- October 6, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Potential Federal Reserve tapering, blackouts in China and global energy crises are sending markets into turmoil. How does bitcoin fit in?

In this episode of Bitcoin Magazine’s “Fed Watch” podcast, hosts Christian Keroles and myself, Ansel Lindner, gave an update on the Federal Reserve, the energy crisis in Europe and Asia, and Chinese blackouts. It is a very pivotal time for markets and things are moving fast. This episode was recorded on September 28 and things are moving so quickly that by the time of publishing, we might have a completely different scenario brewing. For that reason, we are going to be returning to our shorter turnaround schedule of 24 hours.

Federal Reserve News

Our first Fed news item is the resignation of Rosengren, president of the Boston Fed, and Kaplan, president of the Dallas Fed, over allegations of insider trading. This could cause a minor shake up at the Fed, being that both these voting members were on the hawkish side of monetary policy, meaning that they preferred less accommodative measures and faster tapering.

That leads us into talk about the Fed taper. Powell said in the September Federal Open Market Committee (FOMC) meeting that taper will begin “soon.” Pundits are claiming that means they will announce it at the next meeting in November, and we agree unless major circumstances change (which is very possible).

Energy Crisis In Europe And Asia

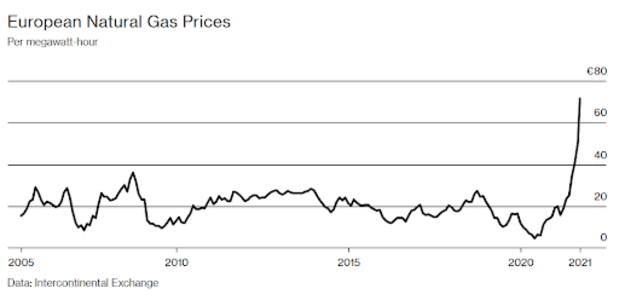

This was a wide-ranging discussion on the current status of the energy crises in Europe and Asia at the time on September 28, and we speculated as to the reasons. Different places on the planet will be affected differently by this crisis, that much is certain, but the fallout could be dramatic. The U.K. has less of a shortage and more of a distribution problem, but continental Europe is facing a true shortage, albeit one of its own making. Years of aggressive environmental policy has left it exposed to shortages like this.

Asia and Europe might seem like disconnected crises here, but they are very much connected. We traced a significant causal factor back to the Chinese trade war with Australia. Starting in January, China stopped buying coal from Australia, a change that has been rippling through the energy markets. The U.S. has taken up some of the slack from China, while Australia has found other markets in India and elsewhere for its coal. China faced a shortfall, so likely bought more natural gas from Russia and Iran, which themselves were facing low inventories brought on through 2020.

Things roll down hill. This diversion of supply met with the slowdown in supply chains to create a bidding war.