- August 14, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Onchain Highlights

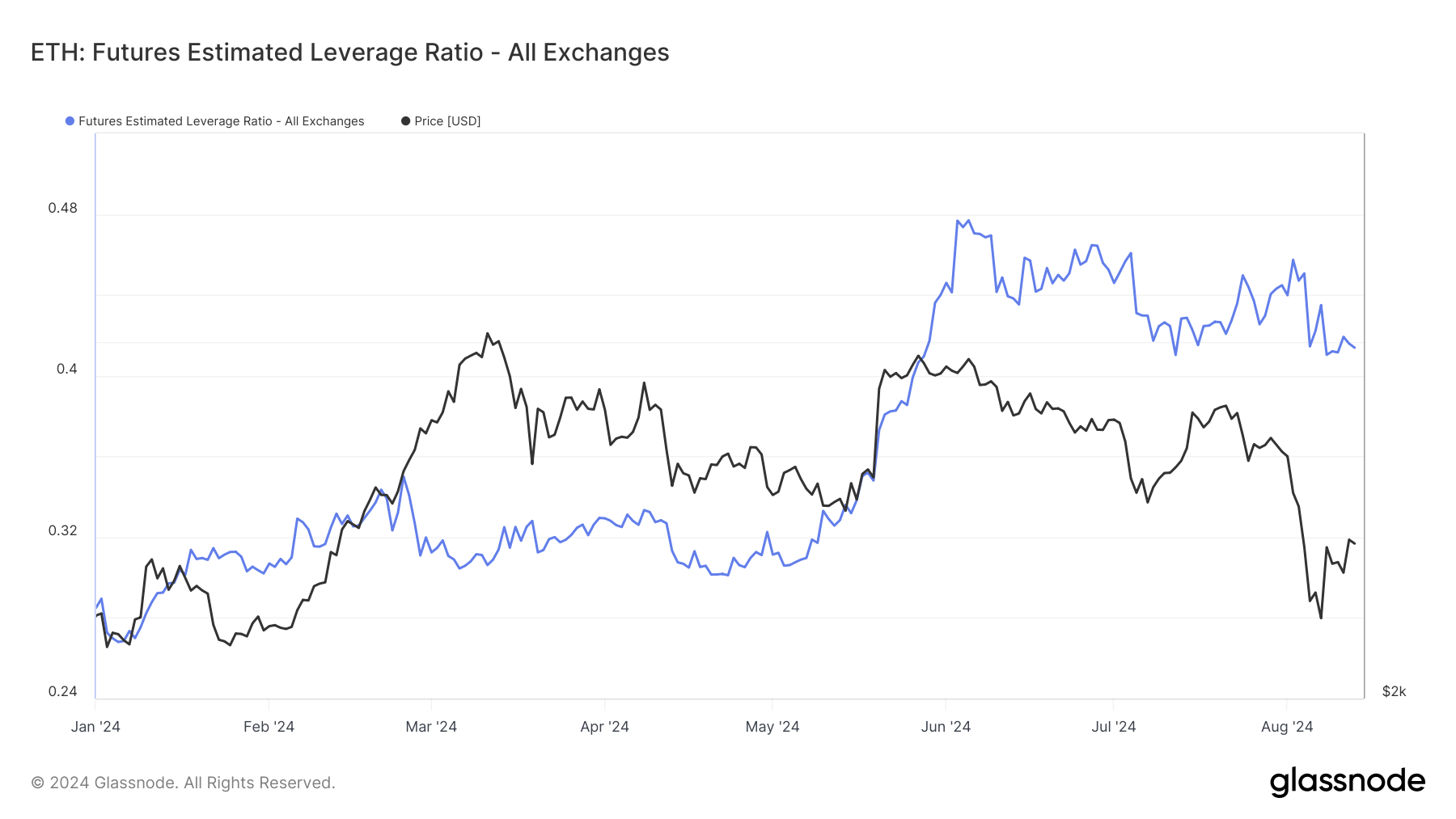

DEFINITION: The Estimated Leverage Ratio is defined as the ratio of the open interest in futures contracts and the balance of the corresponding exchange.

Ethereum’s (ETH) futures estimated leverage ratio saw significant fluctuations throughout 2024, indicating shifts in market sentiment and risk appetite. The data reveals a correlation between the leverage ratio and Ethereum’s price movements, particularly in the first half of the year.

As leverage increased from January to May, Ethereum’s price also climbed, peaking around March. However, a divergence occurred as leverage continued to rise sharply while prices started to decline in late May.

