- March 14, 2023

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

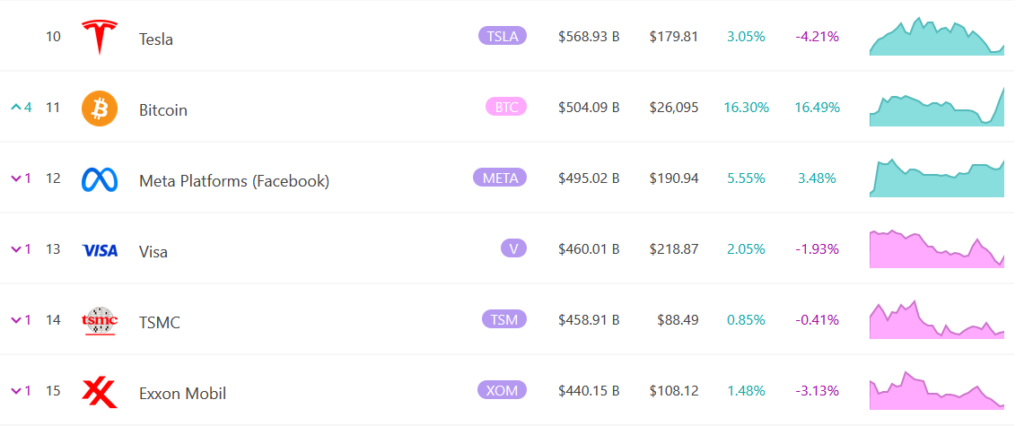

Bulls ran rampant, pushing Bitcoin to a 39-week high at $26,500. The resulting market cap increase saw the leading cryptocurrency leapfrog Meta, Visa, TSMC, and Exxon Mobil in valuation.

Market momentum picks up

This week saw the Fed backstop the banking sector under the Bank Term Funding Program (BTFP). Similarly, U.S. Consumer Price Index (CPI) data come in as expected, at 6% year-on-year.

Crypto markets responded favorably to both incidents, sending Bitcoin higher. Since March 11, BTC has closed three consecutive daily green candles, with today (March 14) on track to follow suit.

Over this period, the leading cryptocurrency posted 32% gains to smash through a resistance level set on May 13, 2022 – 43 weeks ago. The next resistance zone is around the $28,000 level, representing the pre-Terra LUNA/UST price.

The Relative Strength Index (RSI) currently shows no easing in momentum – having shot from 30, on March 11, to 70, at present, in a straight line.

The Fed was careful not to frame the BTFP as a pivot from hawkish policy. But, by definition, backstopping banking deposits with liquidity is a dovish move, albeit with the mismatch of relatively high rates.

As @stackhodler put it, “If it walks like a duck and quacks like a duck, it’s probably quantitative easing.”

Bitcoin valuation spikes

On March 14, due to the buying frenzy, Bitcoin’s market cap spiked as high as $512.19 billion. Profit-taking saw a reversal back down to $502.8 billion at press time.

Nonetheless, Bitcoin still rose in the global asset market cap rankings to 11th place, even at the lower-end valuation. In doing so, the leading cryptocurrency overtook Meta, Visa, TSMC, and Exxon Mobil.

Currently, Bitcoin is significantly behind 10th-placed Tesla, with a $65 billion gap separating the two.

To break into the top 10 global assets and overtake the EV maker, the price of Bitcoin would need to increase to above $29,500, assuming Tesla’s market cap stayed at $569 billion.

The last time Bitcoin’s market cap was above $570 billion was pre-Terra UST de-peg.

The post Bitcoin surges to 39-week high, leaving Meta, Visa, TSMC, and Exxon Mobil in its dust appeared first on CryptoSlate.