- September 8, 2021

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Cardence Launchpad announces that it is integrating Chainlink Price Feeds and VRF

Cardence is happy to announce that it is integrating Chainlink Price Feeds and Chainlink Verifiable Random Function (VRF) to bring enhanced functionality to its decentralized presale platform and launchpad. Through the highly secure and reliable market data of Chainlink Price Feeds, Cardence will enable its users to participate in presales using multiple different cryptocurrencies, while the auditable source of on-chain randomness provided by Chainlink VRF helps ensure fair and transparent reward distribution and IDO whitelisting.

Chainlink Price Feed Integration

Integrating Chainlink Price Feeds will be an important step forward for our ecosystem. Chainlink Price Feeds are the most widely used price oracle solution in the smart contract industry, already helping secure tens of billions of dollars for DeFi projects on various blockchains. For our initial integration, we are using three Chainlink Price Feeds—ETH/USD, BNB/BUSD, and MATIC/USD.

One of the constraints of traditional presale platforms is that they typically allow purchases using only a single asset. For example, on Binance Smart Chain (BSC), one can only use BNB. Similarly, ETH is Ethereum’s native payment token while Polygon’s is MATIC. Cardence is changing this dynamic by using Chainlink Price Feeds for secure and precise crypto-to-crypto conversions at the time of allocation purchases, allowing us to accept BUSD, USDT, and USD on their respective networks.

The next step will be to use more price feeds from Chainlink in order to facilitate cross-chain purchases, such as user-purchases in a BSC presale using ETH.

Unique Benefits of Chainlink Price Feeds for Cardence

Accurate Trading Data

Chainlink Price Feeds source data from numerous premium data aggregators, leading to price data that’s aggregated from hundreds of exchanges (both centralized and decentralized), weighted by volume, and cleaned of outliers and suspicious volumes.

Data security

Chainlink Price Feeds decentralized the data sourcing and data delivery processes, generating strong protections against tampering or anomalies by a single or small set of exchanges, such as flash crash outliers and flash loan attacks.

High reliability

No single entity can tamper with a Chainlink Price Feed, meaning Cardence’s users get a much more objective analysis of price data because the information is supplied and evaluated by large groups of independent entities. To be specific, Chainlink Price Feeds are secured by security-reviewed, Sybil-resistant nodes run by leading blockchain DevOps teams and traditional enterprises with a strong track record for reliability.

Chainlink VRF Integration

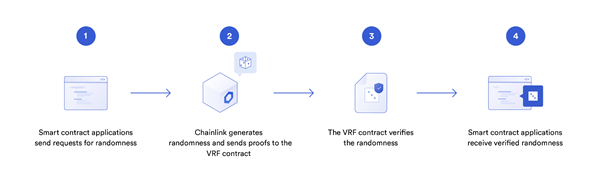

In addition to price feeds, we are also integrating Chainlink VRF—a tamper-proof and auditable source of randomness—to distribute project prizes and airdrops, host secure and honest competitions, and engage in fair and unbiased whitelisting. We plan to create an ecosystem where projects can carry out their community building efforts as well as their presales. Using Chainlink VRF, we are creating a secure and transparent ecosystem which is completely impartial. This will allow us to create user reward portals for distribution of airdrops, create portals for presale whitelisting activities, and any other function where a verifiable source of randomness is required for fair and transparent selection.

Chainlink VRF works by combining block data that is still unknown when the request is made with the oracle node’s pre-committed private key to generate both a random number and a cryptographic proof. The Cardence smart contract will only accept the random number input if it has a valid cryptographic proof, and the cryptographic proof can only be generated if the VRF process is tamper-proof. This provides users with automated and publicly verifiable proof directly on-chain that the randomness supplied by Chainlink VRF is provably fair and was not tampered with by the oracle, outside entities, or the Cardence team.

“We are pleased to bring enhanced functionality to our ecosystem by integrating two highly secure and reliable oracle services from the Chainlink Network,” stated Obaid Ul Ahad, CEO of Cardence. “Chainlink Price Feeds will help ensure that our users have consistent access to fair-market exchange rates for crypto-to-crypto transactions, while Chainlink VRF establishes a fair selection mechanism for picking users within high demand processes.”

About Chainlink

Chainlink is the industry standard oracle network for powering hybrid smart contracts. Chainlink Decentralized Oracle Networks provide developers with the largest collection of high-quality data sources and secure off-chain computations to expand the capabilities of smart contracts on any blockchain. Managed by a global, decentralized community, Chainlink currently secures billions of dollars in value for smart contracts across decentralized finance (DeFi), insurance, gaming, and other major industries.

Chainlink is trusted by hundreds of organizations, from global enterprises to projects at the forefront of the blockchain economy, to deliver definitive truth via secure, reliable oracle networks. To learn more about Chainlink, visit chain.link and subscribe to the Chainlink newsletter. To understand the full vision of the Chainlink Network, read the Chainlink 2.0 whitepaper. Want to discuss an integration? Talk to an expert.

Solutions | Docs | Twitter | Discord | Reddit | YouTube | Telegram | GitHub

About Cardence

Cardence is a Cardano focused multichain decentralized presale platform which creates a trustless fundraise ecosystem. It is launching on BSC, Ethereum, Matic, Cardano, and Solana networks. It is the first presale platform which facilitates affiliate marketing of projects, release of tokens according to vesting schedule, whitelisting of participants and auto locking of liquidity. Additionally, Dapps like SmartMint and Locker App allow creation of new tokens without writing any code and creation of time locked token vaults for release of tokens according to a vesting schedule.

Website | Whitepaper | Telegram | Twitter | Medium