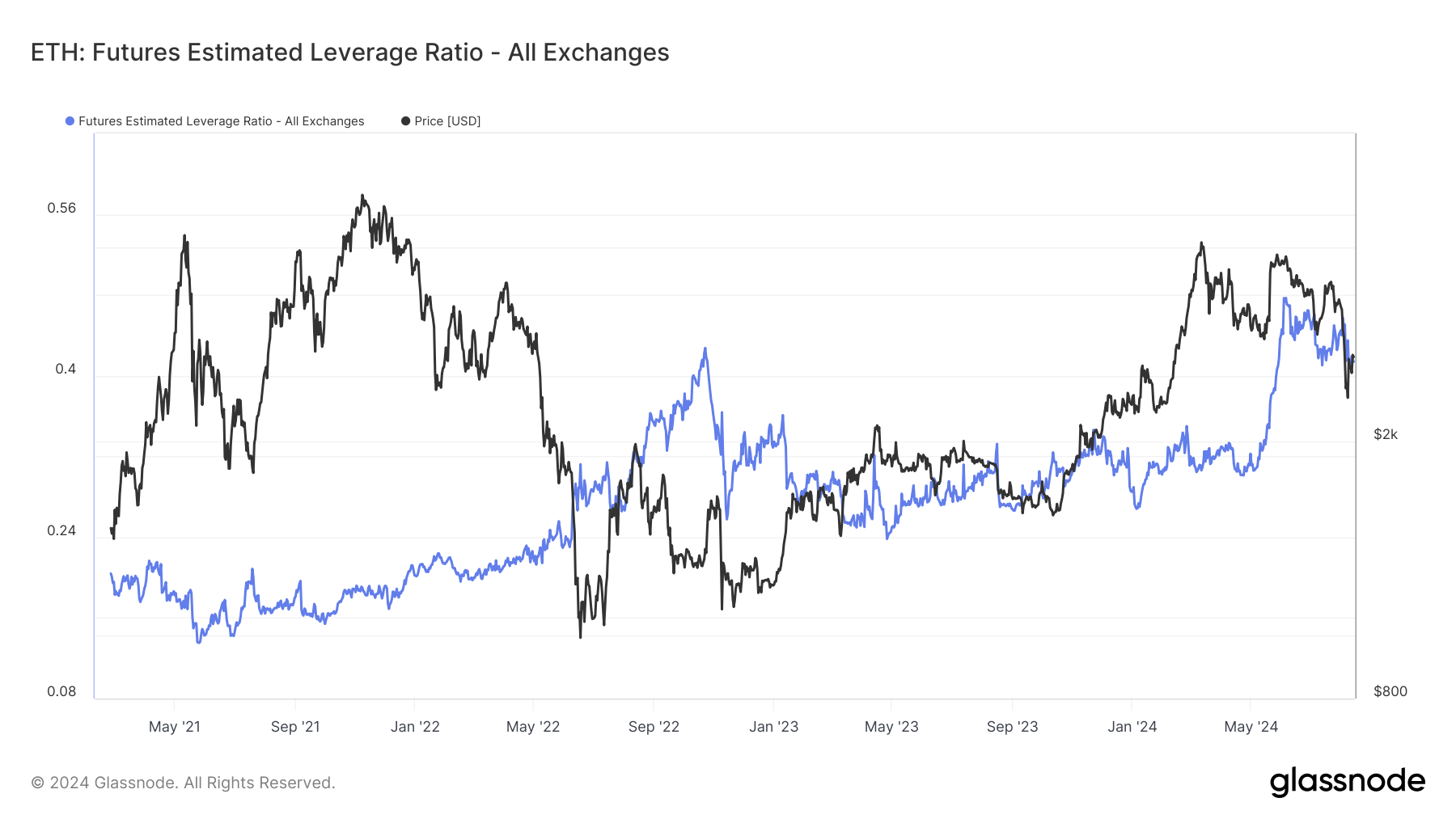

Ethereum Futures Estimated Leverage Ratio: (Source: Glassnode)The history of Ethereum’s futures estimated leverage ratio has been marked by periods of significant volatility, often reflecting broader market trends and trader behavior.

In 2021, during the height of the crypto bull market, the leverage ratio surged as traders increasingly borrowed funds to amplify their positions, driven by the rising price of Ethereum. This trend continued into 2022, although the ratio became more volatile as the market entered a bearish phase, leading to sharp corrections and liquidations.

The following year — 2023 — saw a more cautious approach from traders, with the leverage ratio stabilizing as the market slowly recovered from previous downturns.

Throughout this period, the ratio has served as a key indicator of market sentiment, with higher leverage often accompanying periods of exuberance and subsequent corrections, while lower leverage has typically indicated more conservative trading behavior amidst market uncertainty.

The post Ethereum futures leverage ratio spikes signal market shifts in 2024 appeared first on CryptoSlate.