- September 26, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

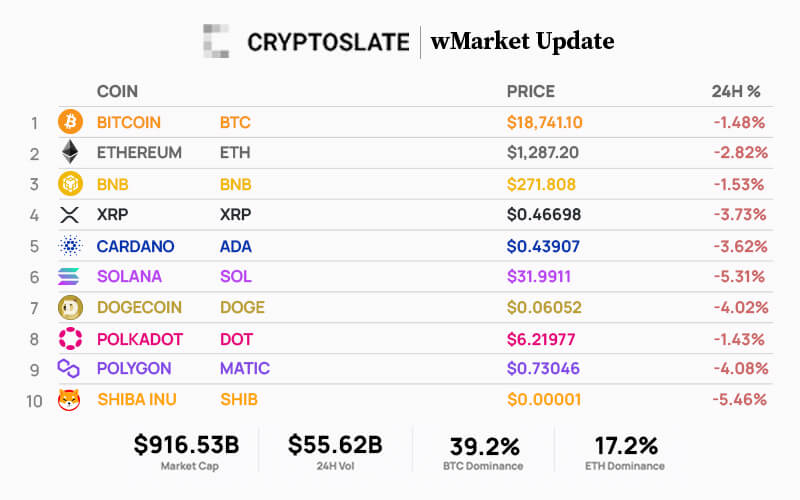

The total cryptocurrency market cap saw net outflows totaling $34.27 billion. As of press time, it stood at $916.53 billion, down 3.6% over the weekend of Sept. 23.

Bitcoin’s market cap fell 3.3% over the reporting period to $358.94 billion from $371.05 billion. Meanwhile, Ethereum’s market cap was down 4.4% to $157.25 billion from $164.54 billion.

The top 10 cryptocurrencies traded largely flat with sell-side bias over the period. This pattern continued over the last 24 hours, posting losses for all of the top 10 cryptocurrencies. The biggest loser is Shiba Inu, down 5.46%. In comparison, Polkadot fared best — only posting 1.43% losses over the period.

The market cap of the top three stablecoins — Tether (USDT), USD Coin (USDC), and BinanceUSD (BUSD) — remained stable over the period, standing at $67.96 billion, $49.40 billion and $20.52 billion, respectively.

