- October 20, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

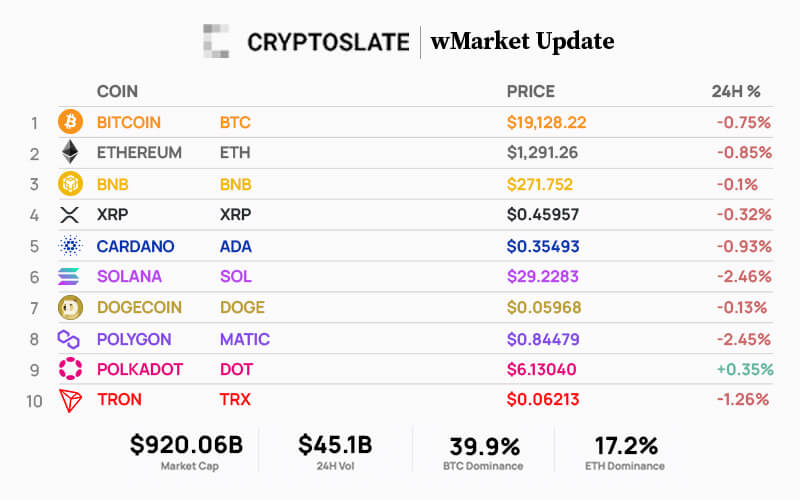

The cryptocurrency market cap saw net outflows of $3.64 billion since the last wMarket report. As of press time, the total crypto market cap stood at $920.06 billion, down 0.4% over the last 24 hours.

Bitcoin’s market cap fell 0.6% over the reporting period to $369.10 billion from $369.10 billion. Meanwhile, Ethereum’s market cap decreased by 0.7% to $158.01 billion from $159.18 billion.

The top 10 cryptocurrencies all posted losses over the last 24 hours. The exception was Polkadot, which saw a marginal gain of 0.35%. Solana was the biggest loser, losing 2.5% of its price over the period.

The market caps of Tether (USDT) and BinanceUSD (BUSD) saw slight increases over the last 24 hours and currently stand at $68.45 billion and $21.63 billion, respectively. Meanwhile, USD Coin’s (USDC) market cap has continued its decline — falling to $44.42 billion.

