- October 26, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Examining the dynamics of short-term holders during bitcoin bull markets and bear markets.

The below is from a recent edition of the Deep Dive, Bitcoin Magazine’s premium markets newsletter. To be among the first to receive these insights and other on-chain bitcoin market analysis straight to your inbox, subscribe now.

Relevant Articles:

The Daily Dive #070 – Short-Term:Long-Term Cost Basis Ratio

The Daily Dive #083 – Bitcoin All Time High

The Daily Dive #081 – HODLer Engineered Supply Squeeze

In previous Daily Dives we examined the supply dynamics of long-term and short-term holders and what it means for the bitcoin market. Today, we will further examine the dynamics of short-term holders during bull markets and bear markets.

Before we begin, it is important to define some terminology for those who may not be familiar.

In this piece, when referring to cost basis, we are referring to the realized price, which uses the price at which the coins were last transferred on the Bitcoin blockchain. Due to the transparent nature of Bitcoin’s ledger, we can quantify a cost basis of various cohorts of holders. Below are a few other terms and abbreviations that will be mentioned frequently in today’s Daily Dive.

- Cost Basis = Realized Price

-

MVRV = Market Value (price) to Realized Price Ratio

-

LTH = Long-Term Holder

-

STH = Short-Term Holder

Let’s dig in.

Short-Term Hodler Cost-Basis Analysis

For information about the quantification of short/long term holders click here

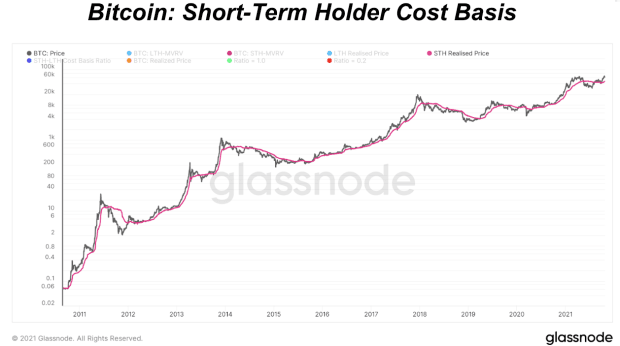

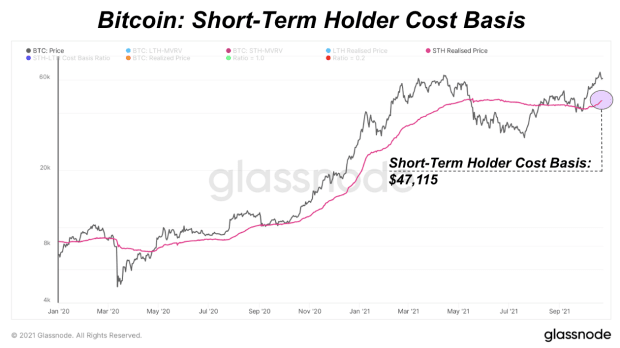

Pictured below is the cost basis for short-term holders over time:

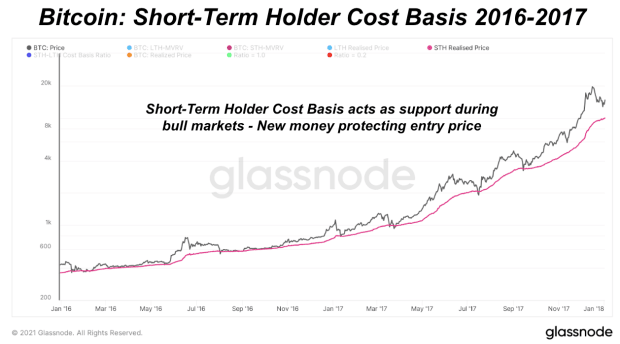

It is clear that the STH cost basis oscillates around the bitcoin price, but when analyzing further, bull markets are driven by new capital flowing into the market, and as a result price will far outpace STH as new money competitively bids for allocations. Examine the trends between STH cost basis and price since the beginning of 2020, as well as the 2017 bull market.

We can display the same value as a ratio using STH MVRV (short-term holder market value to realized value ratio). Notice how 1.0 acts as support for STH MVRV in bull markets?

This can be thought of as new participants aggressively defending their average cost basis, as they continue accumulating a position size.