- March 12, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

February has been a busy month at the crypto front. Many vital changes took place, which was easily missed by the community as the Russian invasion of Ukraine kept the headlines occupied.

The war affected the customer sentiment index and caused minor but significant changes in the market, which lowered the Ethereum gas fees and caused Anchor and LUNA to record substantial growth.

The numbers also demonstrate a surprisingly sharp drop in the NFT and metaverse real estate sales. At the same time, specific actions from corporations signal Bitcoin’s potential to create greener energy may finally be utilized.

1- Macro Analysis

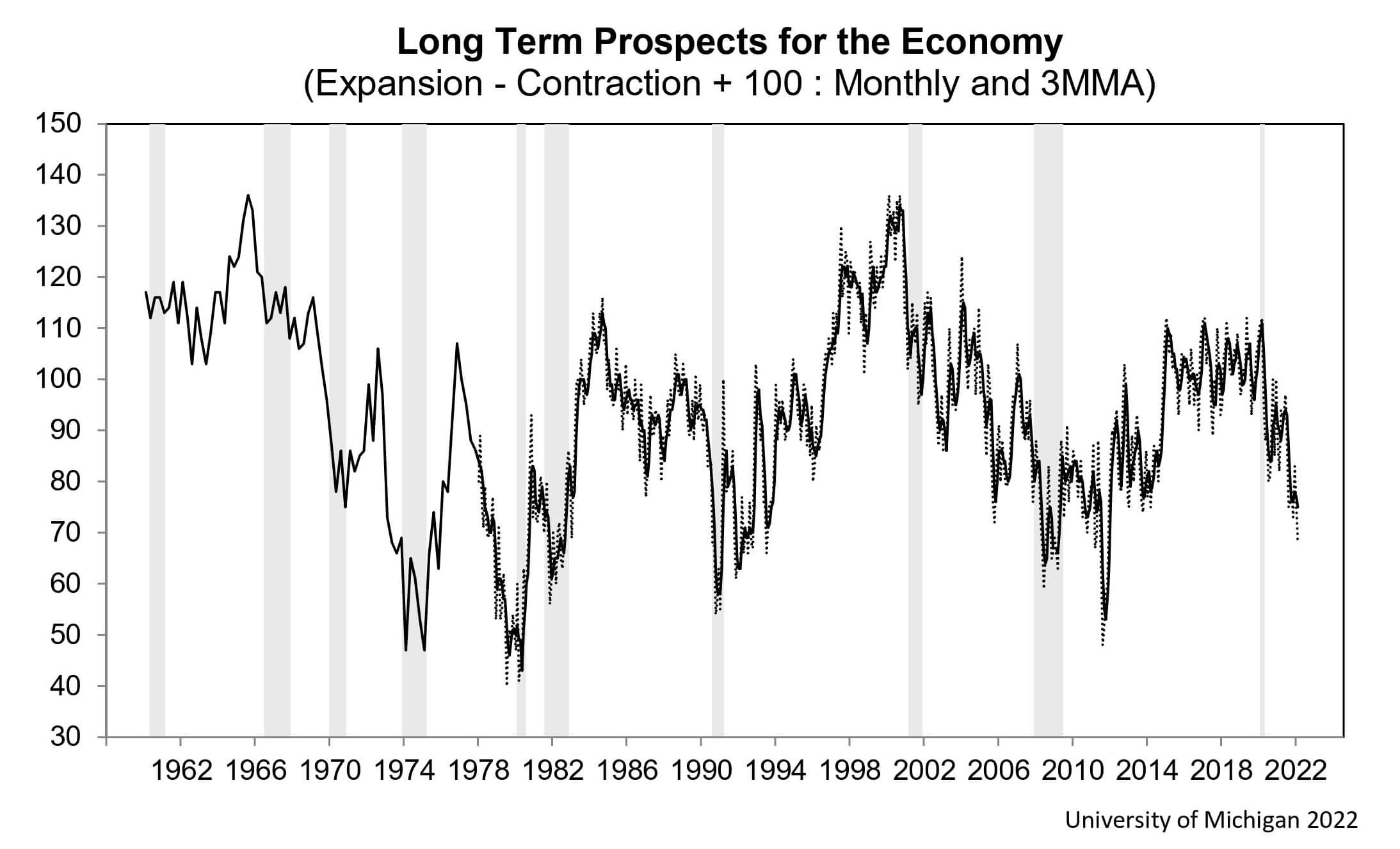

February was the month of war — Russia’s invasion of Ukraine hit the financial markets, which were already showing high inflation alarms. The result was high distress and low customer sentiment.

