- July 4, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

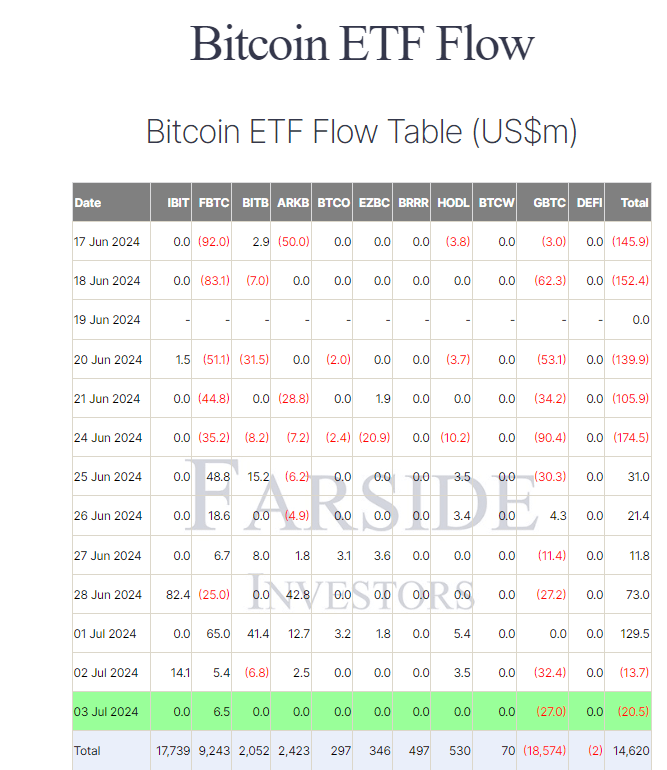

On July 3, Farside data revealed a total outflow in Bitcoin (BTC) exchange-traded funds (ETFs) of $20.5 million, marking the second consecutive trading day of net withdrawals.

The only outflow came from Grayscale’s GBTC, which saw a substantial $27.0 million exit, bringing its total outflows to a staggering $18.6 billion. In contrast, Fidelity’s FBTC experienced the only inflow, amounting to $6.5 million, which increased its total net inflow to $9.2 billion. Other ETF issuers reported no activity, neither inflows nor outflows.

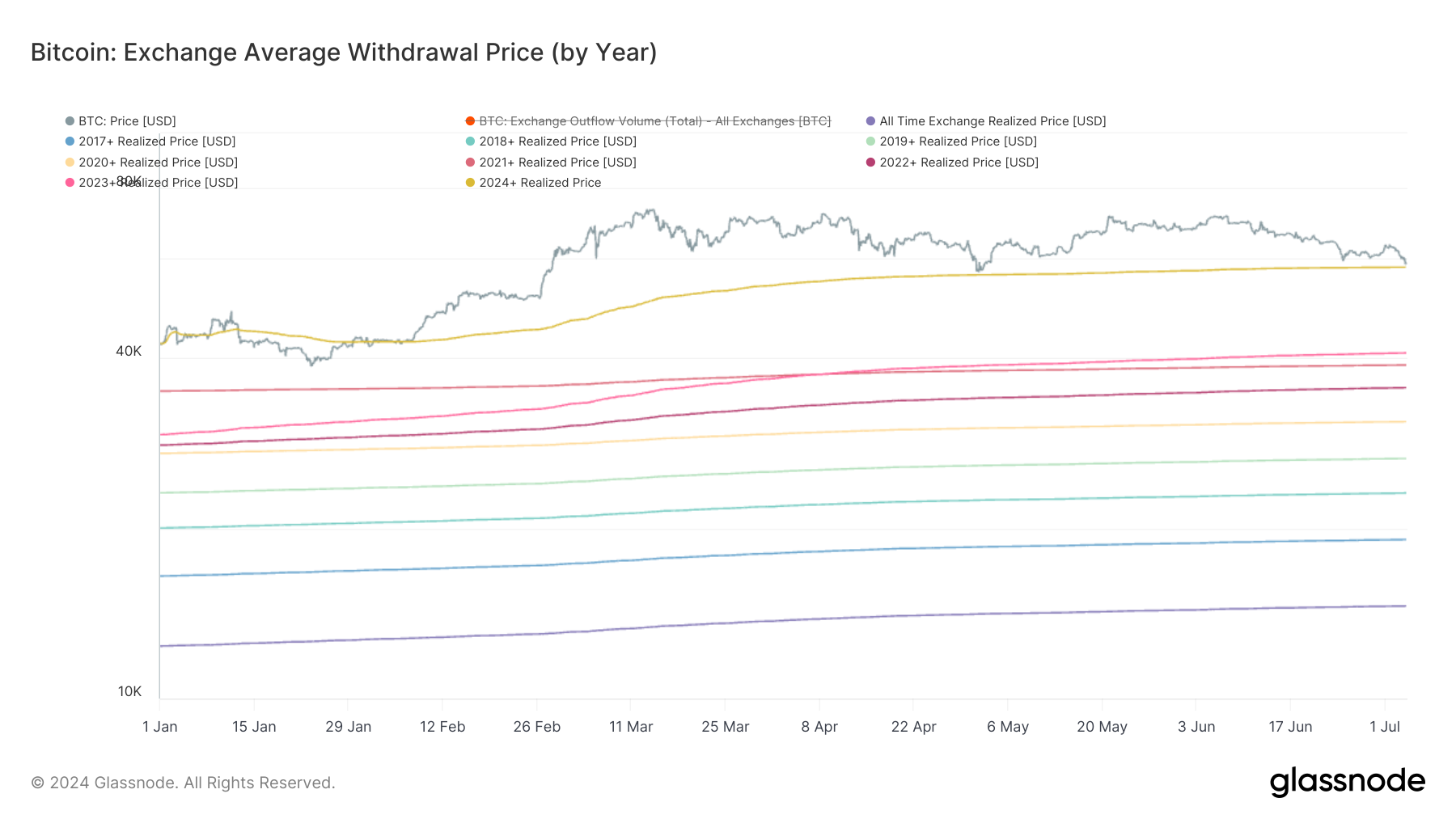

This data coincided with BTC losing its crucial $60,000 support level, currently trading around $58,000. The realized price for ETF buyers since Jan. 11 stands at $57,960, closely aligning with the current BTC price. This situation presents a critical juncture for ETF investors as the BTC price hovers around their cost basis, potentially testing their resolve in the market.

The market’s response to these movements and the price fluctuation will be pivotal in determining the short-term trajectory of Bitcoin ETFs, particularly for those closely tied to recent purchase prices.

The post ETF investors brace as Bitcoin price aligns with realized price appeared first on CryptoSlate.