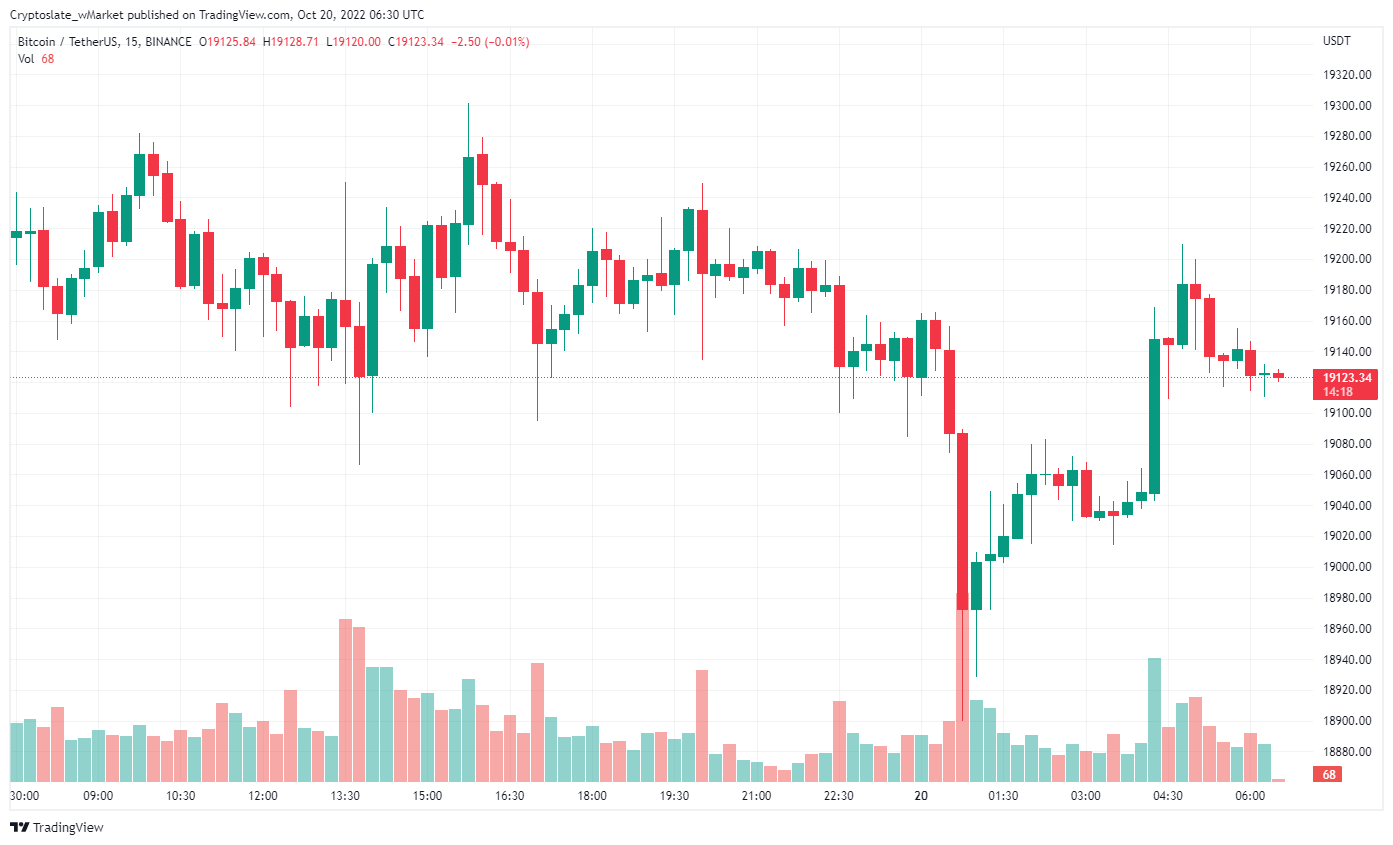

Bitcoin

Over the last 24 hours, Bitcoin fell 0.8% to trade at $19,128 as of press time. Its market dominance fell slightly to 39.90% from 39.91% over the reporting period.

The leading cryptocurrency topped out at $19,300 by Wednesday evening. Since then, a gradual downtrend turned into a sharp spill that found support at $18,900. The ensuing bounce peaked at $19,200, leading to a gradual downtrend.

