- May 16, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

The crypto sector has witnessed growth since the decentralized finance (DeFi) summer of mid-2020. And diving deeper into the DeFi ecosystem reveals the current state of stablecoin utilization and the circulating supply of the decentralized stablecoin ‘DAI.’

Growing stablecoin usage

The growth of the DeFi ecosystem, which is built mainly on the innovative use of smart contracts, can be tracked through key metrics such as active users (2 million unique addresses surpassed) and daily volume on decentralized exchanges (regularly exceeding $2 billion).

The flexibility of these smart contracts enables basic functions like payment and credit, as well as more complex functions like derivatives and trading with crypto assets on decentralized exchanges (DEX).

Stablecoins, an integral part of the DeFi, are cryptocurrencies that peg their market value to an external reference, such as fiat or a commodity’s price. They are achieving price stability either through collateralization (backing) or through algorithmic mechanisms of buying and selling the reference asset.

They have been central to the development of DeFi, with reserve-backed tokens like Tether and USD Coin currently dominating as the base currency in most DEX trading pairs and lending markets.

On account of their ample liquidity and strong utilization on lending platforms that regularly exceed 80% on the liquidity of over $10 billion, stablecoins are among the most adopted assets in DeFi.

DAI and DeFi

Alongside Tether and USD Coin, DAI grew notably with over 3.6 billion in circulating supply since its outset. DAI is backed by collateralized debt positions of ETH and other tokens while maintaining a soft peg to USD via market arbitrage without a central reserve.

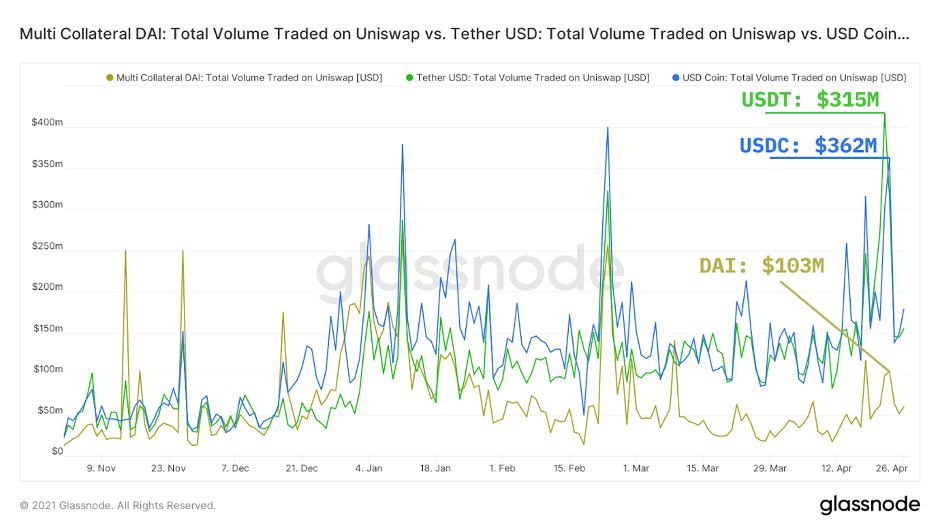

In decentralized exchanges, DAI claims roughly 19% of stablecoin liquidity on Ethereum-based DEX Uniswap, data in a recent report from on-chain analytics provider Glassnode shows.

On the demand side, in pairs that include DAI, its volume takes about 15% of the daily volume of Uniswap, while USD Coin and Tether each take about 43%.

On decentralized lending platforms, DAI is a strong competitor, accounting as the second-largest collateral holder on lending protocol Compound and a close third on Aave.

Stablecoins witnessed a surge last year in the adoption of decentralized services, causing an explosive growth of DeFi, once just a niche sector in crypto. Where does it go from here?

The post Here’s how stablecoins like DAI made an impact in the DeFi space appeared first on CryptoSlate.