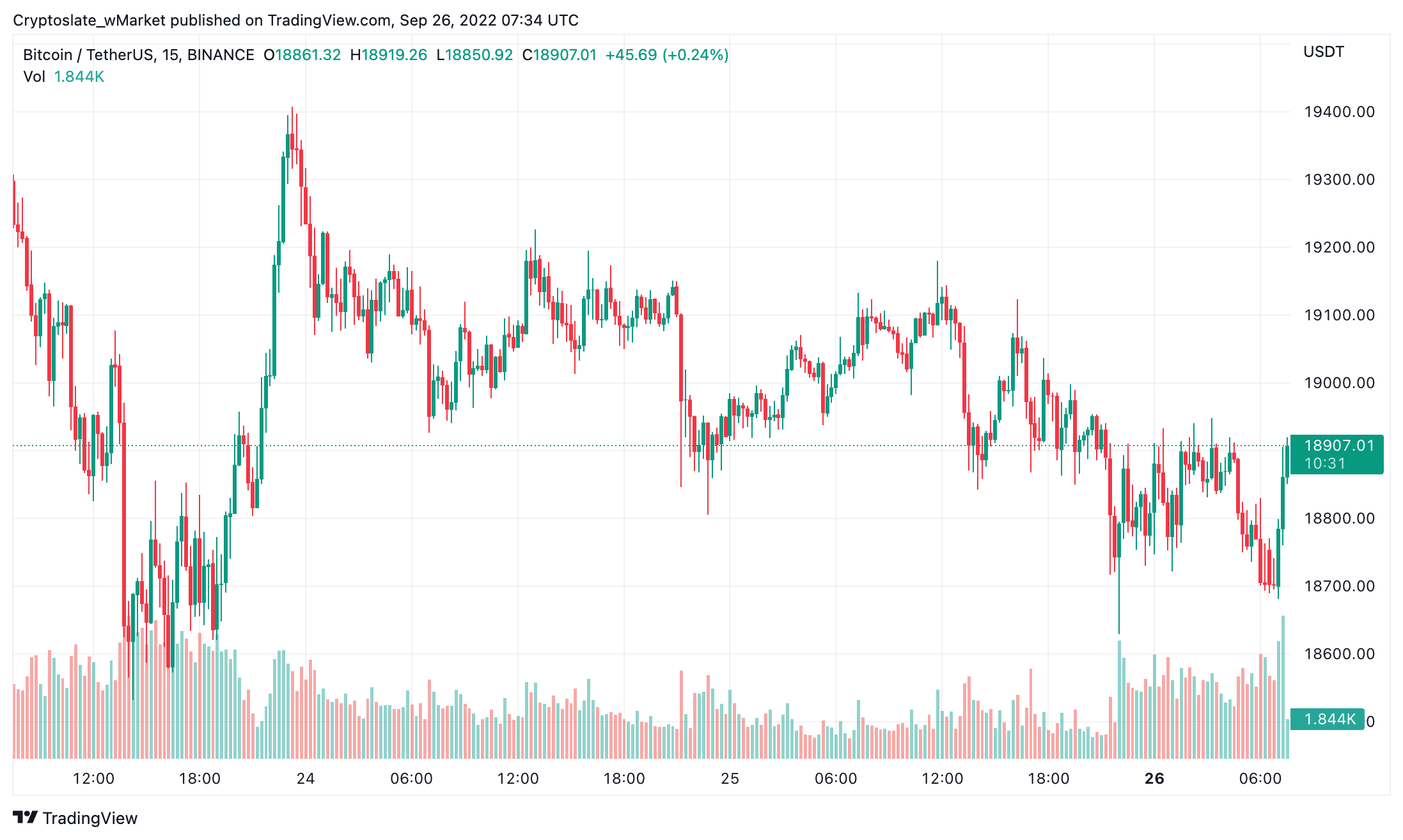

Bitcoin

Since Friday, Bitcoin was down 3% to trade at $18,700 as of press time. Market dominance rose slightly from 38.97% to 39.20% over the period.

A Friday sell-off bottomed at $18,500, leading to a bounce that peaked at $19,400. Since then, the market leader has been trending downward. However, from 08:00 UTC on Sept. 26, BTC has seen strong growth with a retest of $18,900 resistance on the cards.

There have been no significant developments since Sept. 23. However, macro factors continue to exert pressure on investors.