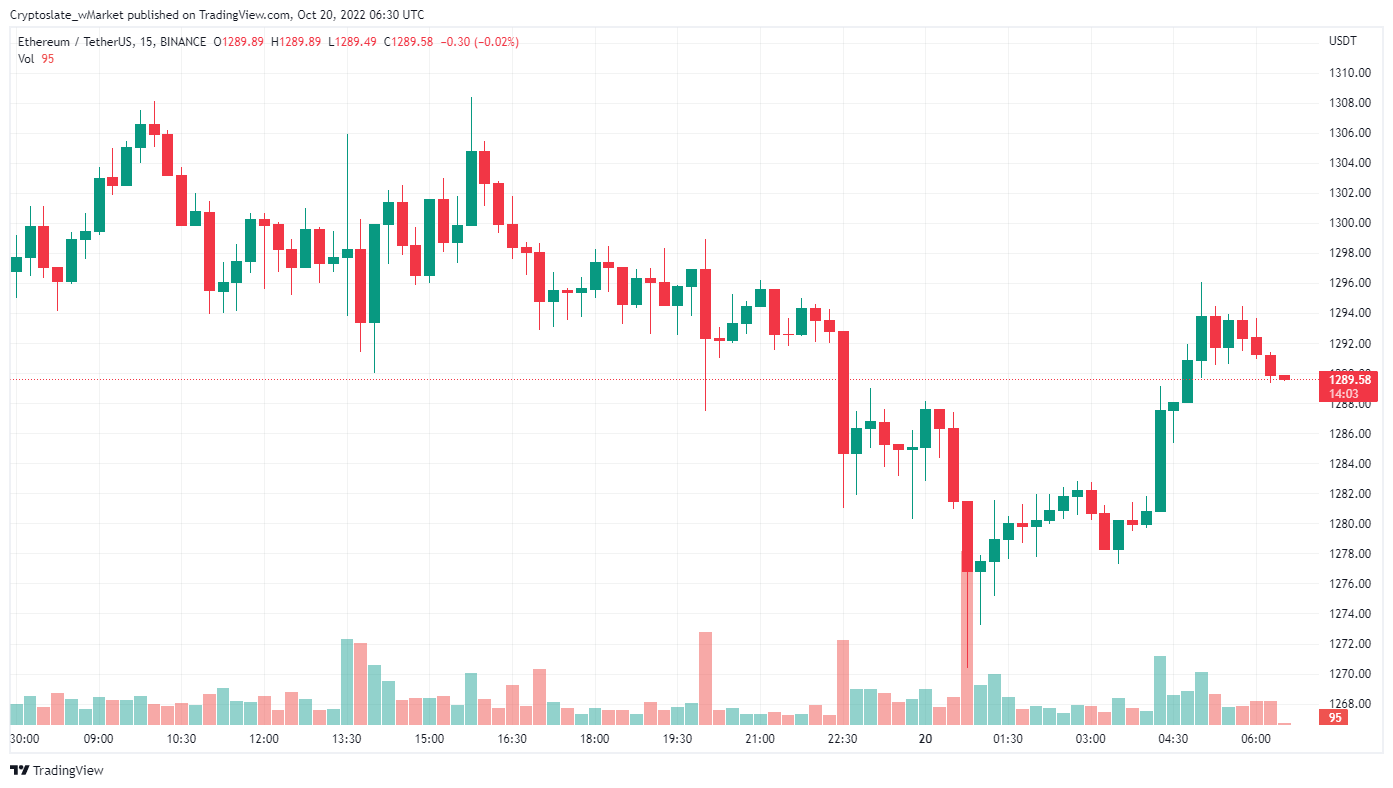

Ethereum

Ethereum’s price fell by 0.9% to trade at $1,291 as of press time. Its market dominance remained flat at 17.2%.

Over the reporting period, the second-largest cryptocurrency also topped out on Wednesday evening, at $1,308. Over the next ten hours, bears dipped the price to $1,270, leading to a recovery that peaked at $1,296.

Top 5 Gainers

TerraUSD

USTC is today’s top gainer, growing 12.5% over the reporting period to trade at $0.03955 as of press time. The Terra stablecoin continues to flip between the top gainers and losers but is still down over 90% from its dollar peg price. Its market cap stood at $387.94 million.

Chain

XCN grew 11% over the reporting period, trading at $0.06900 as of press time. The cloud blockchain protocol saw a near-vertical price rise in the early hours of Oct. 19. Its market cap stood at $33.98 million.

Mdex

MDX gained 9.5% over the last 24 hours to trade at $0.17544 as of press time. The AMM DEX has been on a tear this past month, growing 173% in price. Its market cap stood at $162.11 million.

Balancer

BAL rose 8.6% over the past day to trade at $5.99779 at the time of publishing. The token is up 25% over the last seven days. Its market cap stood at $262.84 million.

APENFT

NFT gained 7.9% over the reporting period, trading at $0.000000613438 as of press time. The NFT incubator platform has seen steady price growth this month. Its market cap stood at $170.32 million.

Top 5 Losers

Fruits

FRTS is today’s biggest loser, shedding 8.1% over the reporting period to trade at $0.01002 as of press time. The charity protocol continues flipping between the top gainers and losers but remains down 99% from its all-time high. Its market cap stood at $211.19 million.

Decentralized Social

DESO recorded an 8% loss over the last 24 hours to trade at $15.4421 as of press time. The social network has recently experienced a resurgence, growing 171% over the past month. Its market cap stood at $137.2 million.

Frax Share

FXS lost 7.95% over the past 24 hours to trade at $6.12899 at the time of publishing. Despite today’s loss, the governance token of the Frax ecosystem remains up 33% over the past month. Its market cap amounted to $99.35 million.

Axie Infinity

AXIE shed 5.8% in the last 24 hours to trade at $10.0046 as of press time. Since its high-profile hack in March, the governance token has plummeted in value, currently down 92% over the last year. Its market cap stood at $830.94 million.

OKB

OKB posted 5.7% losses over the past 24 hours to trade at $15.5966 as of press time. The token is down 37% over the past year. Its market cap stood at $935.8 million.

The post CryptoSlate Daily wMarket Update – Oct. 19: Polkadot leads stagnant top 10 with marginal 24 hour gains appeared first on CryptoSlate.