- July 5, 2024

- Posted by: admin

- Category: BitCoin, Blockchain, Cryptocurrency, Investments

Quick Take

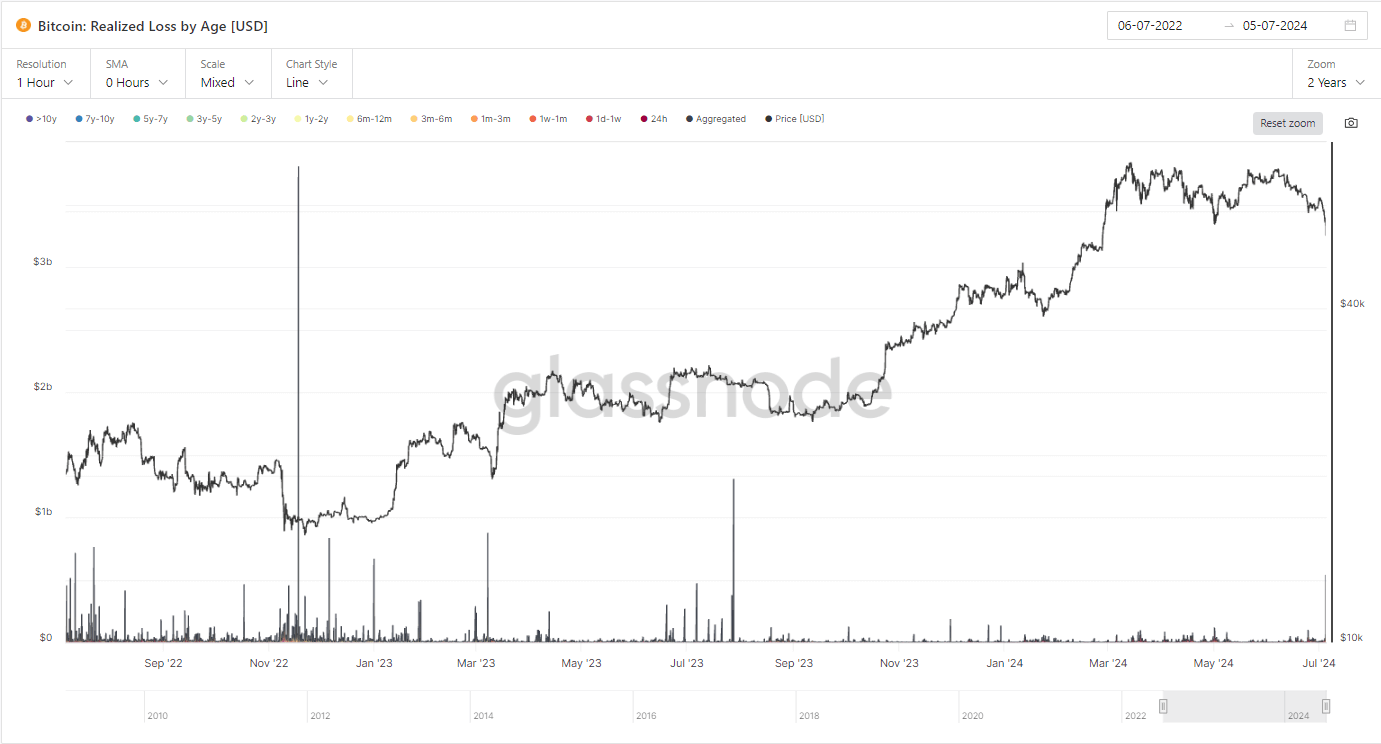

Bitcoin’s recent price dip to around $54,000 has triggered one of the largest realized losses since the FTX collapse, specifically the fifth biggest realized loss since. This significant sell-off is primarily attributed to panic selling spurred by news related to Mt. Gox.

On July 5, within a one-hour resolution, Bitcoin’s aggregated realized loss soared to $814 million. $587 million of these losses were incurred by short-term holders who had held Bitcoin for one to three months. This demographic’s reaction to market turbulence highlights the vulnerability of short-term holders compared to their long-term counterparts.

The sell-off highlights a pattern observed on July 4, where short-term holders were found to be holding 2.5 million BTC at a loss. This indicates that these holders pose a greater risk to a Bitcoin correction than the impact of Mt. Gox.

Despite the turmoil, long-term holders exhibited resilience, contributing minimally to the selling pressure. This stability from seasoned investors indicates confidence in Bitcoin’s long-term prospects, contrasting sharply with the short-term market fluctuations driven by newer entrants reacting to immediate news events.

| Cohorts | $ Values |

|---|---|

| aggregated | 813,775,780 |

| 1m_3m | 586,946,540 |

| 1d_1w | 102,135,624 |

| 24h | 60,121,075 |

| 1w_1m | 46,528,219 |

| 3m_6m | 17,918,197 |

| 2y_3y | 93,782 |

| 3y_5y | 31,089 |

| 6m_12m | 1,051 |

| 1y_2y | 202 |

Source: Glassnode

The post Bitcoin suffers fifth largest realized loss since FTX collapse amid Mt. Gox panic appeared first on CryptoSlate.