- March 13, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Digital asset-based investment products saw $255 million in outflows during the week of Mar. 6 – 12, marking the fifth consecutive week of losses, according to CoinShares’ weekly report.

The amount also marks the most significant single weekly outflow on record, which currently accounts for 1% of the whole market, as CoinShares’ data indicates. During the week of Mar. 6 – 12, the total assets under management (AuM) recorded a 10% decline, which “wiped out the inflows seen this year,” according to the report.

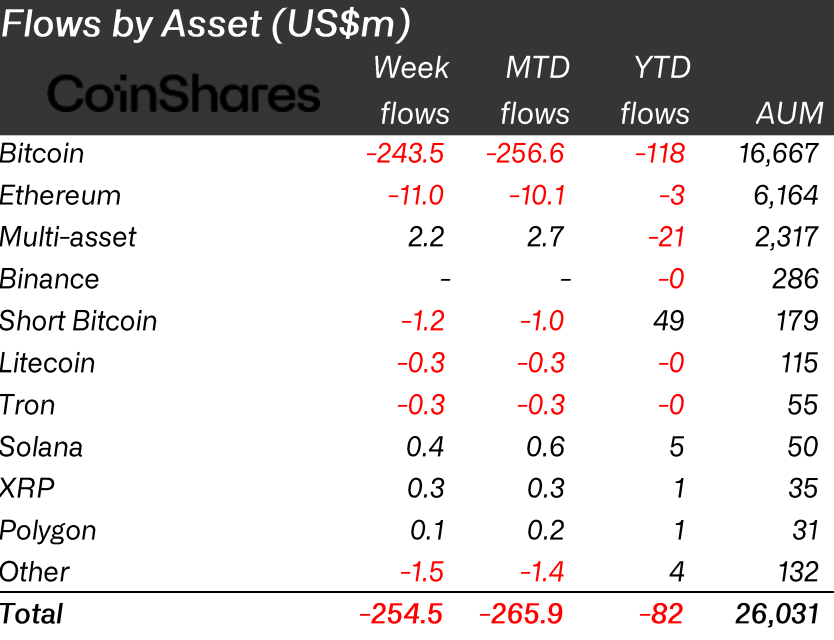

Flows by asset

Bitcoin (BTC) – based investment products recorded the largest outflow last week with $243.5 million outflows, accounting for over 95% of the total flows recorded during the week.

Ethereum (ETH) followed BTC by recording the second-highest amount at $11 million. Even though they have recorded inflows over the past few weeks, Short-BTC products lost $1.2 million in outflows and placed third in the ranking.

Litecoin (LTC) and Tron (TRX) also recorded 300,000 outflows each. On the other hand, Solana (SOL), Ripple (XRP), and Polygon (MATIC) ended the week by growing 400,000, 300,000, and 100,000, respectively.

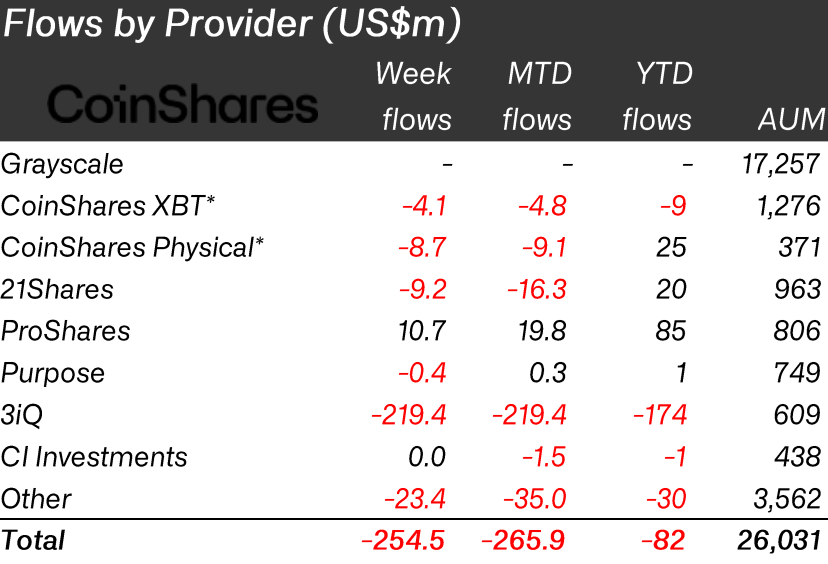

Flow by provider

Looking at the flow of the funds based on the providers, 3iQ emerges as the institution that recorded the highest amount of outflows by recording $129.4 million.

Coinshares physical and Coinshares XBT lost a combined $12.8 million, while 21Shares recorded $9.2 million in outflows. Purpose and other institutions also recorded 400,000 and $23.4 million in outflows last week.

On the other hand, ProShares emerged as the only institution that recorded inflows and grew by $10.7 million within seven days.

The post Fifth week of losses in crypto investment products sees $255M withdrawals appeared first on CryptoSlate.