- May 27, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

For the second time in 24 hours, Bitcoin might have been rejected on the $40,000 mark. The cryptocurrency has been moving sideways in lower timeframes, but finally has started to display some green after a week in the red.

At the time of writing, BTC trades at $39,100 with a 5.9% profit in the weekly chart. In the 30-day chart, the cryptocurrency still has a 27% loss.

BTC saw one of its worst crashes since March’s 2020 “Black Thursday”. The price collapsed beyond all critical support, the bulls were in shambles and since then have been trying to reclaim previous support territory flipped into resistance.

Tesla’s CEO, Elon Musk, was one of the crash catalyzers. On two different occasions, the entrepreneur went against Bitcoin for its alleged negative environmental footprint. The price action took a fast turn to the downside, as Musk was attacked by the crypto community.

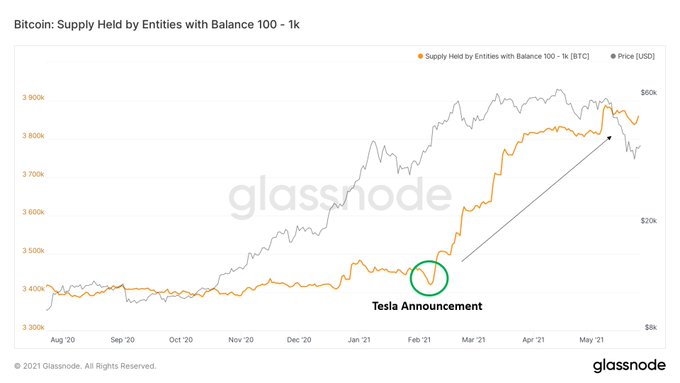

Ironically, data from Glassnode indicates that when Tesla announced its Bitcoin purchase, the crypto market initiated a trend. As depicted below, from February 2021 until the recent crash, the supply held by entities with balances of 100 or 1,000 BTC increased exponentially.

In other words, Bitcoin whales have been accumulating and have been doing so at a faster pace from the day Elon Musk’s company enter the crypto market. Analyst William Clemente said:

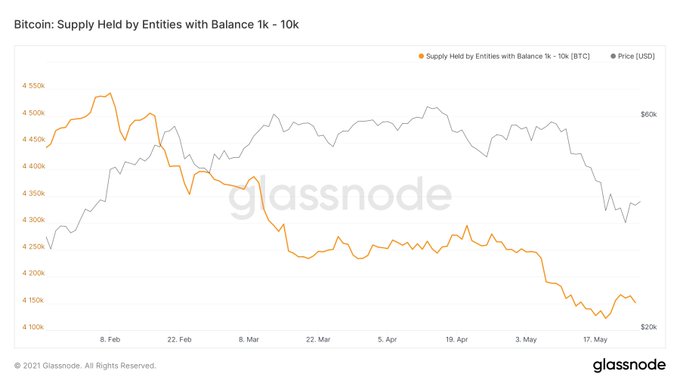

Interestingly enough, the day Tesla announced their holdings also marked the top of supply held by entities with 1K-10K BTC.

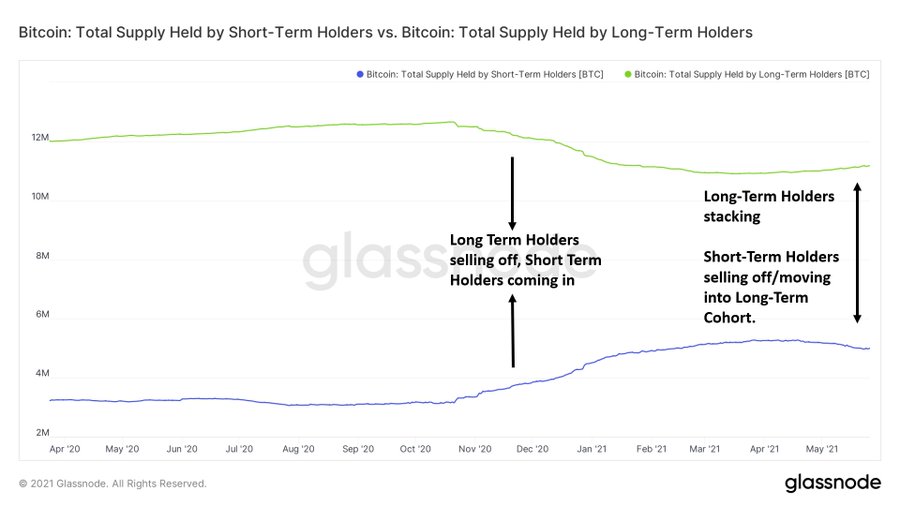

As a bullish indicator, the whales buying Bitcoin’s dip could have “stronger hands”. Further data provided by Clemente suggest that BTC’s supply exchange hands from long-term to short-term investors during November and December 2020. The recent crash saw an opposite phenomenon.

A Bitcoin Crash For The History Books

A Glassnode report written by analyst Checkmate estimates that on May 19th, around $4.53 billion in daily Realized Losses were hit with a total of $14.2 billion on week 21. This number is higher than the one recorded in March 2020, January, and November 2018, when BTC’s price saw significant corrections.

In comparison, on these occasions, the daily Realized Losses stood at $0.96 billion, $0.94 billion, and $1.43 billion in “Black Thursday”.

The data also suggest that there was a long period of net profit-taking, as Checkmate said. The chart below shows this period with the green spikes.

The subsequent level of capitulation, red spike, indicates that the market was taken by surprise when Bitcoin’s price crashed. Checkmate said:

(…) around 9.0% to 9.5% of the current market cap ($700B) exists as unrealised losses, equal to around $65B in underwater value. Despite this being a historical capitulation event, relative to the market size, the value of underwater positions on-chain is actually relatively small.