According to the Customer Sentiment Index (CSI) published annually by the University of Michigan, February’s CSI was 61.7, the lowest since the 2011 global financial crisis. Genesis warns that CSI may continue to drop in the following months if the war escalates.

2 – Bitcoin

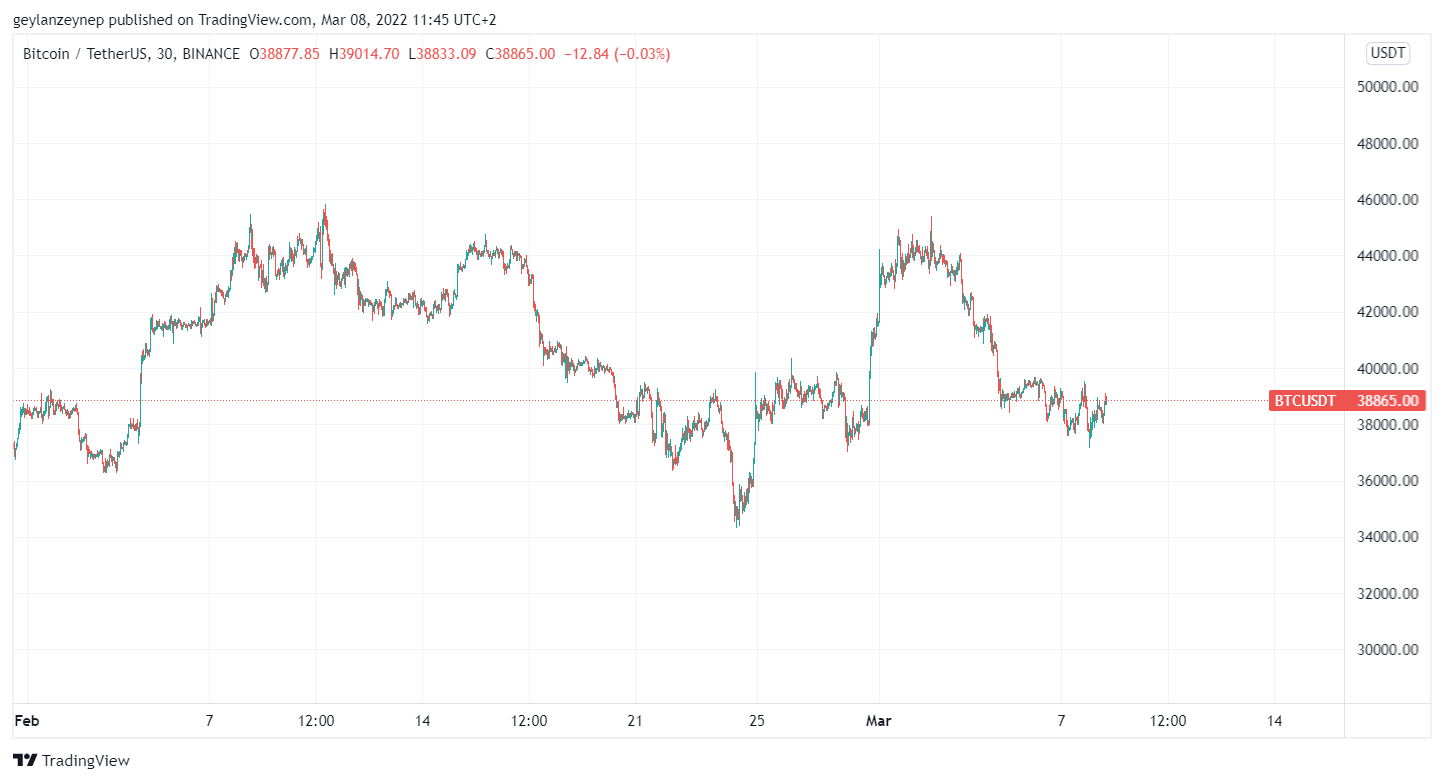

Bitcoin showed the same reaction to the war as the traditional markets throughout the month. However, the end of February witnessed a sudden spike in BTC prices.

