- January 19, 2022

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

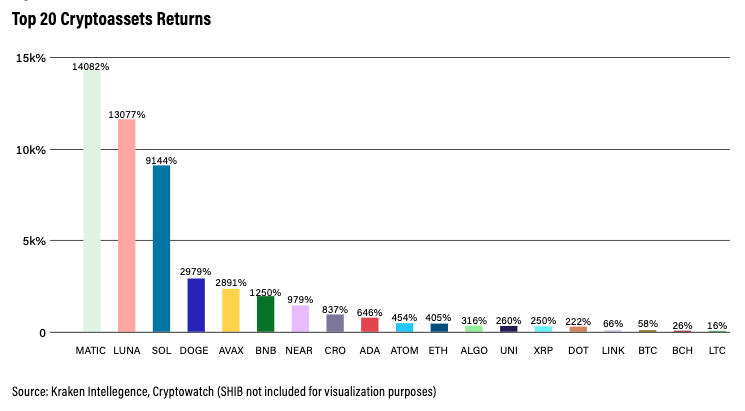

Looking at the top 20 cryptocurrencies by market cap (excluding stablecoins), altcoins showed the biggest returns leaving Bitcoin in the dust.

According to Kraken Intelligence’s Crypto-in-Review report, the crypto market had a huge disparity in returns last year, with Shiba Inu (SHIB) amassing a return of 41,800,000%, while Bitcoin (BTC) recorded a return of just 58%.

And while these numbers might seem high when compared to traditional financial assets like the S&P 500 index, it’s important to note that Bitcoin was the third-worst performer of the 20 largest cryptocurrencies—well below the median return of 646%.

Bitcoin fails to leave a mark in last year’s performance metrics

Last year has been monumental for the crypto market. After a painfully volatile 2020 scarred by the global pandemic, 2021 started with tangible positivity in the air. It reinstated the macro bull trend in the market, bringing much-needed upward price action that revitalized the industry.

In its 2021 Crypto-in-Review report, Kraken Intelligence found that, as a whole, the market finished 2021 up 187%. And while this pales in comparison to 2020’s 310% return, it’s still miles ahead of 2019’s 58% return.

As a beacon of the broader crypto market, Bitcoin’s performance is always taken as an indicator of the de facto state of the market. Just like every year in the past 4-year market cycle, Bitcoin outperformed most traditional financial assets such as the S&P 500, the NASDAQ, gold, government bonds, and high-yield bonds.

However, while Bitcoin showed returns that are highly unlikely in the traditional finance market, its 2021 performance looks bleak when compared with the rest of the crypto market.

Kraken’s report looked at the top 20 cryptocurrencies by market capitalization excluding stablecoins and found that Bitcoin was the third-worst performing asset. Litecoin’s (LTC) extremely modest 16% return made it the worst-performing asset among the group, while Bitcoin Cash (BCH) posted returns of just 26% and was the second-worst in Kraken’s list.

The year’s outperformer was, unsurprisingly, Shiba Inu (SHIB) which removed Dogecoin (DOGE) from its throne as the king of memecoins. Launched in 2020, Shiba Inu amassed an astronomical 41,800,000% return in 2021—that’s 41.8 million for those unsure about the number of zeros.

The top 20 cryptocurrencies by market capitalization showed an average return of 2,240,000% and a median return of 646%. However, when excluding Shiba Inu and its unprecedented return, the average and median readings drop to 2,524% and 454%, respectively.

A 12-month long alt season

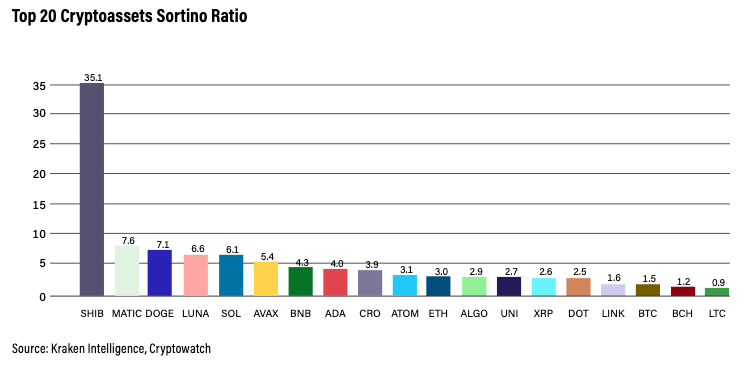

When accounting only for downside volatility, called the “Sortino Ratio,” Bitcoin remained the third-worst performing asset. The Sortino ratio is a variation of the Sharpe ratio that recognizes the difference between harmful volatility and overall volatility. This ratio is calculated by subtracting the risk-free rate from an asset and then dividing that amount by the asset’s downside deviation. As the Sortino ratio focuses only on the negative deviation of an asset’s return, it’s thought to give a better view of its risk-adjusted-performance. Just like the Sharpe ratio, a higher Sortino ratio result is better.

With a ratio of 1.5, Bitcoin ranked extremely low on the list. Litecoin remained an underperformer here as well, posting a ratio of just 0.9, while Shiba Inu’s outrageous return gave it a Sortino ratio of 35.1.

Polygon (MATIC), Dogecoin (DOGE), Terra (LUNA), and Solana (SOL) were among the top 5 cryptocurrencies with Sortino ratios that came in well ahead of the group’s average and median ratings of 5.3 and 3.5, respectively.

Once the main driving force behind every movement on the market, Bitcoin seems to have taken the backseat in 2021. While Kraken acknowledged that Bitcoin had several historic moments during which it sustained revisions to its levels of dominance, it found that the trend in 2021 was defined by altcoins taking a greater share of the market capitalization.

One of the biggest obstacles to Bitcoin’s significant growth this year was the law of large numbers, which states that an asset cannot sustain the same growth as it increases in market capitalization. And with a market cap of more than $786 billion at press time, it’s hard to show the returns we’ve seen among the low-cap altcoins last year.

“The ebbs and flows associated with market participants shifting their preference for altcoins in favor of BTC and vice versa can help explain the short- and medium-term shifts in the market,” Kraken Intelligence reported.

Diving deeper into Bitcoin’s relationship with the rest of the market also shows another interesting trend—the decrease in Bitcoin’s dominance.

The year started with Bitcoin’s dominance sitting at just under 70%—meaning that 70% of the entire crypto market capitalization was locked in Bitcoin. However, shortly after the year began Bitcoin entered into a 5-month downtrend which ended June as its market dominance dropped to just 39%. According to Kraken Intelligence, this downtrend coincided with the broader market sell-off in May, which led to several months of slow rebounding for Bitcoin.

Throughout the second half of 2021, Bitcoin’s dominance was largely range-bound between 40% and 50%. This is a result of a rather interesting phenomenon—the majority of market participants see Bitcoin as a safe-haven asset within the crypto ecosystem. This view of Bitcoin means that most traders tend to trade back into Bitcoin to preserve their wealth and avoid drawdowns that hit altcoins the hardest.

The post Bitcoin was the third-worst performer last year as low cap altcoins showed the biggest returns appeared first on CryptoSlate.