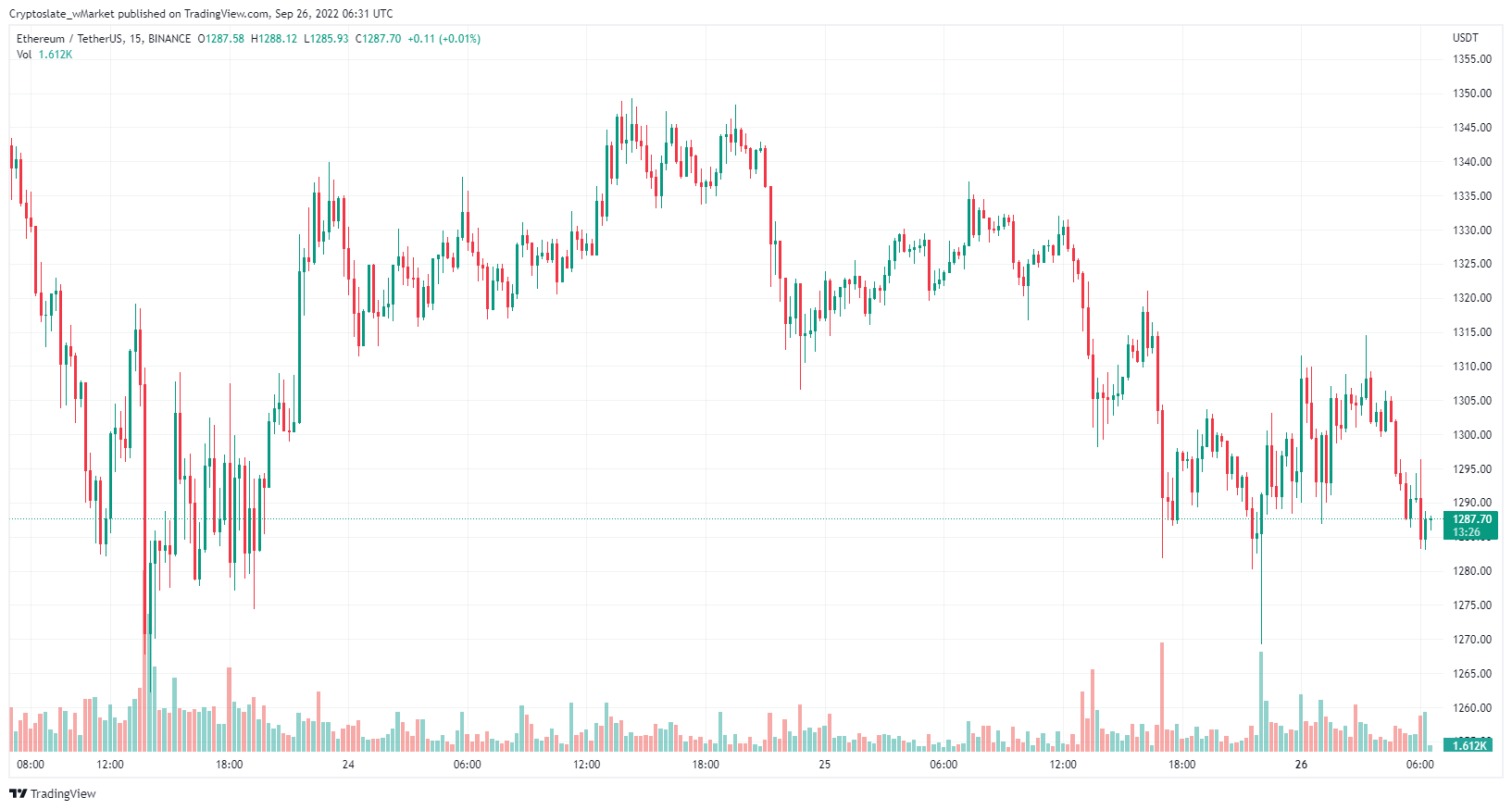

Ethereum

Ethereum fell 5.6% over the last three days to trade at $1,287 as press time. Market dominance decreased slightly from 17.32% to 17.20%.

ETH price actions followed a similar pattern to BTC, bottoming at $1,260 on Sept. 23 in the early evening (UTC,) leading to a $1,350 peak on Sept. 24 lunchtime. A slow bleed followed on Sept. 25, with strong buying as European markets opened.

Top 5 gainers

Fruits

FRTS leads the top gainers over the last 24 hours, trading around $0.01123 as of press time — up 11.1% over the period. The token has frequently featured in the top gainers and losers, suggesting extreme volatility lately. FRTS is down 99.9% from its December 2021 ATH. Its market cap stood at $236.55 million.

IOTA

MIOTA grew 9.5% over the past 24 hours and was trading at around $0.30900 at the time of publishing. With no new significant developments, it’s unclear why the platform pumped today. Its market cap stood at $858.88 million.

Injective Protocol

INJ recorded 5% gains over the past 24 hours to trade at around $1.74379 at press time. The token is up 21% over the last seven days, and its market cap stood at $127.31 million.

Ocean Protocol

OCEAN is up 4.9% over the last 24 hours to trade at $0.16925 at the time of publishing. There have been no new significant developments recently. Its market cap stood at $103.77 million.

Quant

QNT is up 4% since the last wMarket update to trade at $119.349 at press time. The token has posted strong performance over the past month, up 26%. Its market cap stood at $1.44 billion at the time of writing.

Top 5 losers

Terra Classic

LUNC is today’s biggest loser falling 14.7% over the past 24 hours to trade at around $0.00020 as of press time. Following a phenomenal run, which saw 52% gains over the last month, rumors of close ties with the Terra Labs Foundation and ongoing woes regarding token burn support continue to hurt the token price. Its market cap stood at $1.21 billion.

TerraUSD

USTC sunk 9.9% over the past 24 hours to $0.02719 at press time. The rebranded UST stablecoin continues to trade below its peg price and is similarly afflicted with the same concerns as Terra Classic. Its market cap stood at $266.94 million.

Terra

LUNA plunged 7.7% in value over the reporting period to trade at $2.26403. Interpol has issued a “red notice” for founder Do Kwon, taking his manhunt to the international level. Its market cap stood at $288.61 million.

Chiliz

CHZ is down 7.3% over the past 24 hours to around $0.24934 as of press time. The token has seen moderate gains recently, up 9% over the last month. Its market cap stood at $1.5 billion.

Lido DAO

LDO declined by 7.1% to trade at $1.59322. The Ethereum liquidity staking solution has been trending downwards for the past month, down 5% over this period. Its market cap was $498.6 million at press time.

The post CryptoSlate Daily wMarket Update – Sept. 23 to 25: Terra revival narrative comes unstuck appeared first on CryptoSlate.