During the last hours of February, Bitcoin prices increased by almost 16% to $44,125. Genesis states that time will tell if this spike decoupled Bitcoin from the traditional market. The report also noted that 80% of BTC was held in long-term addresses at the end of the month, which supports the possibility of BTC’s decoupling from the “risk asset” narrative.

Firms are entering Bitcoin mining

As a result of traditional energy firms’ involvement in Bitcoin mining, the network hash rate reached an all-time high during February. In addition, the Genesis report claims that Bitcoin mining could contribute to greener energy by reducing flare contamination, which seems to be the goal of the traditional energy firms that started investing in Bitcoin mining.

3- Ethereum

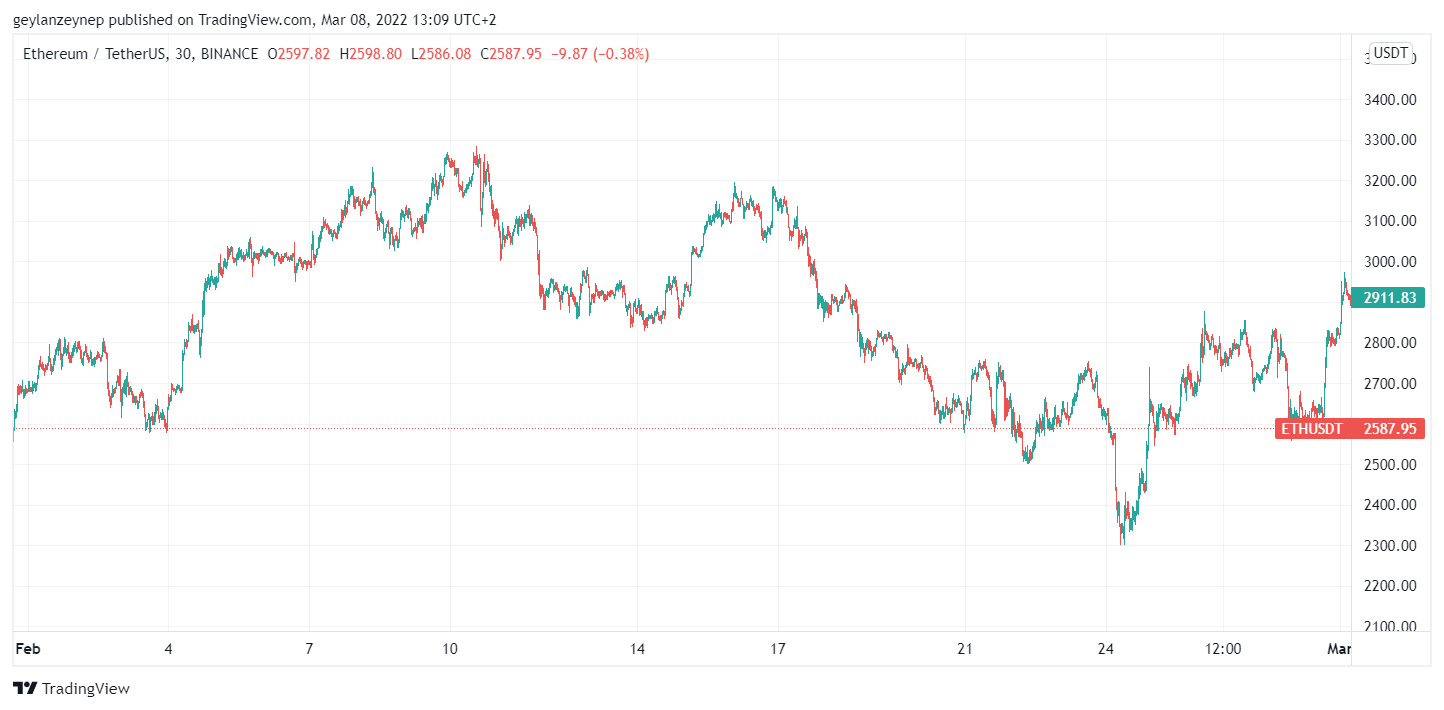

Ethereum prices also accompanied BTC’s upwards trend at the end of the month by increasing more than 8%.

