- December 3, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Central bank interventions in the monetary system – from lowering interest rates to printing money – do not change peoples’ saving and spending behavior: They only redirect it.

We live in a highly politicized world today – we spite our neighbors, refuse to watch certain news channels, and increasingly ignore any information which counters our own preconceived views. Our wealth gap in the developed world is rising, and calamities like the pandemic are highlighting and exacerbating those divides.

What brought our society to this point? With technological advancements and scientific progress seemingly unstoppable, why are we not living in a world where we are content, stress levels are low, food is healthy, agriculture is sustainable, and housing is affordable?

Every day, we lean on our elected officials and brilliant minds to help us navigate these waters as a society and lead us to an ideal world which seems so close, yet so far. Unfortunately, our leaders are armed with an incorrect map to reach that world. The theories they rely on to make decisions that affect our jobs, businesses, and livelihoods suffer several fatal flaws – one of which we will explore here.

Central Banks And Consumer Behavior

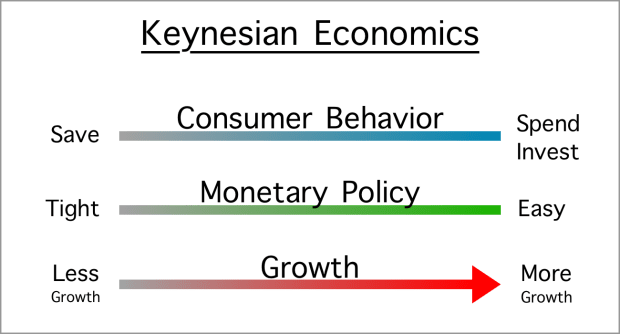

Traditional Keynesian economic theory, popular among all the leading economists in academia and government today, espouses a certain relationship between consumer behavior and central bank policy.

Keynesian theory dictates that easy money policies drive people and businesses to spend and invest, which drives growth and takes up the slack in a waning economy. Tight policies drive saving, as higher yields attract consumers and businesses to purchase financial assets earning those yields.

Almost all major central banks and governments for the past 50 years have favored easy monetary policy, believing it spurs growth across the economy and raises living standards. Easy monetary policy means lower interest rates as well as more aggressive tactics to “provide liquidity” in currency, like quantitative easing and cooperating with governments to increase their spending using newly-created cash.

This relationship between monetary policy, growth, and consumer behavior is an accepted fact today within any respected economics institution. We continue to teach these relationships to our best and brightest at top universities from the 101 level up, and it forms the basis of policy actions by modern central banks.

This is the map our policymakers are holding today.

The Meaning Of Saving And Investment

We need to pause for a moment – in Keynesian economic theory, investment is placed opposite from saving. Easy monetary policy supposedly drives investment and thereby economic growth, while tight monetary policy drives saving.

However, I bet when you think of investing today you think about saving. That extra income you make each month gets saved by way of an investment, like a stock, 401k, or some other financial instrument. Why then does Keynesian theory place these two on opposite ends of a spectrum?

Clearly we need a more nuanced understanding of the relationship between consumer behavior and monetary policy than Keynesian theory gives us.

Introducing Time Preference

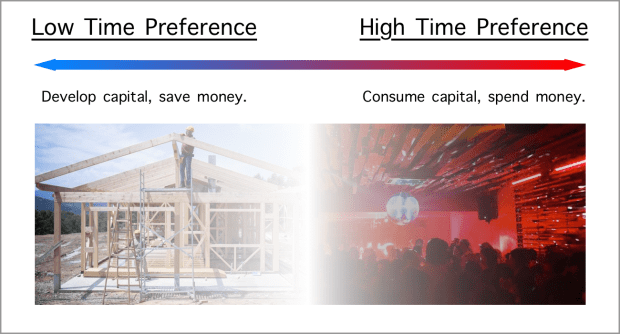

The foundational economic concept of time preference gives us a tool for understanding consumer behavior independent of monetary policy. Time preference simply describes an individual’s propensity to delay gratification in order to satisfy future needs more fully. Lower time preference means more willingness to delay gratification and treat your future self well, while high time preference indicates a desire for instant gratification over future needs.

Intending to store your purchasing power over time, also known as saving money, is on the lower end of the time preference spectrum. Spending money for consumable pleasures is on the higher end. This is not to say either end is better or worse – both have their time and place – but just to set up how this spectrum can chart our behaviors.

Through the lens of time preference, investment is a low time preference activity which the investor undertakes to carry and grow their money over time. Saving cash is similarly a low-time-preference activity, delaying gratification so that cash can be used to satisfy future needs. Saving cash and making investments are both low time preference activities.

How does this understanding mesh with Keynesian theory, which tries to tie investment and saving to opposite ends of the behavioral and monetary policy spectrum?

