was soon picked up by members of the crypto community.

Today, DeFi is a free financial market in which decentralized platforms serve as banks, and people no longer have to worry about their account being blocked by someone.

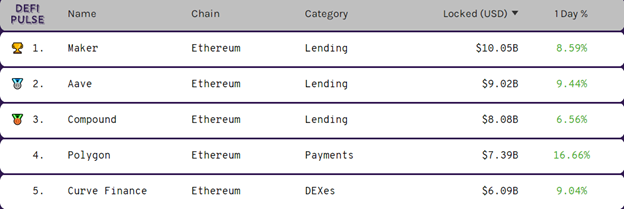

Top-5 DeFi projects in terms of total funds locked for their needs. Source: DeFi Pulse

DeFi destroys the monopoly that has been enjoyed by traditional financial organizations to provide a number of financial services that offer distinct advantages. For example, decentralized projects offer credit terms that are significantly more favorable than those offered by banks.

Popular Ways to Make Money on Defi in 2021

There are several ways to make money in the decentralized finance market. We suggest considering the two most popular ones.

№1 –Lock Digital Assets Using DeFi Protocols

This method is based on providing funds for the needs of DeFi projects. For example, developers create an instant loan protocol. To start making loans, they need initial capital. To do this, they use the following scheme:

- Attract funds for the needs of their project from market participants

- With these funds, they begin to issue loans and earn on interest

- Give market participants who provided the initial funds part of the income generated from loan interest.

Thus, you can earn on DeFi by locking your assets for the needs of projects.

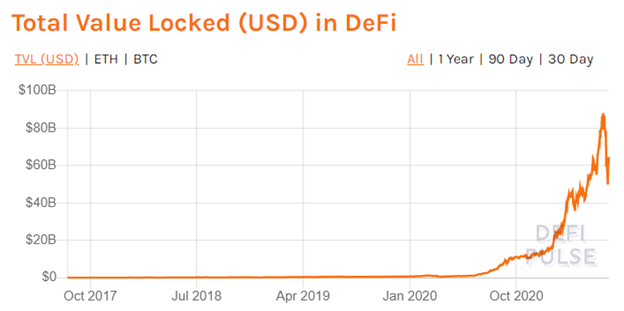

A graph reflecting funds locked for the needs of DeFi protocols. Source: DeFi Pulse

Interesting! There is a growing number of investors looking to profit quickly from DeFi-protocols through ‘yield farming’. These people begin to actively invest in a project, thanks to which the value of its tokens rapidly rise. When these ‘farmers’ decide to lock in their profits, they quickly sell their coins en masse, which drives the value of the cryptocurrency down. Consequently, many ordinary investors suffer losses.

Advantages

- You can receive a stable income

- Wide selection or projects

Disadvantages

- There is a risk of encountering an unscrupulous project.

- Many popular DeFi protocols have high entry thresholds. Some programs require several thousand dollars to start.

- You may fall victim to yield farmers.

№2 – Invest in DeFi Project Tokens

This method is also suitable for those who want to make quick money from fluctuations in the value of DeFi-protocol coins. Tokens in decentralized projects can be purchased as:

- Long-term investments

- Short-term investments

In the bull market conditions of 2021, it’s worth noting that the value of many large DeFi projects’s tokens tend to follow the rates of classic cryptocurrencies – the leaders in capitalization ratings.

Charts comparing the movement of popular decentralized project tokens with Bitcoin confirm this:

Graph comparing, Chainlink, and Uni. Source: TradingView

The correlation of DeFi with the traditional cryptocurrency market can be used to make money. Consider this and other schemes:

№1. Profiting from the News

You don’t need to be a crypto expert to make money in this way. It’s enough to understand how this or that news might affect the digital asset market. For example, it wasn’t difficult to guess that the value of Bitcoin would go up after Tesla announced it would be accepting it as payment for its cars.

A trader who’s heard such news can make money on the rise of this cryptocurrency by purchasing DeFi-tokens that shadow BTC’s behavior.

And don’t neglect the news from the decentralized finance market. The release of project updates, publications about remedied technical problems, and other infopods can also be used to make money.

№2. Profiting from Technical Analysis

The movement of any asset is cyclical. Correction phases always follow growth. Accordingly, sooner or later, there are times when assets can be profitably bought or sold, and traders have combined ways of finding these windows through technical analysis.

As an example, we’ll consider a chart tracking an asset’s price from the point of view of an analyst.

To do this, we’ll use the basic knowledge provided by technical analysis:

- The asset price moves within the channel formed by the green lines. When the asset price reaches the upper line, known as the resistance line, it is likely to fall. The chart shows that this has already happened. If the price declines to the lower line, known as the support line, it will probably rebound and begin to rise.

- An asset price can also show certain patterns of behavior within a channel, such as moving within a narrowing triangle. When the price breaks through one of the lines forming these triangles, it often signals the beginning of an active phase. Knowing this, you can find a profitable moment to enter the market. For example, you might buy an asset when it touches the lower edge of the triangle or breaks through its upper edge.

Example of Technical Analysis

Traders can be guided by these indicators, as well as other technical analysis tools.

Advantages:

- You don’t need a lot of capital to start making money.

- DeFi project tokens often grow more actively than those of classic cryptocurrencies, so you can make many times more money than you would by buying ordinary crypto coins.

- Choosing tokens on trusted exchanges reduce the risk of encountering fraudulent projects, as their representatives carefully check cryptocurrencies before listing them on trading platforms.

Disadvantages:

- May require knowledge of technical analysis.

Where to Buy DiFi Tokens

In 2021, investors have many ways to buy tokens issued by decentralized projects. For example, you can buy coins on exchanges. Unfortunately, when choosing a trading platform, investors risk encountering a number of problems, including the following:

- Many exchanges require you to verify your account, and verifying your identity may take several days. At the same time, the investor will have to accept the fact that their personal information will be shared with a third party.

- High commissions. Unfortunately, with the growing popularity of digital assets, many platforms are increasing the cost of their services.

- The need to repeatedly convert assets. It’s not possible to directly purchase DeFi-tokens for rubles or other fiat currencies on all exchanges. In most cases, investors have to purchase other popular cryptocurrencies in order to later convert them into the DeFi coins they’re interested in. Consequently, the user may have to pay out a lot of money just for commissions and conducting operations.

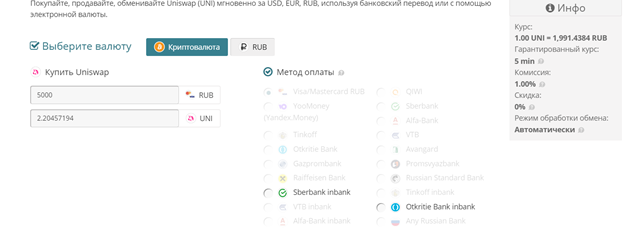

The Alfacash platform offers an alternative to buying DeFi tokens on exchanges. The coins of many popular decentralized projects are available on the site, and you can buy them anonymously, without additional conversions.

With Alfacash, buyers can conveniently pay for cryptocurrencies in rubles or other fiat currencies, as well as with digital assets. The fully Russified system displays information about the available options in a separate window:

Alfacash Interface

Alfacash’s other advantages include low fees, high transaction execution speeds, a simple interface, and a responsive support service.

Summing Up

Investing in DeFi tokens can be profitable. At the same time, there are several ways for investors to do this, which can be combined or used individually.

In 2021, purchasing DeFi-tokens is extremely simple and convenient thanks to platforms such as Alfacash.

Image by Paweł Szymczuk from Pixabay