One of the significant highlights of Ethereum was the reduction in its transaction fees, which was hindering the development of Layer-2 scaling solutions. Since January, transaction fees have dropped and hit $17 in February, which is an all-time low since September 2021.

Genesis states that Tether, Opensea, and Uniswap, which account for most of the gas fees on Ethereum, showed significant drops in volume during February, which affected the gas fees.

Despite lowering gas fees, February was a slow month for the growth of layer-2 solutions on Ethereum. The numbers show that TVL diminished by 0.68% throughout the month.

4- Layer 1s

Among tokens with a market cap larger than $5, LUNA showed the highest performance by increasing 75%, followed by Avalanche, which increased by 21.7%. On the other hand, Solana had a rough month due to a hack attempt.

LUNA

Genesis analyses LUNA’s exponential growth in relation to the increased demand towards USDT throughout February, fueled by Avalance-based DEX Pangolin’s decision to adopt USDT as their default stablecoin and signals of long-awaited MARS airdrop to users who locked over $208 million worth of USDTs.

USDT is minted by burning LUNA, which increases its price by reducing supply. As a result, increased USDT demand burned more LUNAs, leading to grow further.

Moreover, Terra also received $1 billion in support, made a $40 million sponsorship deal with the Washington Nationals, and announced their affiliation with FTX starting March 1, contributing to the price increase.

Avalance

While Avalanche has an overall price increase, its real growth took place in its transactions counts, which are approaching that of Ethereum. Genesis notes this increase could result from increasing subnets on Avalanche, WGM Airdrops and Avalanche’s first significant developer conference.

Solana

Solana was faced with a $320 million exploit in February due to an attack on a Wormhole. Wormholes behave as bridges connecting multiple blockchains where users can deposit their Ethereums to receive wrapped Ethereums (whETH), compatible with another blockchain.

The hacking attempt was made by an attacker who found a way to mint whETH without providing any deposits. The loss was compensated by Jump Crypto, who deposited 120 ETH into the Wormhole to provide for the missing collateral.

As a result of this attack, Solana prices saw a downwards trend throughout February.