Time Preference And Monetary Policy

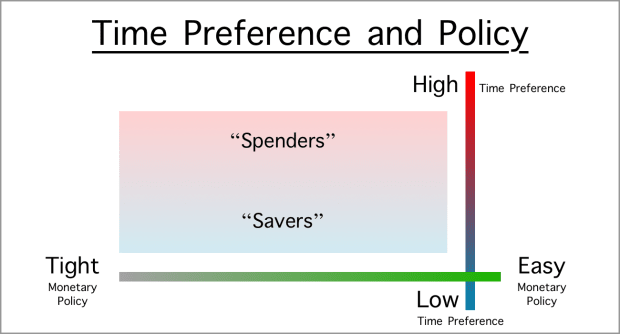

We need to look at time preference as a separate axis from monetary policy. Individuals with a low time preference can still desire to store their purchasing power over time regardless of central bank monetary policy.

Mainstream Keynesian economic theory misses the fact that central bank monetary policies likely have little effect on peoples’ actual time preferences, but they do have a massive effect on the assets people use to express those preferences.

Research on the empirical reality of the relationship between saving behavior and the main tool of monetary policy until recently – interest rate manipulation – backs this up. The Federal Reserve in this 1996 paper admits that mountains of research on the impact of monetary policy on savings is inconclusive.

“First, economists’ understanding of the response of saving to changes in interest rates is quite limited, despite a large volume of research on the topic. Different models of consumer behavior imply different magnitudes for the interest elasticity of saving, and even different signs. Each model probably describes the behavior of some people, and it is not clear which model best characterizes the behavior of the “average saver.” Thus, it is simply not possible to provide a precise estimate of the interest elasticity of saving with any confidence.”

Individuals echo this lack of relationship as well – stating that low interest rates are not spurring spending in their circumstances. Only one’s confidence in their own income and the strength of the economy can do that.

This leads us to a new understanding of the relationship between consumer behavior and monetary policy. Both are independent, but changes in monetary policy can change the assets in which savers put their savings.

Central banks are only capable of manipulating the supply of cash – a very powerful commodity given its use in trade and economic calculation. They do not create food, homes, or other productive capital which we use to produce the goods and services we desire. However, their impact on cash gives central banks a massive influence on all prices, for goods and assets alike.

When central banks ease by making cash and credit more available, they lower the returns from holding cash and other low-risk savings options, making them less attractive as a vehicle for saving. The availability of more cash absent real economic growth leads to upward pressure on prices. Again, the central bank does not provide real economic growth – it only pushes cash into the economy.

Individuals with a low time preference who desire to store their savings and transport them to the future must now beat rising prices. Said more simply, their return on investment must beat inflation. This drives investment into progressively riskier projects and strategies with higher potential returns.

The more cash is printed, the higher prices go, and the more risk must be taken on just to stay afloat over time.

For very risk-averse investors, another effect takes hold. These investors simply desire to lose less than inflation. If cash loses value against goods and services at 6% per year, investors are happy to buy anything with an expected return of more than negative 6%. Investing in a business that loses 5% per annum is worthwhile in this environment! This environment makes for a terrible time for savers.

Easing or tightening monetary policy does not change time preferences directly, it only alters the asset classes and strategies individuals can use to most effectively express their preferences.

The Real Impact Of Easy Money On Economic Growth

Central banks, using their Keynesian map of the world, believe easy monetary policy drives economic growth by spurring spending and investment. However, given our understanding of time preference and the different vehicles for storing value over time, we see a different map coming into view.

Civilization-building investments: solid education, clean water, sustainable agriculture, high quality infrastructure, durable tools and the like tend to have “low and slow” returns. They cost a lot to build and take a long time to pay off.

Easy money and resulting inflation make civilization-building investment opportunities negative yielding in real terms, because returns on these investments fail to meet the pace of inflation. Even the lowest time preference investor will need to look for higher yielding investments just to break even with their purchasing power over time.

While some risk-averse investors may still choose these civilization-building investments, many investors will increase their risk level in the hope of keeping up with inflation.

This leads investors – including you and me – to end up knowingly or unknowingly driving devastating real economic effects when we attempt to save our money over time through investments.

Let’s make the effects of easy money on economic growth more tangible with three current examples:

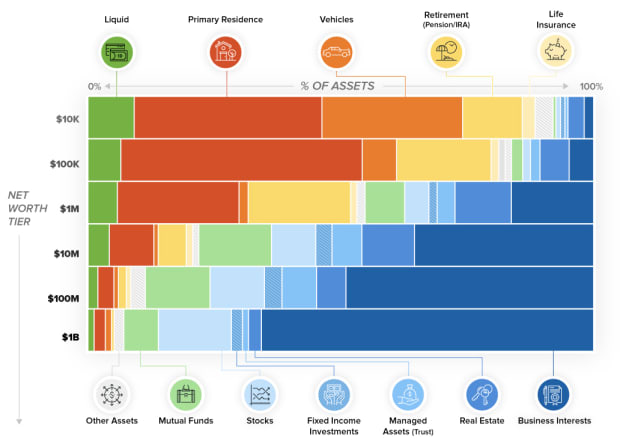

The Wealth Gap

As monetary easing increases the supply of cash, pushing investors to buy riskier assets, the existing wealthy class benefit disproportionately due to their larger exposure to assets and business interests. The majority of people have a low level of assets and mostly live off of cash via fixed wage contracts, i.e. salaries, which are slow to adjust to inflation and often track indices that vastly underestimate inflation. Central banks practicing easy monetary policy directly debase cash. The result is a widening wealth gap.

