- July 28, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Bitcoin’s scarcity, both perceived and realized, sells.

The below is a recent edition of the Deep Dive, Bitcoin Magazine‘s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

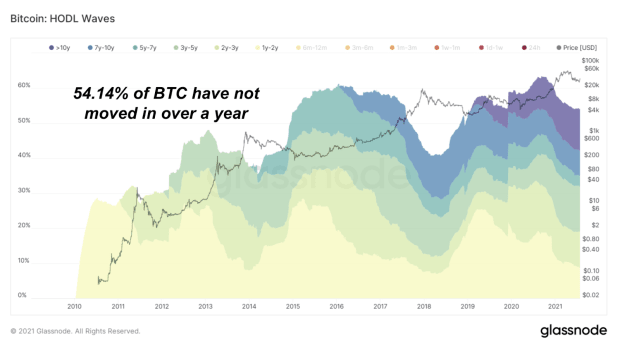

HODL Waves

“Do you know that when bitcoin went from $17,000 to $3,000 that 86% of the people that owned it at $17,000, never sold it?

“Well, this was huge in my mind. So here’s something with a finite supply and 86% of the owners are religious zealots. I mean, who the hell holds something through $17,000 to $3,000? And it turns out none of them — the 86% — sold it. Add that to this new central bank craziness phenomenon.” – Stan Druckenmiller on his discussion with Paul Tudor Jones

54% of the circulating supply of bitcoin has not moved in over a year. Over time, an ever increasing proportion of the bitcoin supply is acquired and hoarded, decreasing the available free float, and as exemplified by the quote above, this is an increasingly attractive feature of the asset.

Scarcity, both perceived and realized, sells.

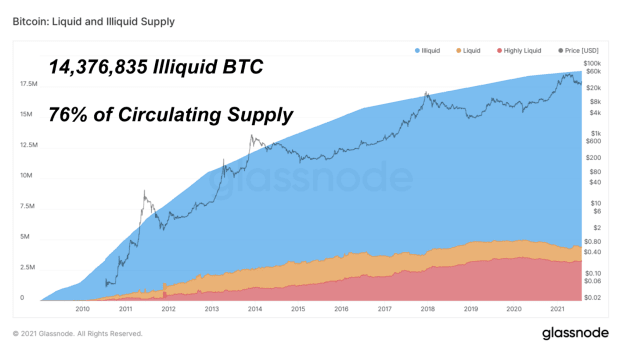

This dynamic on a micro and macro level is what brings about events similar to what occurred this weekend with the bitcoin short squeeze.

If you are short bitcoin, the longer you wait, the greater the likelihood that you will have to pay a greater price than you originally sold for. This is the dynamic of a sound monetary asset undergoing global adoption.

Currently, 76% of the bitcoin supply is classified as illiquid and, over time, this number has only grown.

Grayscale Premium/Discount

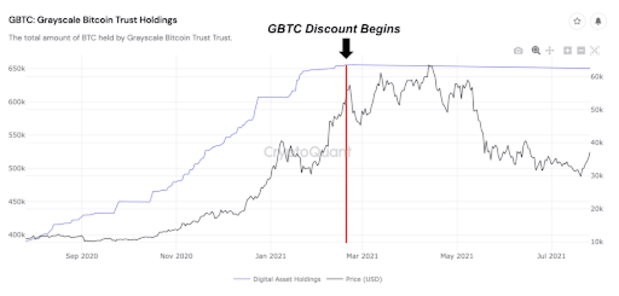

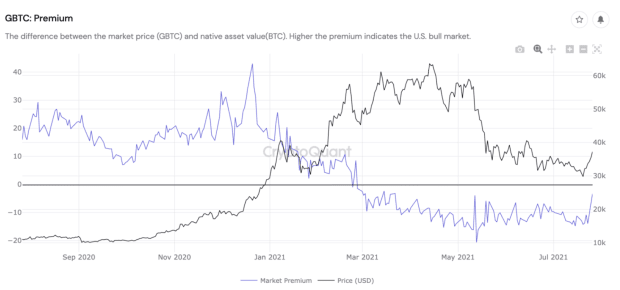

The Grayscale Bitcoin Trust (GBTC) discount improved to its highest levels in over two months earlier this week as a rebound in the price of bitcoin has seemingly reinvigorated institutional and retail interest in the security.

With the GBTC discount approaching 0% again following the large unlockings of shares onto secondary markets, the spot bitcoin markets should reclaim some of the previously siphoned off demand that the severely discounted GBTC may have briefly stolen.

It is also worth watching if sufficient demand in secondary markets is able to push shares of GBTC back into positive territory against its net asset value (NAV), as this would most likely mark the return of new share creation of GBTC, which would obviously be a welcome sign in the bitcoin markets.

Following the product’s fall below NAV on February 18, new share creation halted at Grayscale, which was one of the biggest drivers of demand during the second half of 2020 and early months of 2021.