5- DeFi

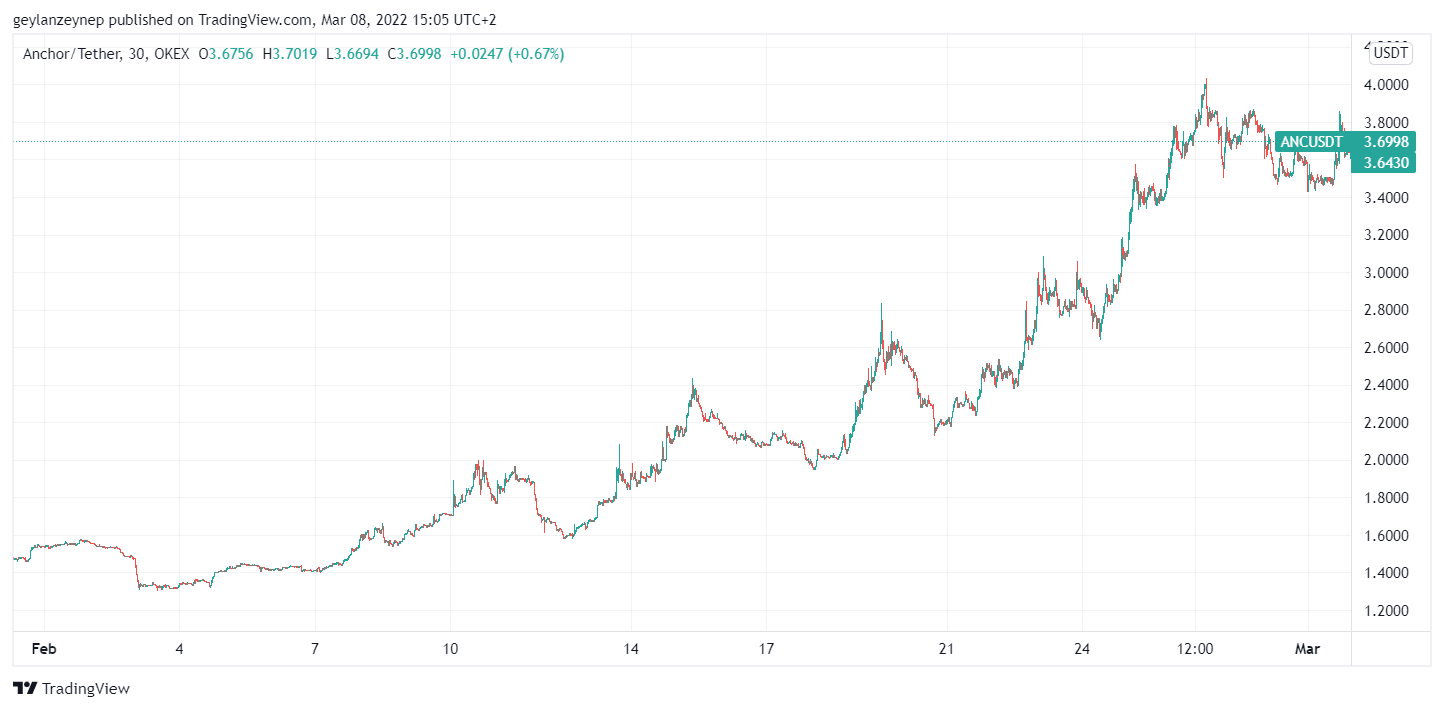

Even though TVL mainly remained the same at over $220 million at the end of February as the beginning, Anchor protocol overperformed, increasing its market cap by 127.2%.

Anchor’s TVL also showed a 45% increase from $7.13 billion to $10.32 billion.

According to Genesis, this increase is a sum of the tendency to turn towards yield in recent weak market conditions, the impressive growth of Terra and the Terra ecosystem’s decision to burn $450 million worth of LUNA from the Anchor reserves.

6- Metaverse/NFT

Despite extensive publication during the Super Bowl, metaverse real estate showed little growth while NFT sales declined during February.

Metaverse

According to metametric solutions, real estate sales on Decentraland, The Sandbox, Axie Infinity, Enjin Coin, and Illuvium reached $501 million in 2021 and is expected to increase up to $1 billion in 2022.

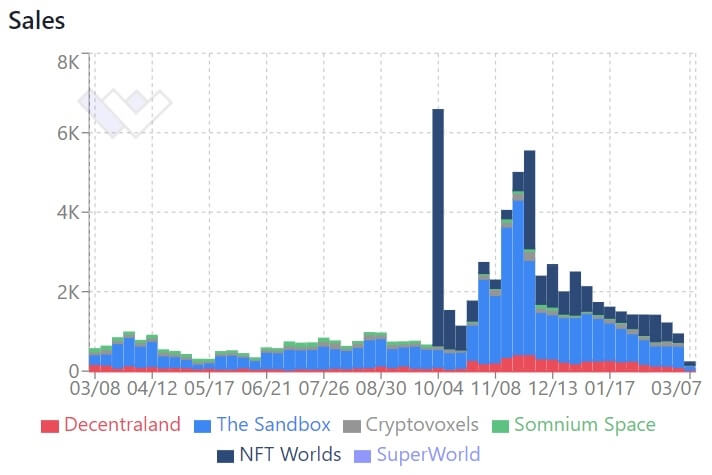

On the other hand, the above chart shows that after a very active November, metaverse real estate sales continue their downwards trend in February.

However, the metaverse publicity showed significant growth as J.P. Morgan opened its first metaverse branch, Gucci bought land in The Sandbox, and Everyrealm received a $60 million investment during February.

NFT

NFTs received good publicity throughout February as Super Bowl commercials were seen by over 100 million; Samsung announced that the new Galaxy S22 would come with a commemorative NFT, Reese Witherspoon, Zynga and Take-Two announced their NFT related projects, and Twitch’s creator tweeted about gaming NFTs.

