- April 17, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

No Comments

Quick Take

RHODL Ratio

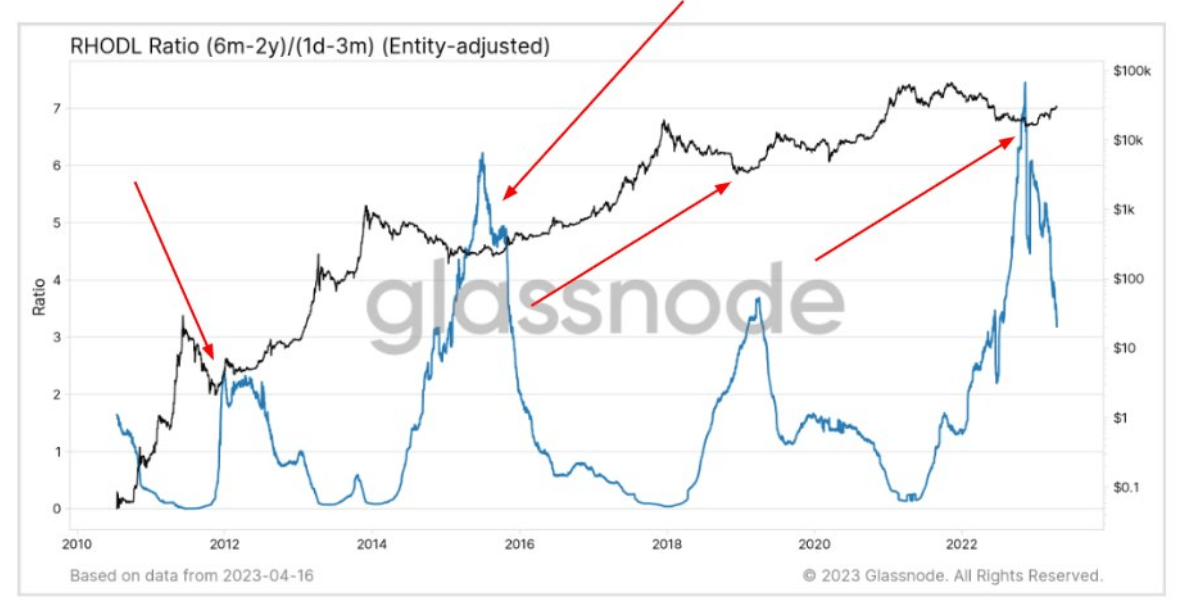

- The Bitcoin RHODL ratio looks at the capital rotation turning point across cycle transitions.

- The methodology behind the ratio is (Single-cycle Long-Term Holders) (6m-2y)/(1d-3m) to the youngest Short-Term Holders.

Realized cap HODL waves

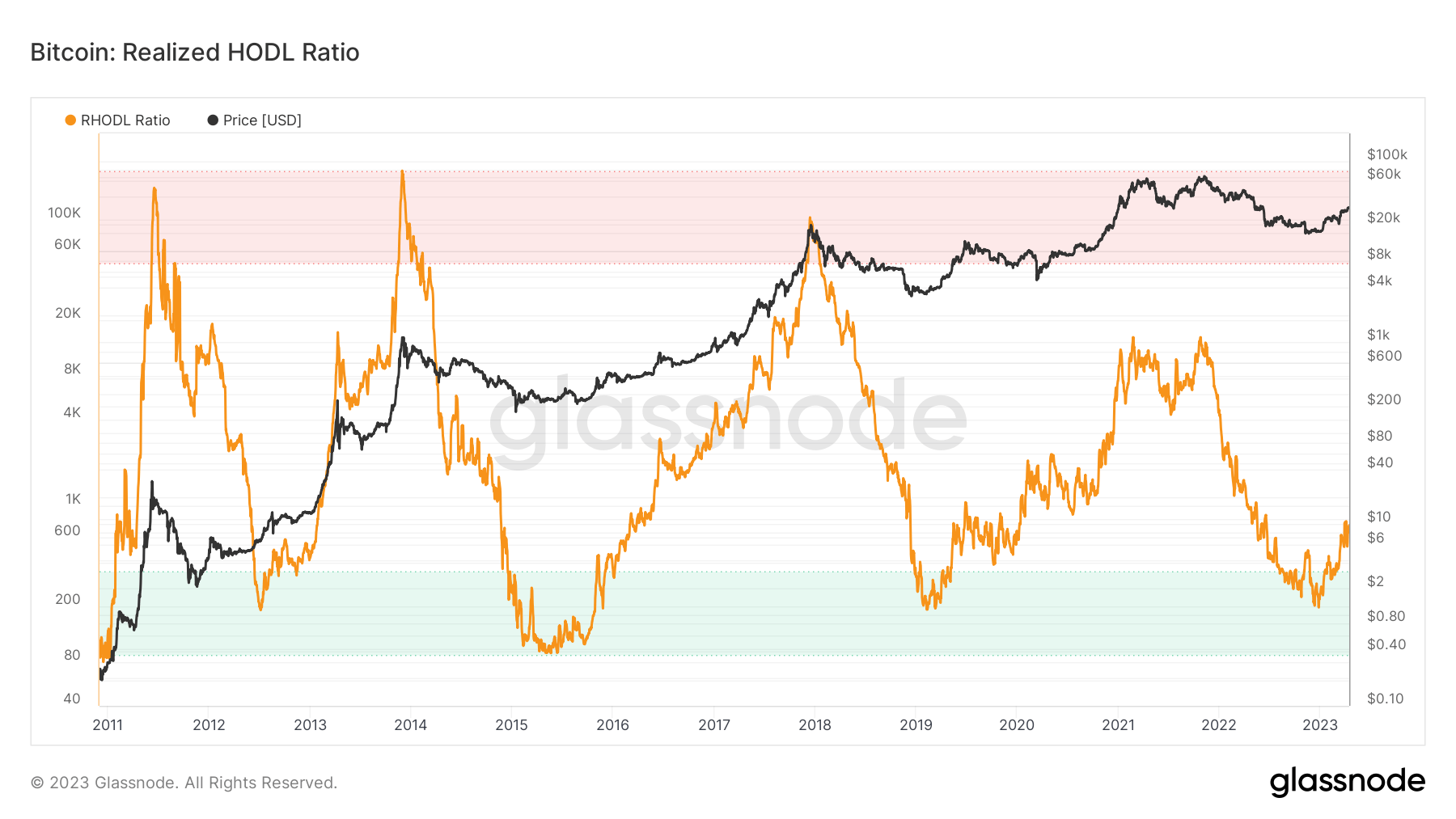

Realized cap HODL waves - While looking at the realized HODL ratio is a market indicator that uses a ratio of the Realized Cap HODL Waves. In particular, the RHODL Ratio takes the ratio between the one week and the 1-2 years RCap HODL bands.

- In addition, it accounts for increased supply by weighting the ratio by the total market age. A high ratio indicates an overheated market and can be used to time cycle tops.

Conclusion

Both these graphs conclude that the cycle bottom appears to be in from November 2022 during the FTX collapse. A case can be seen that the next bull run has started as the ratio has left the ‘green zone’ — while this cycle has plenty of room to run.

The post Cycle analysis, has the next leg for the bull run started for Bitcoin appeared first on CryptoSlate.