Piggy Bank Housing

Monetary easing pushes more types of assets to take on the role of transporting value over time for low-time-preference people. Homes are one of these assets, leading cities like Vancouver to become hotbeds for investors who want to protect their savings – both from debasement and government overreach. In 2016, British Columbia even added a tax on foreigners buying homes without using them as their primary residence.

Due to this monetary environment, homes are bought as assets to preserve value over time, sometimes not even as places to live or rent out. Homeowners who value their home as a key asset in their portfolio also have a strong incentive to keep housing prices rising, countering the goal of affordable housing. Housing prices thus continue to float to unaffordable levels.

Stock Buybacks

For a corporation, easy monetary policy means cheaper credit is available for expansion of operations. However, a corporation is like an individual in that the company simply wants to grow, or at least preserve, its value over time. When a company finds itself with more credit on hand, it chooses from many different capital allocation options, just like you and I do.

What central banks believe monetary easing does is primarily drive productive capital investment: meaning companies buy new machinery or hire employees such that their business grows and increases in value, at the same time providing more value to society. Think of the equivalent for you and I as purchasing an education, like an online course to teach ourselves a new skill and make our labor more valuable. These are civilization-building investments.

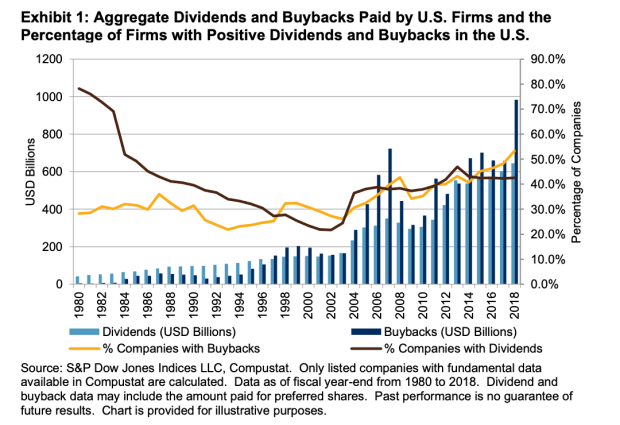

An “easy money” environment makes those low-and-slow business investments less profitable, or even negative-yielding. Businesses, like us – want to outpace inflation in order to grow their business value. The recently hot method of choice? Stock buybacks, which pump the value of the company on the market. This buyback activity displaces productive capital investment, and is often further fueled by credit. Companies are taking out loans to gamble on their own stock prices.

Importantly, this is not the fault of stupidity or greed – it is a natural reaction by corporations to today’s monetary environment. Without forced monetary easing from central banks, corporations would have no need to chase persistent inflation with riskier investments, and could instead focus on long-term, productive capital investment.

In all of these examples, numbers are going up – which makes economists in their towering office buildings pat themselves on the back. We have growth! The reality for the vast majority of people, however, looks darker.

Unfortunately, when our policymakers notice these problems, they often misdiagnose the disease and respond to it with regulations, taxation, and other controls. Instead of solving the underlying problem of a manipulated monetary system, they treat the symptoms of it with more controls and burdens for the public. Like giving Tylenol to a brain tumor patient, we feel a false sense of progress while allowing the underlying problem to quietly grow in severity.

Opting Out Of An Easy Money System

Knowing that our leaders are looking at an incorrect map of the relationships between our behavior, monetary policy, and economic growth – how can we chart a new course to avoid sailing into the rocks?

Central banks, governments, and powerful economic entities built a strong edifice around their easy money system. Every asset today is influenced by monetary policy, and most assets are held by custodians where they can be easily frozen or snatched in calamitous times. Policymakers are even pushing to have our bank balances held directly by central banks in the name of convenience and monetary stability.

Opting out of this system, however, can be accomplished in small, completely peaceful steps. Investors are already leaving easy money by buying assets: homes, stocks, bonds and more. However, these assets all suffer from supply shocks, risk of seizure, and powerful entities rewriting the rules when they lose.

What we need is an asset that’s impossible to inflate in supply which an individual can self-custody, transfer instantly, and hide from oppressive governments. This asset should be easy to transport physically and over time, without losing value. What asset wins on all these marks today? Bitcoin.

Enough of us opting out of easy money into hard money – like bitcoin – will force our leaders out of their monetary easing stupor and press them to reckon with reality. The “easy money show” can only go on as long as we all act in it.

This is a guest post by Captain Sidd. Opinions expressed are entirely their own and do not necessarily reflect those of BTC, Inc. or Bitcoin Magazine.