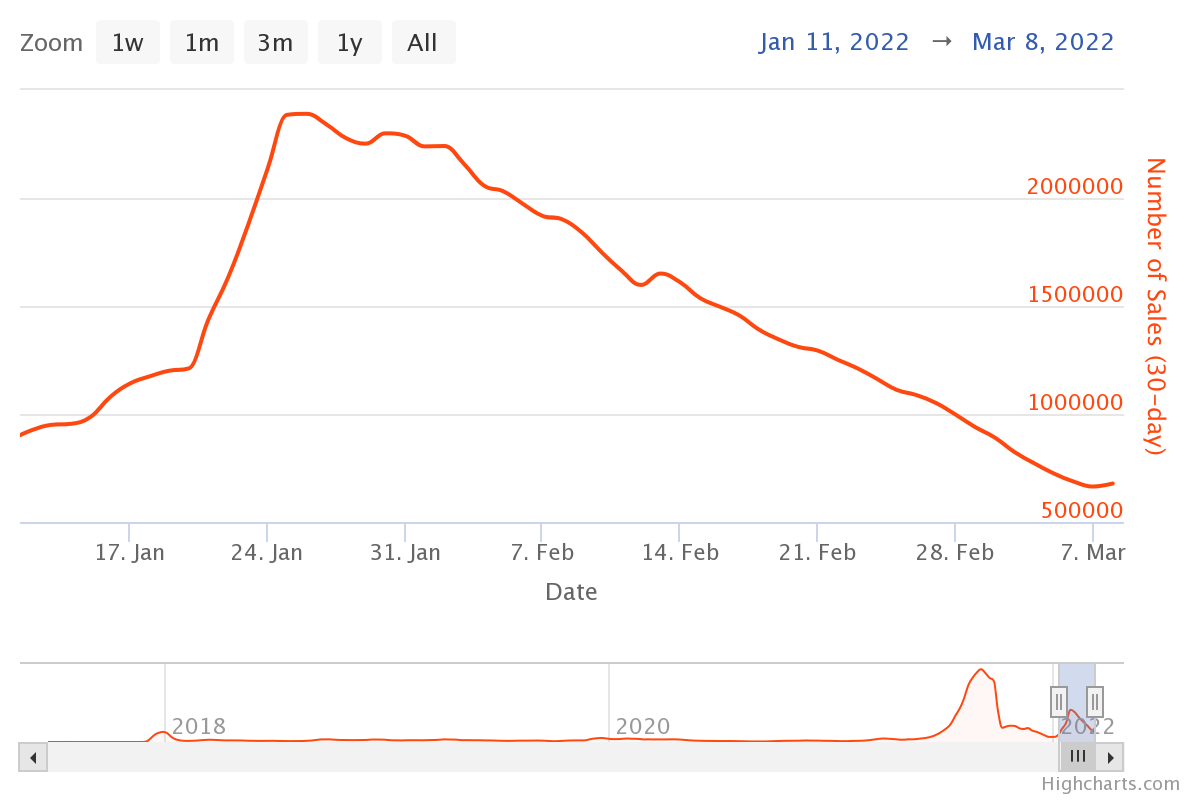

However, despite the publicity, numbers clearly show a sharp decline in NFT sales throughout February 2022.

A significant crisis hit the NFT space when 17 OpenSea users were subjected to a phishing attack, leading to the loss of nearly $3 million worth of NFTs.

In addition, CryptoPunks also lost its surge. The sale of 104 CryptoPunks was pulled at the last minute since supposedly they received only one bid, which was well below the expected price. This was after the creators of CryptoPunks publicly apologized for mishandling some V1 CryptoPunks due to an ill smart contract.

7- Regulations

Regulatory attention was focused on the stablecoins and the States started to get involved in the crypto space throughout February.

Propositions on stablecoins

The month started with two official hearings from the House and the Senate, where the propositions of the President’s Working Group to treat stablecoin issuers as banks were rejected.

Another proposition came from Congressman Josh Gotthiemer, which set protections to stablecoins, issued by a qualified non-bank entity that maintains 100% reserves.

Right after Congressman’s proposition, NY Federal Reserve published a paper pointing out that requiring 100% reserve for safe assets could lead to scarcity.

States’ involvement

In February, Wyoming became the first state to authorize crypto banks, officially recognize the custody of digital assets as a regulated activity and allow the registration of DAOs as LLCs.

In addition, Tennessee introduced a bill to allow the state and its municipalities to invest in crypto; Colorado announced that they would accept taxes in cryptocurrency, and California presented a statement indicating their interest in accepting cryptocurrency as payment for government services.

Conclusion

While Russia’s aggression occupied the newsrooms throughout February with depressing news, many positive advancements took place in DeFi, Bitcoin and Ethereum. Nevertheless, customer sentiment rankings took a significant hit from the war, while NFTs and metaverse real estate sales faced recessions of their own.

The post Global economic outlook tanks in February as Bitcoin decouples from traditional market appeared first on CryptoSlate.