- April 16, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

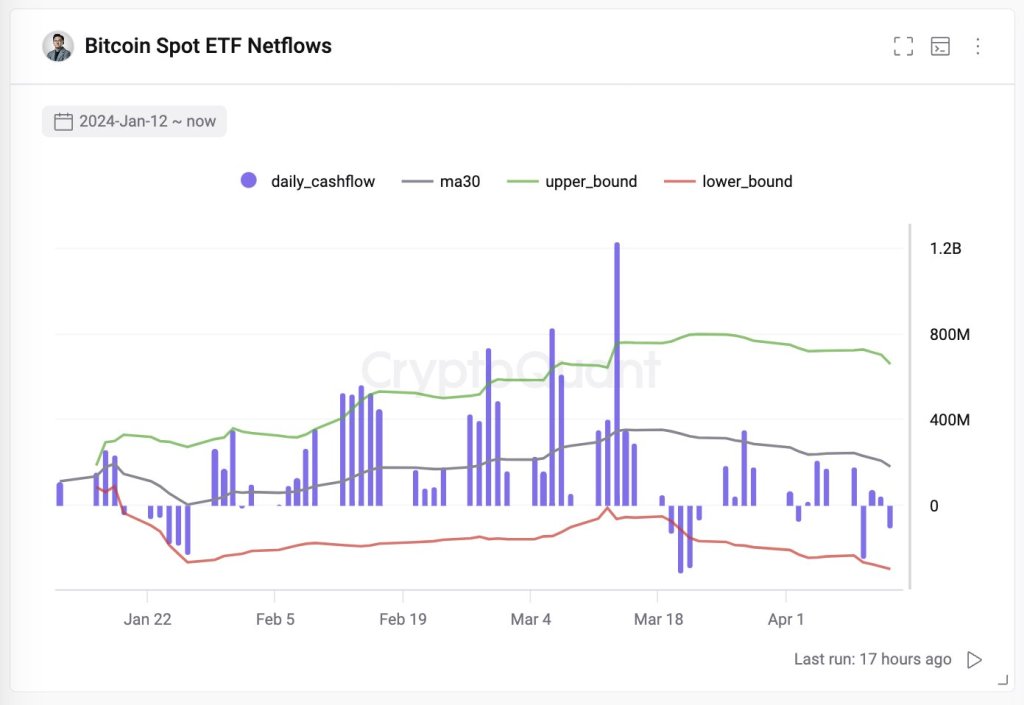

Despite the active on-chain accumulation, demand for Bitcoin exchange-traded funds (ETFs) in the United States appears to have stagnated over the past four weeks, according to Ki Young Ju, the founder of CryptoQuant, an on-chain analytics platform. This assessment, the founder notes, is even when excluding ETF settlement transactions.

Spot Bitcoin ETF Demand Slumps In The United States

Spot Bitcoin ETFs are crypto derivative products allowing investors, primarily regulated institutions and whales, to get exposure to the world’s most valuable coin while being saved the hassle of custody. Leading spot ETF issuers like Bitwise and Proshares use a regulated custodian to secure all BTC backing all minted shares in circulation.

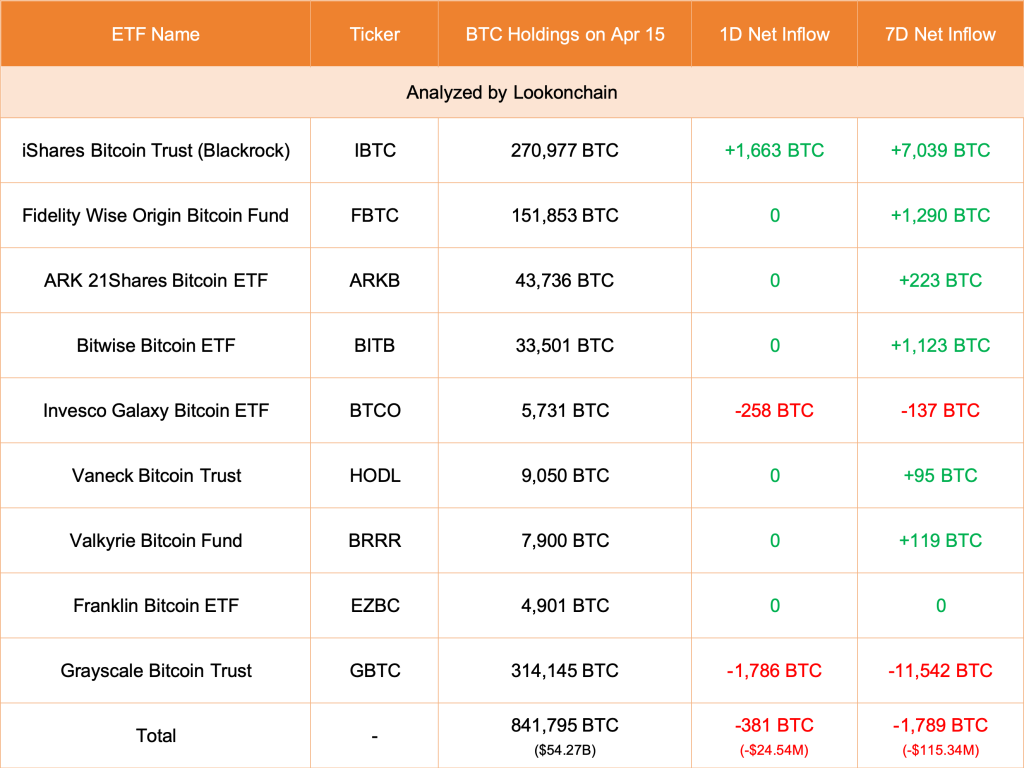

However, as parallel data shows, the demand has been slowing down over the past trading month, with all but one United States-based spot Bitcoin fund, iShares Bitcoin Trust (IBIT) by BlackRock, seeing zero inflows over the past two days.

According to Farside data, IBIT registered $73.4 million on April 15. However, this figure was a near 30% drop from the $111 million recorded a day earlier on April 14. At the same time, all other eight ETFs, excluding GBTC, which is being unwound and converted into a spot ETF, saw nil inflows over the same period.

On April 15, Lookonchain data shows that GBTC recorded $115 million in outflows while all the nine spot Bitcoin ETFs also decreased roughly $25 million.

BTC Remains Under Immense Selling Pressure

The contraction of inflows into spot Bitcoin ETFs can be attributed to dicey market conditions. At press time, sellers have been pressing lower. From the BTCUSDT daily chart, the coin is down 14% from all-time highs.

Even though prices are within a broad range, with support at $61,000 and resistance at $73,800, sellers have the upper end in the short term. Of note, prices are still boxed within the bear bar of April 13, swinging the trend in favor of sellers from an effort-versus-result perspective.

It is likely that spot Bitcoin ETFs might record outflows if prices plunge below $60,000 in continuation of the end of last week’s price action. If that’s the case, the odds of BTC dropping to as low as $53,000 and even $50,000 won’t be discounted.

Presently, it remains to be seen whether sentiment will shift. Although Hong Kong regulators approved multiple spot Bitcoin and Ethereum ETFs on April 15, their impact is yet to be seen on the market. Ethereum, like Bitcoin, remains under pressure and continues to slip towards crucial support levels.